Netflix Inc., one of the world’s leading entertainment services companies based in California which engages in paid streaming and the production of films and series, is scheduled to report its Q2 2024 earnings on 18th July (Thursday), after market close. Netflix is ranked the world’s 33rd most valuable company by market cap.

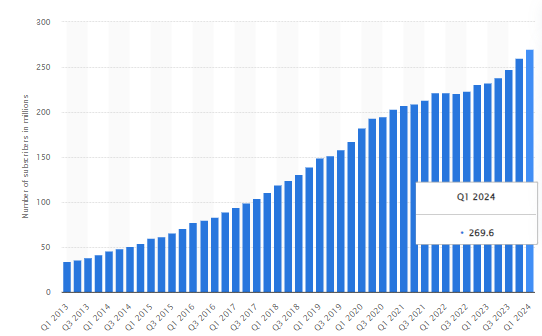

Netflix’s position as the leader in the streaming service market is undeniable, with a remarkable total of 269.6 million subscribers worldwide, well above Wall Street’s estimates of 264.2 million. This number reflects an increase of 3.58% from the previous quarter and a near 16% growth year over year. Clearly, the company’s consistent slate of programming, cracking down on password and account sharing, as well as its push into advertising via a less expensive ad tier have helped to boost the addition of new subscribers. In near future, the management has planned to further build out its advertising business, and also focused on creating a “consistent, dependable and expected drumbeat of hits shows, films and games”.

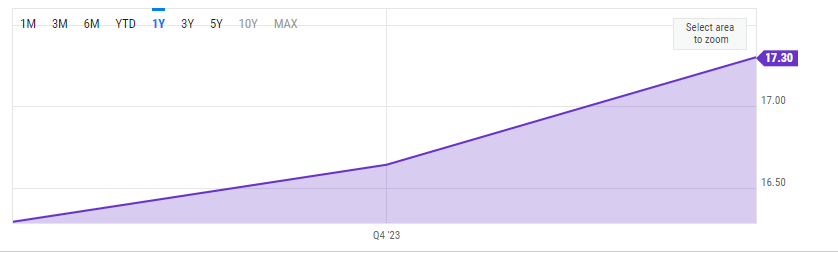

In the United States and Canada region, Netflix average revenue per membership (ARPU) is at $17.30, up nearly 4% from $16.64 last quarter, and up nearly 7% from $16.18 in the same period last year. In general, ARPU may serve as an indicator of long-term profitability. Following its strategies in serving ads to more viewers, there is still room for raising ARPU, thus the overall revenue and profitability.

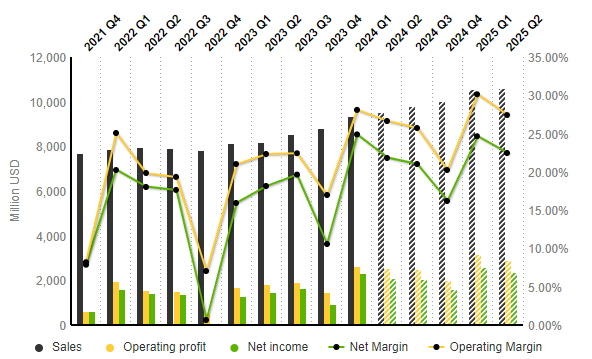

In the previous quarter, Netflix.Inc reported $9.37B in revenue, up 6.1% from the previous quarter, and up 14.8% from the same period last year. It saw a remarkable rise of 53.6% (y/y) in operating income to $2.6B, while net income has also improved significantly by 79% (y/y) to $2.3B. As a result, operating margin rose to 28.09%, while net margin hiked up to 24.89% (the first time since Q1 2022 that it has gone above 20%).

Projection for sales revenue in the coming quarter stood at $9.53B, slightly up 1.7% from the previous quarter, and up 16.4% from the same period last year. However, following “typical seasonality” as mentioned by the management, operating profit and net income is projected lower, at $2.54B and $2.09B respectively. Operating margin and net margin are also expected to edge lower, towards 26.66% and 21.87%.

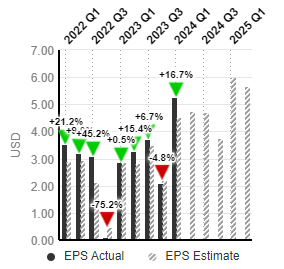

EPS is estimated to hit $4.74, down over -11% from the previous quarter’s $5.28. It was $3.29 in Q2 2023.

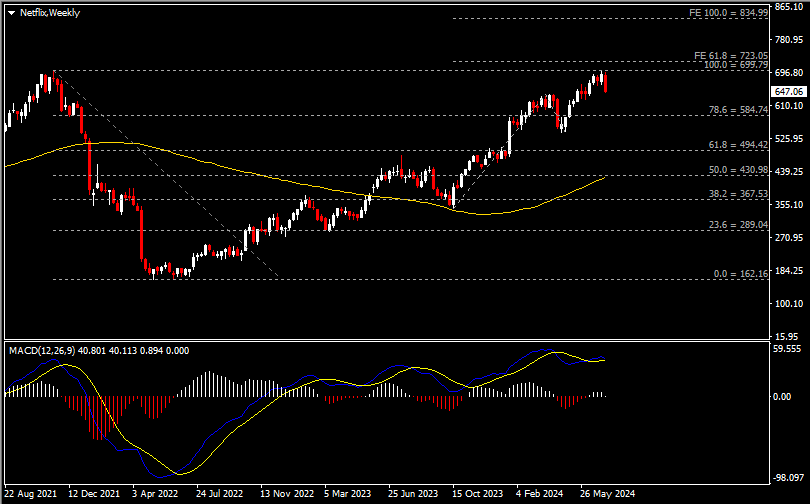

Technical Analysis:

The #Netflix share price has retraced from a new high since November 2021 (which is also the ATH at $699.79). The ATH and $723 (61.8% FE level) form a strong resistance zone. On the other hand, MACD double lines are about to form a death cross, whereas a bullish histogram is seen contracting which reflects a diminishing bullish momentum at the moment. A technical correction may direct focus towards support $585 (FR 78.6% which extends from the ATH to the lows of May 2022), followed by $494 (FR 61.8%).

Click here to access our Economic Calendar

Larince Zhang

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.