- Stock Market crash in Asia sparks concern amongst Bank of Japan representatives. The Japanese Yen loses short term momentum.

- Uchida advises the Central Bank will not hike again while the market remains unstable.

- The New Zealand Dollar soars as the country’s employment sector grows 0.4%. Additionally, the Unemployment Rate remains lower than previous predictions.

- Amgen’s quarterly earnings reports fall short numbing the stock market’s upward push attempt.

EURJPY (Euro/Japanese Yen) – Dovish BOJ Pressures The Japanese Yen!

The Euro increased against the Japanese Yen for the first time since July 25th. The exchange rate has dropped in value for 8 consecutive days. The price this morning trades 1.65% higher but still remains at its lowest point since March 2024. What is driving the price movement?

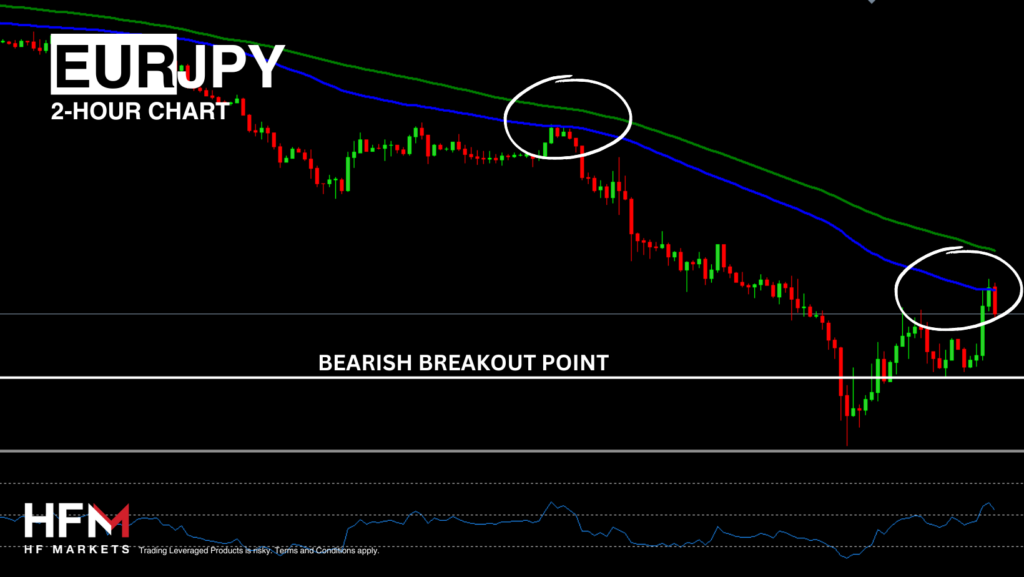

EURJPY 2-Hour Timeframe Honoring Recent Trend-Line!

EURJPY 2-Hour Timeframe Honoring Recent Trend-Line!

The price movement is largely due to two factors. The first is the price has fallen almost 12% in the space of a month making the exchange rate oversold on most indicators. As a result, investors can become uneasy further speculating the decline in the short term. In addition to this, investors are also scrutinising the dovish comments from the Bank of Japan Deputy Governor, Shinichi Uchida.

After the comments from the Bank of Japan Deputy Governor, investors are now almost certain the bank will not hike again any time soon. According to economists the Bank of Japan is not likely to increase interest rates again in 2024. This can trigger some weakness in the Japanese Yen. However, if the Federal Reserve, European Central Bank and Bank of England continue with their plan to cut rates throughout the year, the Yen can still perform well. Currently, analysts expect the Federal Reserve to cut between 75-basis points and 125-basis points by the end of the year.

In regard to the Euro, yesterday June’s data on retail sales in the Eurozone were published, revealing weak performance: sales volume decreased by 0.3%, falling short of experts’ forecasts. This confirms ongoing risks of a slowdown in the European economy, which could prompt the European Central Bank to ease monetary policy. The Euro Index is trading 0.18% lower and the currency is declining against the US Dollar and the Yen. Therefore, investors should be cautious of conflicting price action. If investors wish to avoid two depreciating currencies, the USDJPY or GBPJPY could be a more appropriate option.

On the 2-Hour timeframe, the EURJPY is trading at the trend-line (75-Period EMA) and still remains below the 100-Period Simple Moving Average. However, the price is above the 50.00 level on the RSI but is at a previous resistance level. Therefore, technical analysis is providing a slight bearish bias, but this could gain momentum if the price falls below 158.846 and 157.274.

EURNZD – The NZD Rebounds As Employment Data Beat Expectations!

Currently the best performing currency is the New Zealand Dollar which is being supported by positive employment data. The employment change rose 0.4%, meaning the country’s employment sector has expanded by 2.2% in the past six months. The Unemployment Rate rose from 4.3% to 4.6%, but still read lower than previous predictions. As a result, the central bank is less likely to consider an interest rate cut imminently.

EURNZD 1-Hour Timeframe On The 7th August 2024

EURNZD 1-Hour Timeframe On The 7th August 2024

The New Zealand Dollar index is currently trading 0.86% higher so far, but investors should be cautious of retracements as we switch to the European session and the US session. For the NZD, tomorrow’s inflation expectations for the next quarter will be vital and can create higher volatility. In addition to this, the Reserve Bank of Australia’s speech can also trigger volatility for both the AUD and NZD.

Previously the RBA Governor, Michele Bullock, told journalists that the committee discussed another interest rate hike, but decided that their size is sufficient for now, and the short-term reduction in borrowing costs is not in line with the current view of the regulator’s board members.

Michalis Efthymiou

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.