FX News Today

- Asian stock markets rallied following the bounce on Wall Street yesterday that was fueled by seemingly conciliatory signals on the trade front and comments from Fed Chairman Powell

- Fed Chair Powell said the Fed will “act appropriately” signaling that the Central Bank is open to rate cuts if necessary.

- China’s Services PMI came in much weaker than anticipated at 52.7, down from 54.5 in the previous month.

- World Bank cut global growth forecast to just 2.6% from 2.9%, the weakest since the financial crisis, citing trade tensions and risks .

- The WTI future meanwhile is trading at just USD 52.94 per barrel.

- Markets are positioning for a very dovish signal from the ECB tomorrow, amid the multitude of geopolitical risks and weak PMI and inflation data this week.

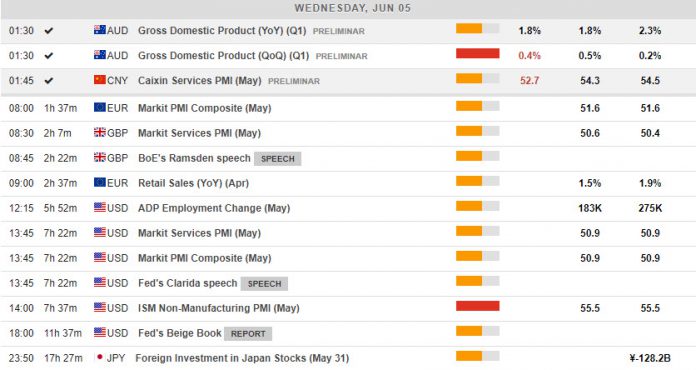

- Today’s calendar has Services PMIs for the Eurozone and the UK as well as Eurozone retail sales and PPI readings.

Charts of the Day

Technician’s Corner

- USDCAD – H4- remains heavy on the session, bottoming at 1.3372 following the Powell comments, though since remaining in a decline, retesting the 3-month Support at 1.3356-1.3375, after breaking the significant 50-day MA. The close yesterday below the latter could be taken as a bearish USDCAD sign,with the next Support at 200-day EMA and April’s low at 1.3273.

- XAUUSD – H1 – boosted ahead of London open, spiking above 1334.00, just a dollar away from 3-month highs of $1,346.70. The contract had been bid up since late last week on severe risk-off conditions, with safe-haven flows seeing gold prices rising from lows under $1,274.00 last Thursday. Bigger picture, talk of Fed rate cuts limit downside potential for now. Next Resistance at February’s highs.

Main Macro Events Today

- ADP Employment Change (USD, GMT 12:15) – The April ADP Employment report should reveal a 183k gain for the month, after a 275k April gain.

- ISM Non-Manufacturing PMI (USD, GMT 14:00) – The ISM-NMI index is expected to edge up to 55.7 in April from a 19-month low of 56.1 in March, versus a 13-year high of 60.8 in September.

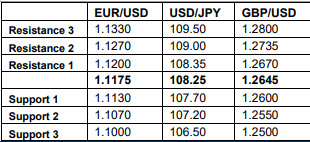

Support and Resistance levels

Click here to access the Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.