Lately, the USDZAR currency pair has shown some interesting trends. Right now, $1 is equivalent to R18.12. It’s been a bit of a rollercoaster, considering it moved down from a 2024 high of 19.39. This drop hints at the South African Rand getting stronger against the US Dollar.

Currently, key support levels for the USDZAR pair are around 18.03 and 17.55, while resistance levels are sitting at 18.56. Technical indicators, like the Average True Range (ATR), suggest moderate market volatility, implying that the pair is likely to stay within these levels for the short term.

In June, the US Non-Farm Payrolls (NFP) report showed a slowdown in job growth, with 206,000 jobs added, still this was more than analysts had expected. This slowdown has led to a decrease in Treasury yields, hinting that the Federal Reserve might not be as aggressive with interest rate hikes. The US unemployment rate also rose to 4.1%,

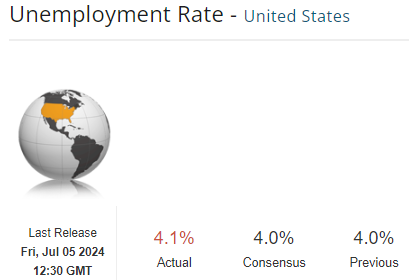

In June, the US Non-Farm Payrolls (NFP) report showed a slowdown in job growth, with 206,000 jobs added, still this was more than analysts had expected. This slowdown has led to a decrease in Treasury yields, hinting that the Federal Reserve might not be as aggressive with interest rate hikes. The US unemployment rate also rose to 4.1%, slightly up from the previous month’s 4.0%, indicating a cooling labour market that might influence the Fed’s decisions.

slightly up from the previous month’s 4.0%, indicating a cooling labour market that might influence the Fed’s decisions.

Looking ahead, the Consumer Price Index (CPI) and Producer Price Index (PPI) reports are due on July 11 and July 12. These reports are crucial as they provide insights into inflationary pressures within the US economy, which the Federal Reserve closely monitors when making monetary policy decisions.

Market Trends and Trading Opportunities

Given the current technical and fundamental factors, the USDZAR pair might continue to see the Rand strengthen if the upcoming CPI and PPI reports show subdued inflation. This would support the case for a less aggressive stance from the Fed. Traders could look for opportunities to enter short positions on rallies towards resistance levels, while keeping an eye on the CPI and PPI data releases.

On the flip side, if the reports reveal unexpected inflation spikes, the current trend could reverse, with the USD gaining against the ZAR. In such a case, traders should watch for a breakout above the resistance level, potentially paving the way for higher levels.

Click here to access our Economic Calendar

François Du Plessis

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.