US President Joe Biden unexpectedly announced that he will complete his current term, but not run for re-election. This development introduced a new layer of intrigue and uncertainty, which usually unsettles markets. Following Biden’s announcement, many members of the Democratic Party were quick to support Vice President Kamala Harris. The US dollar weakened slightly as markets began to consider the implications of a potential Harris presidency on the economy.

Amidst the uncertainty and the marathon of political campaigning that will take place, hedge assets will generally be looked upon. Besides Gold, the Japanese Yen and Swiss Franc are likely to benefit. Throughout the year, the US Dollar has benefited from safe haven flows, however current concerns stem partly from the prospect of a Kamala Harris and Democratic Party victory, which could theoretically weaken the US Dollar in the long run due to potential tax increases and lower borrowing costs. These concerns may explain the current reduced hedge appeal of the US Dollar. Although, at the moment it is too early to judge.

The yen started the week with gains, continuing the strength from previous interventions. And today, the Japanese yen stabilised below 157.0 against the US dollar, as investors braced for next week’s Bank of Japan policy meeting, where the bank is expected to raise interest rates again to defend its currency. Prime Minister Fumio Kishida also said that the central bank’s normalisation of monetary policy will support Japan’s transition to a growth-driven economy.

The yen strengthened about 2% over the past two weeks on alleged government intervention, with BOJ data showing authorities may have bought nearly 6 trillion yen on 11-12 July through intervention. Data also showed that Japan sold about $22bn of US bonds in May to raise dollars, building a support fund for potential foreign exchange market operations. Meanwhile, last week’s data showed that Japan’s headline inflation rate remained unchanged at 2.8% in June, while the core inflation rate rose to 2.6% from 2.5%.

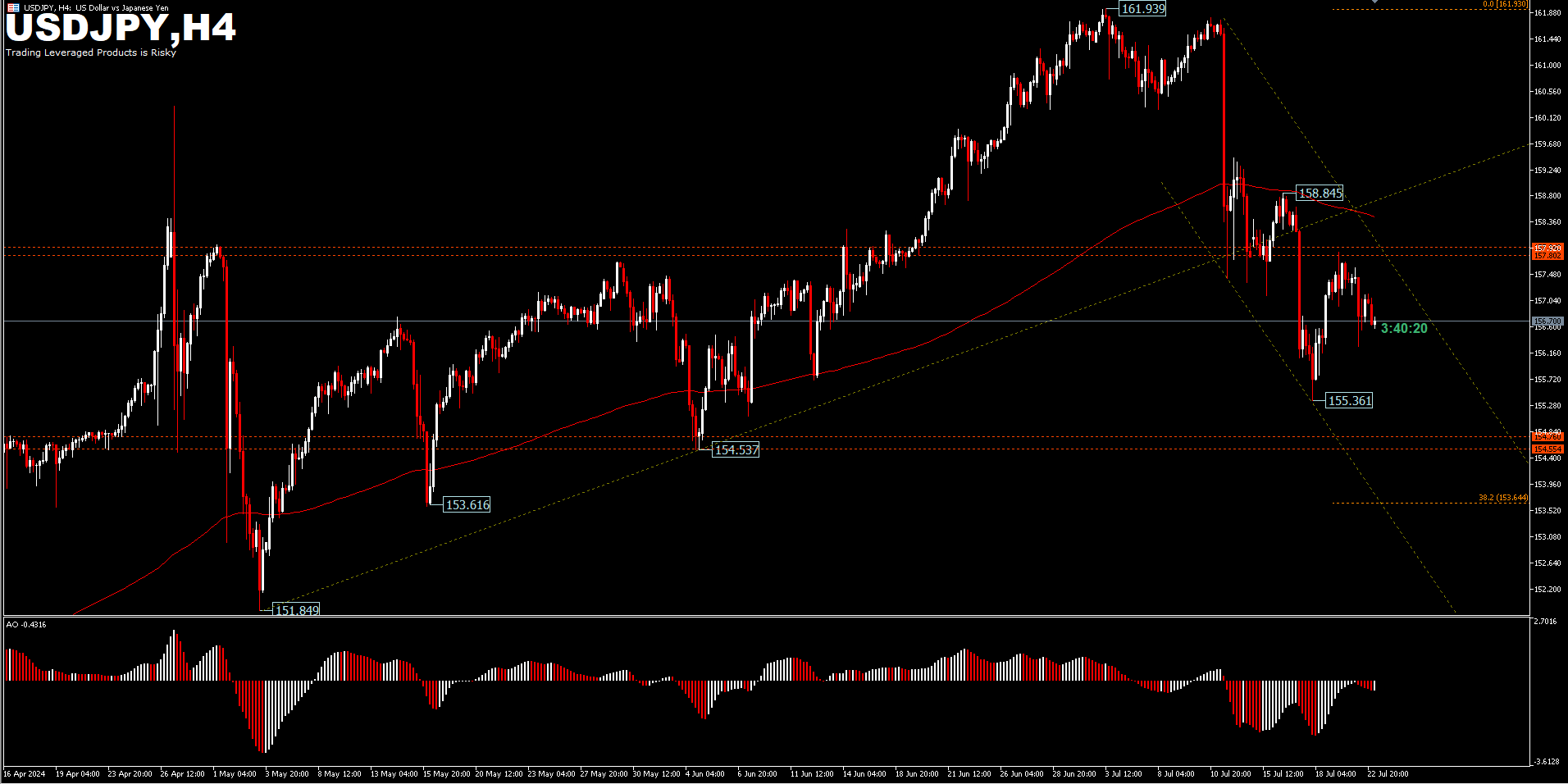

From a technical perspective, USDJPY is holding in a range above the 155.36 temporary low and the intraday bias is still neutral. Further downside is expected as long as 158.84 resistance is intact. A move below 155.36 could test the 38.2% retracement of the 140.24 – 161.93 pullback at 153.64. On the upside, a move above 158.84 resistance will turn the bias back to the upside resulting in a stronger rebound.

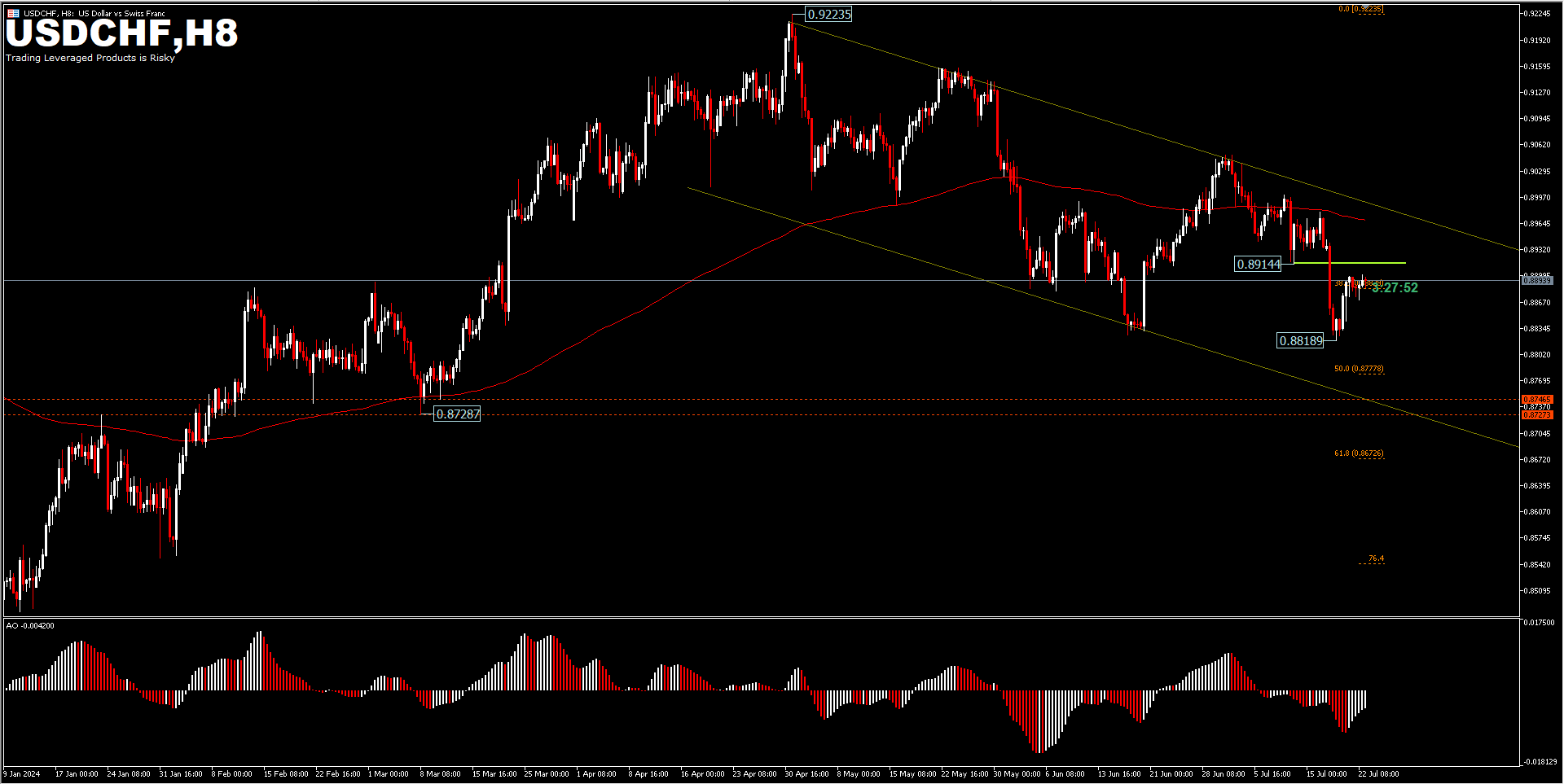

Meanwhile, the USDCHF pair was relatively stable for the day trading at 0.8890 price range. On the other hand, the Dollar is at its lowest level in four months as traders anticipate an interest rate cut by the Federal Reserve this year. A series of dovish statements from Fed officials, including Fed Chair Powell, reinforced those expectations. Powell noted that recent data ‘added to confidence’ that inflation will return to target and emphasised that the central bank will not wait until inflation reaches 2% before cutting rates.

From a technical perspective, USDCHF is holding in a range above 0.8890 and the intraday bias is still neutral. Further downside will occur as long as 0.8914 support turned resistance holds. A break of 0.8818 will target the 50.0% retracement of 0.8332 to 0.9223 pullback at 0.8778 and further at 0.8728 support/resistance level next. However, a break of 0.8914 will turn the bias back to the upside and a stronger rebound to test 200-period EMA and the bearish trendline.

Click here to access our Economic Calendar

Ady Phangestu

Market Analyst – HF Educational Office – Indonesia

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.