Apple,Inc., an American multinational technology company that specializes in the design, manufacture, and sale of smartphones (iPhone), personal computers (Mac), tablets (iPad), wearables and accessories (Apple Watch, AirPods, Apple Beats), TVs (Apple TV) and other varieties of related services (iCloud, digital content stores, streaming, licensing services), shall release its Q3 2024 earnings result on 1st August (Thursday), after market close. What lies ahead for this most valuable conglomerate with market capitalization over $3.3 ttrillion?

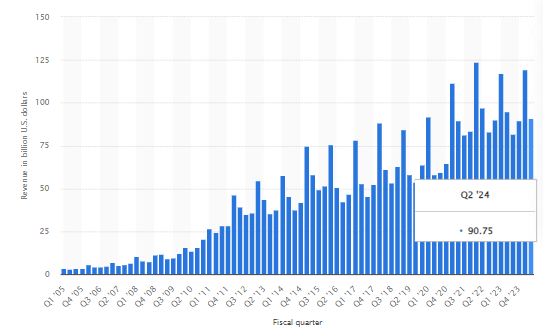

In Q2 2024, Apple Inc. reported a revenue of $90.75B, down -24.1% from the previous quarter, and down -4.3% from the same period last year. The slump in sales revenue was mainly dragged by a slide in hardware sales, albeit the rapidly growing services revenue.

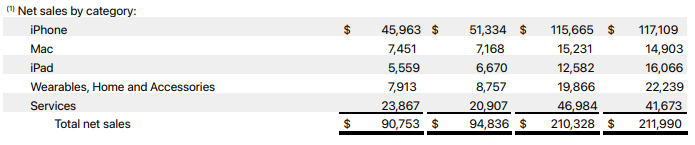

As seen from the financial statement above, iPhone sales revenue has dropped over -10% (y/y) to $45.96B, hit by weak demand globally including the Greater China (Following news of AI-supercharged iPhone 16 with upgraded operating system to be launched in September, some analysts expected the company to reach $4T in market cap); iPad sales revenue down -16.7% (y/y) to $5.6B, following an absence of innovation since 2022 (Nevertheless, a redesigned iPad models in May could probably revive demand in the product line); Wearable, Home and Accessories sales revenue down -9.6% (y/y) to $7.9B; Mac sales revenue remain flat, at $7.5B; Services revenue, on the other hand, up over 14% (y/y) to all-time record, at $23.9B. In the near term, the management expected to see double-digit growth in services segment. In addition, the company reported a decline of -2.2% (y/y) in net income, to $23.6B.

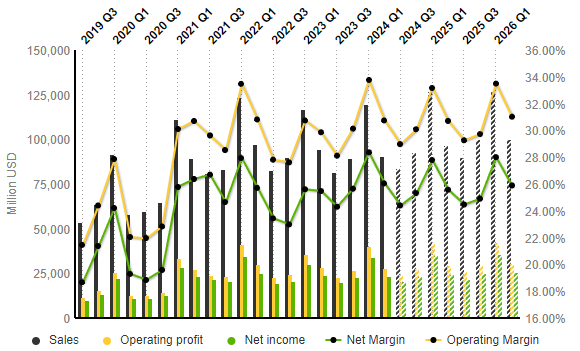

Pessimism persists for the coming quarter. According to projection by the S&P Global Market Intelligence, sales revenue of Apple Inc. is expected to hit $84.1B, down -7.3% from the previous quarter, but up 2.8% from the same period last year. Operating profit and net income are estimated at $24.4B and $20.5B (was $27.9B and $23.6B in the previous quarter). As a result, operating margin is projected to down -1.77% (q/q) to 28.97%, whereas net margin is expected to down -1.64% (q/q) to 24.40%.

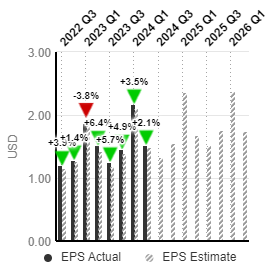

Apple: EPS. Source: Market Screener

EPS is estimated to hit $1.33, down 20 cents from previous quarter $1.53. It was $1.26 in Q3 2023.

Technical Analysis:

#Apple, Weekly: #Apple share price has retraced recently from ATH $237.15 and FE 100% $239. The FE 61.8%, or $211 serves as the nearest support, followed by $197 and dynamic support 100-week SMA. On the other hand, $239 serves as the nearest resistance, in which a break above this level shall indicate trend continuation, with the next focus on $284 (FE 161.8%). MACD indicator remains in positive territory, with its fast line at value 11.243.

Click here to access our Economic Calendar

Larince Zhang

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.