US stock indices closed higher on Tuesday [16 July], with the S&P 500 and Dow Jones Industrials recording new all-time highs.

Positive corporate news boosted the broader market on Tuesday, with Bank of America up over +5% after reporting better-than-expected Q2 net interest income and forecasting above-consensus Q4 net interest income. Morgan Stanley shares rose 1.5% after the bank’s profit and revenue topped Wall Street estimates, fuelled by strong trading and investment banking results. Charles Schwab fell more than -9%, after reporting a 17% decline in bank deposits to $252.4 billion and a 6% decline in net interest income.

Additionally, Match Group closed up over +7% after Starboard Value said it had built a 6.6% stake in the company. UnitedHealth Group closed up over +6% after forecasting full-year adjusted EPS above consensus.

Weakness in chip stocks limited gains in the Nasdaq 100, as investors shifted from large-cap chip stocks to small-cap stocks.

The S&P 500 Index on Tuesday, closed up +0.64%, the Dow Jones Industrials Index closed up +1.85% and the Nasdaq 100 Index closed up +0.20%.

Stock indices also received support from lower bond yields, the yield on 10-year T-notes on Tuesday fell to a 4-month low of 4.17%. Over the past 4 weeks, the US 10-Year Bond Yield lost 11.78 basis points, and in the past 12 months increased 37.00 basis points. Tuesday’s news showed that US retail sales increased more than expected in June, indicating that the economy is holding up.

- June US retail sales were unchanged on a monthly basis, stronger than expectations of a -0.3% m/m decline. In addition, June retail sales other than autos rose +0.4% m/m, stronger than expectations of +0.1%m/m.

- The June US import price index other than petroleum unexpectedly rose +0.2% m/m versus expectations of a -0.2% m/m decline.

- The July US NAHB housing market index unexpectedly fell -1 to a 7-month low of 42, weaker than expectations of no change at 43.

The #USA30 continued to rise on Wednesday, gaining more than 700 points. The surge was fuelled by the strong performance of UnitedHealth Group Inc, which topped the list of profitable companies, following the release of its second quarter earnings report. The report revealed a 6%y/y increase in revenue, reaching $98.9 billion. Following the multinational health insurer, Caterpillar Inc. and Boeing Co. rose 4.54% and 4.06%, respectively. The #USA500 rose 0.64% with Match Group Inc surging 7.78%. The Nasdaq 100 fell 0.11% as Constellation Energy Corp dropped 3.11%.

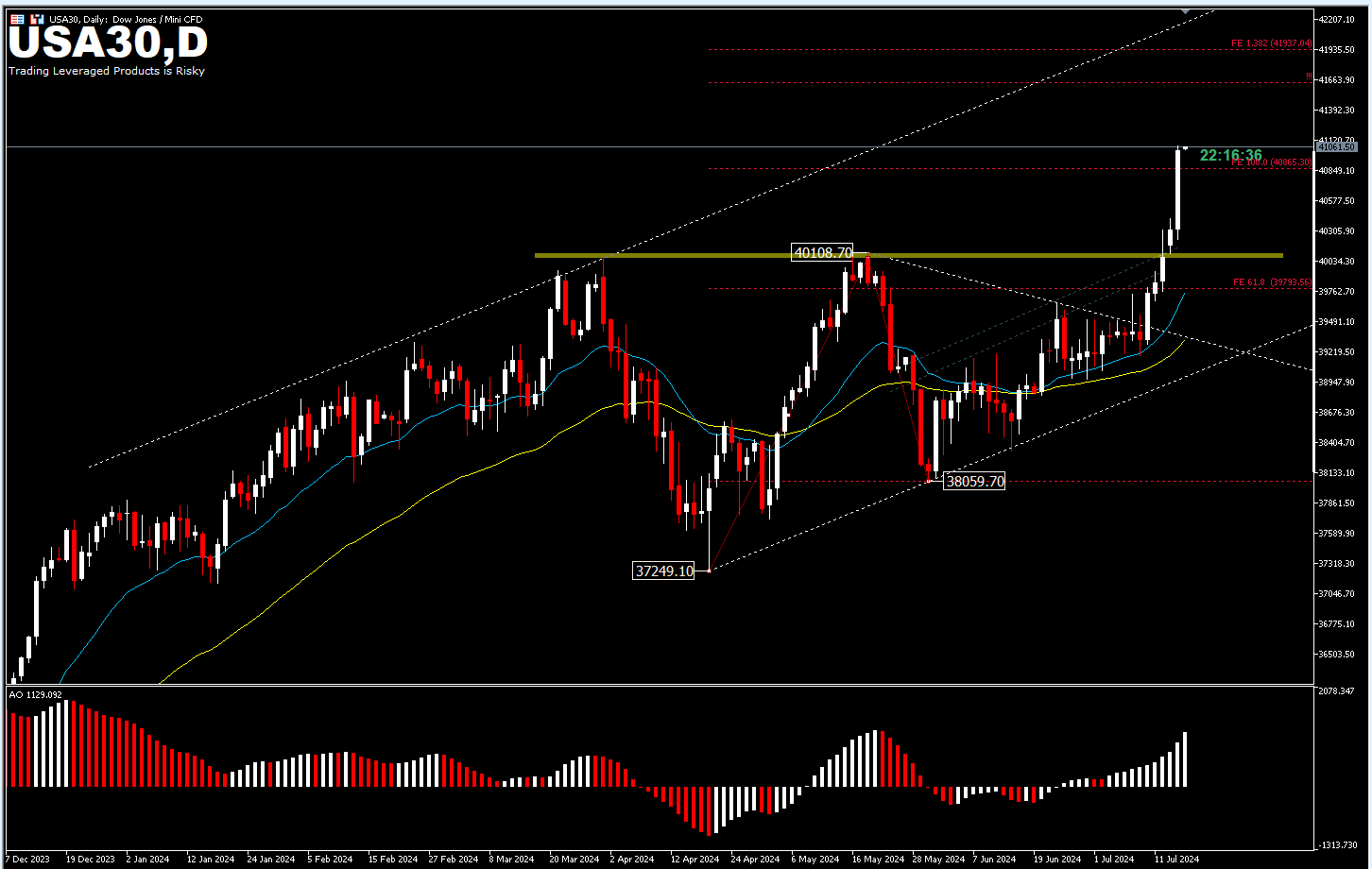

From a technical perspective, the #USA30 has surpassed the FE100% projection, [from 37,249 – 40,108 and 38,059 drawdown] so going forward the rally range is likely to widen with the possibility of testing FE138.2% and FE161.8% at $41,937 and $42,599 respectively. This outlook is yet to change, if the $40,108 resistance which serves as support remains intact.

Click here to access our Economic Calendar

Ady Phangestu

Market Analyst – HF Educational Office – Indonesia

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.