AUDUSD stabilised around 0.6700 halting recent declines, as investors reacted to the latest employment figures. Data showed that Australia added more jobs than expected in June amid high job vacancies and a strong participation rate, although the unemployment rate edged up to 4.1% from 4%.

The RBA is expected to hold rates steady in August, but some traders continue to bet on another rate hike amid persistent inflationary pressures and a tight labour market. The latest minutes showed that policymakers emphasised the need to be vigilant against positive risks to inflation, adding that significant price increases would require much higher interest rates. The RBA is also expected to ease its policy more slowly than other major central banks. Externally, the Australian dollar benefited from a weaker US dollar amid speculation that the Federal Reserve will cut interest rates this year.

Meanwhile, Australia’s NAB Quarterly Business Confidence improved slightly, rising from -2 to -1 in Q2. However, overall business conditions weakened, with the index falling from 10 to 5. Trading conditions fell from 15 to 9, profitability conditions fell from 8 to 2, and employment conditions fell from 7 to 5.

Cost pressures continued, with labour costs increasing by 1.2%, unchanged from the previous quarter, and purchasing costs increasing by 0.9%, down from 1.1%. Price growth measures showed little improvement, with final product price growth of 0.6% q/q, down from 0.8%. Retail price growth slowed to 0.7% from 0.9%, and recreation and personal services price growth slowed to 0.6% from 0.8%.

NAB Chief Economist Alan Oster noted that the survey showed mixed results regarding cost and price pressures. Although raw material cost growth improved, labour costs remained high. He highlighted that 30% of companies face major challenges regarding labour availability, and wage costs continue to be a major concern.

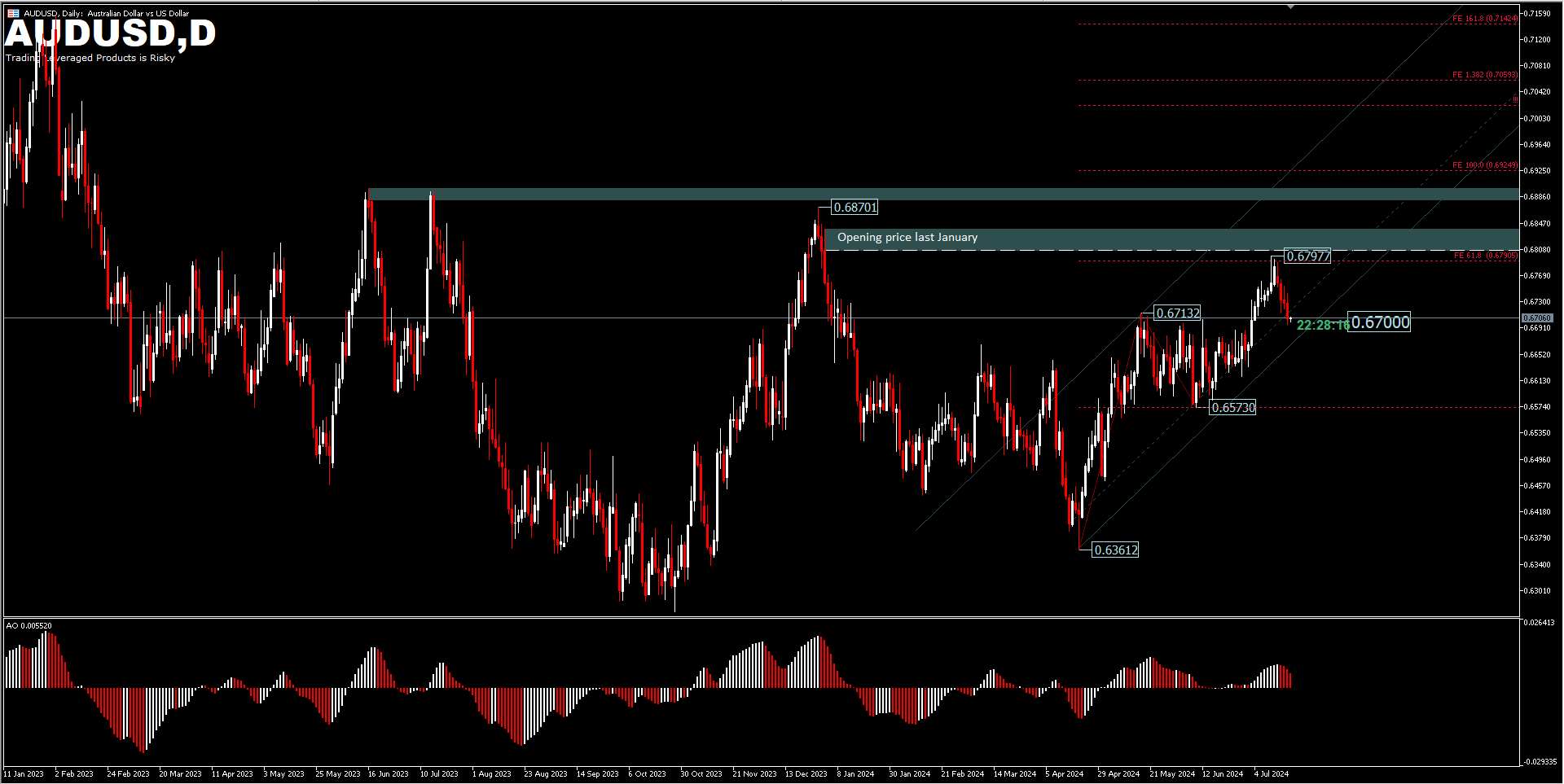

In the exchange market, the Australian Dollar has rallied over 5% from its April lows with a recent breakout to reach technical resistance last week. The Aussie is down over 1% this week and the threat of a deeper pullback in the broader uptrend remains. On an annualised basis, AUDUSD is only down 1.4%, as the decline since January has been largely reversed this month.

From a technical perspective, the current bias is still neutral. Further rallies are expected as long as the 0.6700 round figure holds. A move above 0.6797 will resume the upside from 0.6361 and target the FE100% projection at 0.6925 [from 0.6361 – 0.6713 and 0.6573 pullback]. On the downside however, a strong break of the 0.6700 round-figure will turn the bias to the downside causing a deeper pullback with important support at 0.6573.

Click here to access our Economic Calendar

Ady Phangestu

Market Analyst – HF Educational Office – Indonesia

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.