FX News Today

- Risk aversion continues to prevail as US Treasuries, JPY , CHF and Gold remain in Bid mode

- Treasury yields did come off highs and the 10-year yield backed up 2.9 bps to 2.100%, after risk aversion and comments from Fed’s Bullard, who said a rate cut may be “warranted soon”, underpinned rate cut speculation and fresh gains in Treasuries yesterday.

- The RBA cut rates to record lows, as expected. The latter helped the ASX to outperform in Asia and move up 0.25%, but elsewhere stock markets were remained under pressure during the Asian, after the NASDAQ closed with a loss of -1.6% yesterday amid selling in the likes of Facebook and Amazon, with speculation of antitrust probes after the US Justice Department and the Federal Trade Commission agreed to split up oversight of tech giants.

Charts of the Day

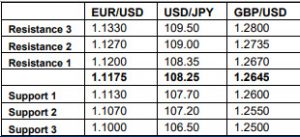

Technician’s Corner

- USDAUD – H1 – Ran out of steam at 0.6990, but remains over daily pivot at 0.6960 and trades at 0.6982 as USD continues to soften into European session. R1 and the psychological 0.7000 next key resistance. R2 at 0.7015 would need a significant deterioration in USD today.

- USDJPY – H1 – Keeps the bid as 108.00 handle is breached once more. S1 sits at 107.80, S2 at 107.56 and S3 at 107.24. Pivot Point and 20 period moving average at 108.10, R1 at 108.37 and R2 108.68. RSI remains north of OS at 34.7, Stochastics in OS zone all of Asian session and remain there. Lower Bollinger band 107.65.

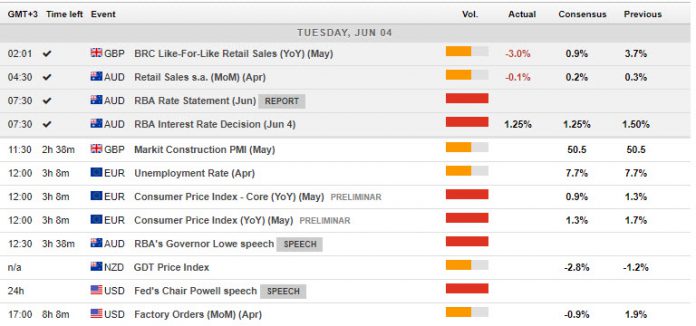

Main Macro Events Today

- Consumer Price Index (EUR, GMT 09:00) – The preliminary Euro Area CPI for May is expected to drop back to 1.4% y/y from 1.7%y/y last month. The core inflation is seen at 1.0% y/y from 1.3% y/y.

- RBA Chair Lowe speech (AUD, GMT 09:30) – Due to speak at the RBA Dinner following today’s meeting – Q&A expected.

- Fed’s Chair Powell speech (USD, GMT 13:55) – Due to speak in Chicago about Federal Reserve’s policy strategy, tools, and communication practices.

Support and Resistance levels

Click here to access the Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.