Tesla. Inc. is a company which engages in the design, development, manufacture, and sales of fully electric vehicles, as well as power storage and photovoltaic systems. It is currently ranked 11th by market cap (over $792B.) The company is scheduled to release its Q2 2024 earnings result on 23rd July (Tuesday), after market close.

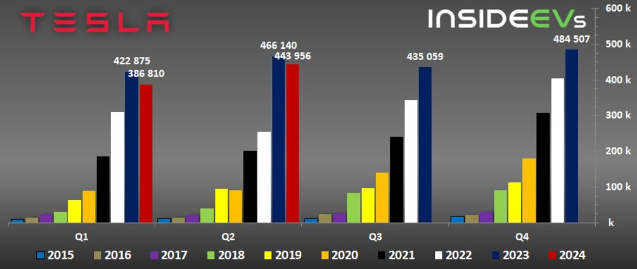

In Q2 2024, Tesla reported total vehicle production at 410,831, down –14% compared to the same period last year, and also the lowest quarterly volume since Q3 2022. On the other hand, total deliveries hit 443,956, down 5% from the same period last year (Model 3/Y deliveries were down -5%, whereas other model deliveries were up 12%, which may have been boosted by the Cybertruck ramp-up).

Despite macroeconomic headwinds and supply disruptions following Red Sea conflicts and factory shutdowns, the officials expected the deliveries “will be a lot better in the second quarter”, yet the segment revenue shall still experience a year-over-year decline. Its short-term growth projection has also been tempered, in which the deliveries “might fall short of last year’s figures”.

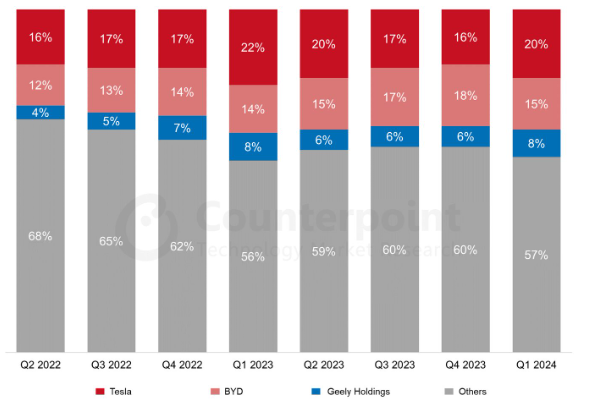

Despite the reported decline in sales, Tesla regained its position as the best-selling BEV brand in Q1 2024, occupying 20% of global market share. More than 70% of its sales came from Model Y. In the US, however, the company’s EV market share fell to 49.7%, much lower than the year-ago 59.3%, as a result of intense competition among peers.

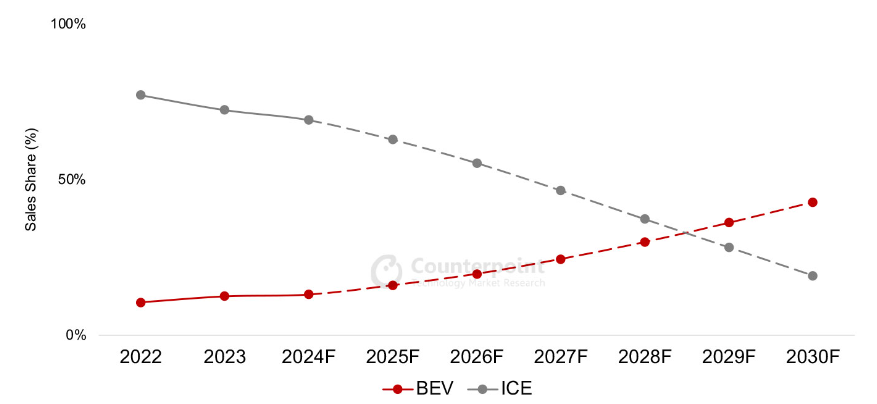

BEV vs ICE Sales Share Trend. Source: Counterpoint

In general, the prospect for battery electric vehicles (BEV) remains bright. According to Counterpoint, BEV sales shall hit the 10 million milestone this year, while internal combustion engine (ICE) vehicles is set for a drop below 50% in four years, and to continue on a long-term decline. It is said that the continuous growth of BEV sales will be supported by the revamping of production processes, and strategic partnerships with battery manufacturers which are aimed at producing affordable EVs with lower manufacturing costs, as well as bolstering supply chains.

The Tesla’s Robotaxi event which was originally scheduled to be announced on 8th August, has been confirmed by Elon Musk to be postponed to October, as according to him, “extra time is needed to redesign the front of the vehicle”. The Robotaxi (driverless taxi) is claimed to be functioning like a combination of Airbnb and Uber. The Robotaxi shall run with Tesla’s Full Self-Driving (FSD) software, however it is also worth noting that there is more work in progress in the software, not to mention a number of lawsuits and regulator scrutiny related to the safety concerns over the software.

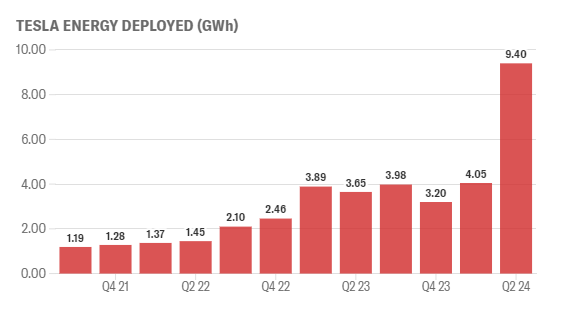

Tesla: Energy Storage Deployment. Source: Yahoo Finance

In the previous quarter, Tesla reported 9.4 GWh (gigawatt hours) of battery energy storage, more than double the amount of battery storage deployed in the first quarter, and also the highest quarterly amount ever. According to Morgan Stanley, Tesla’s energy storage business is poised to continue benefiting from investment in the US electric grid accelerated by the AI boom.

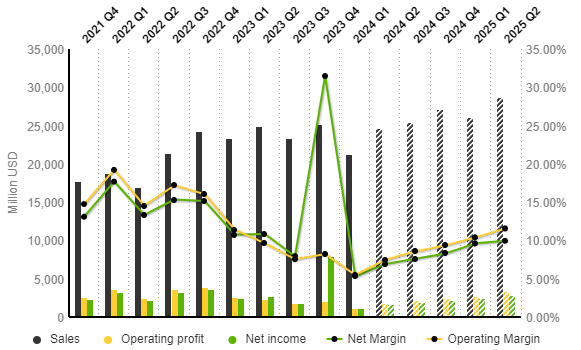

Tesla: Income Statement Evolution (Quarterly Data). Source: Market Screener

Tesla: Income Statement Evolution (Quarterly Data). Source: Market Screener

In the coming announcement, the S&P Global Market Intelligence projected the company’s sales revenue to reach $24.7B, up nearly 16% from the previous quarter, but slightly down -0.8% from the same period last year. Operating profit and net income are expected to extend higher towards $1.9B and $1.7B, respectively. This would lead the operating margin and net margin to increase slightly to 7.48% (was 5.50%) and 6.93% (was 5.30%).

EPS is estimated to hit $0.49, up over 44% from previous quarter $0.34. It was $0.78 in Q2 2023.

Technical Analysis:

#Tesla shares underwent selling pressure last week, currently testing $240 (FR 61.8% extended from the highs in July 2023 to the lows in April 2024.) MACD indicator has just formed a dead cross. If price breaks below the support mentioned, the next level to focus on will be $219 (FR 50.0%). On the contrary, if support remains intact, the nearest resistance is seen at $265 (FR 78.6%) and the highs in July 2023, at $299.28.

Click here to access our Economic Calendar

Larince Zhang

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.