Markets corrected again amid the back and forth on the Fed outlook and uncertainties over soft and hard landings that have besieged the outlooks since the jobs report. Global stocks have largely recovered from last week’s downturn, which had traders worried that the Fed might not cut rates quickly enough to prevent a recession.

- Asian stocks surged as investors returned to riskier assets, driven by increasing optimism that the US economy will sidestep a recession.

- September’s Fed rate cut was knocked out by the better than expected retail sales & jobless claims data and inflation. They are now anticipating less than a 30-basis point cut next month, with a total reduction of 92 basis points projected for the remainder of 2024.

- The RBA’s governor indicated that the central bank is still some distance from easing monetary policy.

- RBNZ governor Adrian Orr raised the distinct prospect of cutting rates another 50 basis points by year-end. NZDUSD rose to 0.6020.

Asian & European Open:

- Japanese stocks climbed, benefiting from a weaker Yen, which enhances exporters’ profits. The Nikke is set to end the week on a high, surging 2.9% to 37,800.42.

- Treasuries extended their losses, and the Yen is on track for its steepest weekly decline since May.

- The VIX fell further, dropping -6.49% to 15.14. It is well below the intraday spike to 65 on August 5 and is the lowest since July 23, even before the jobs report.

- Wall Street surged 2.34%, with the S&P500 advancing 1.61%, while the Dow climbed 1.39%. The rebound in US stocks from the heavy selling suggests that trend-following quant funds may soon reenter the market, potentially providing further support to equities.

- Walmart’s solid earnings report added to signs that the consumer is by no means dead, corresponding with the better news on retail sales. Alibaba Group Holding Ltd. saw gains as optimism around tech stocks overshadowed concerns about its earnings. JD.com Inc. surged the most since March after exceeding net profit expectations in its earnings report released late Thursday.

Financial Markets Performance:

- The USDIndex firmed to 103.024 after fading from the spike to 103.227. It was as low as 102.530.

- The Yen dropped 1.3% hovered around the 149 mark. This currency depreciation might even entice some hedge funds back into the carry trade that unraveled two weeks ago.

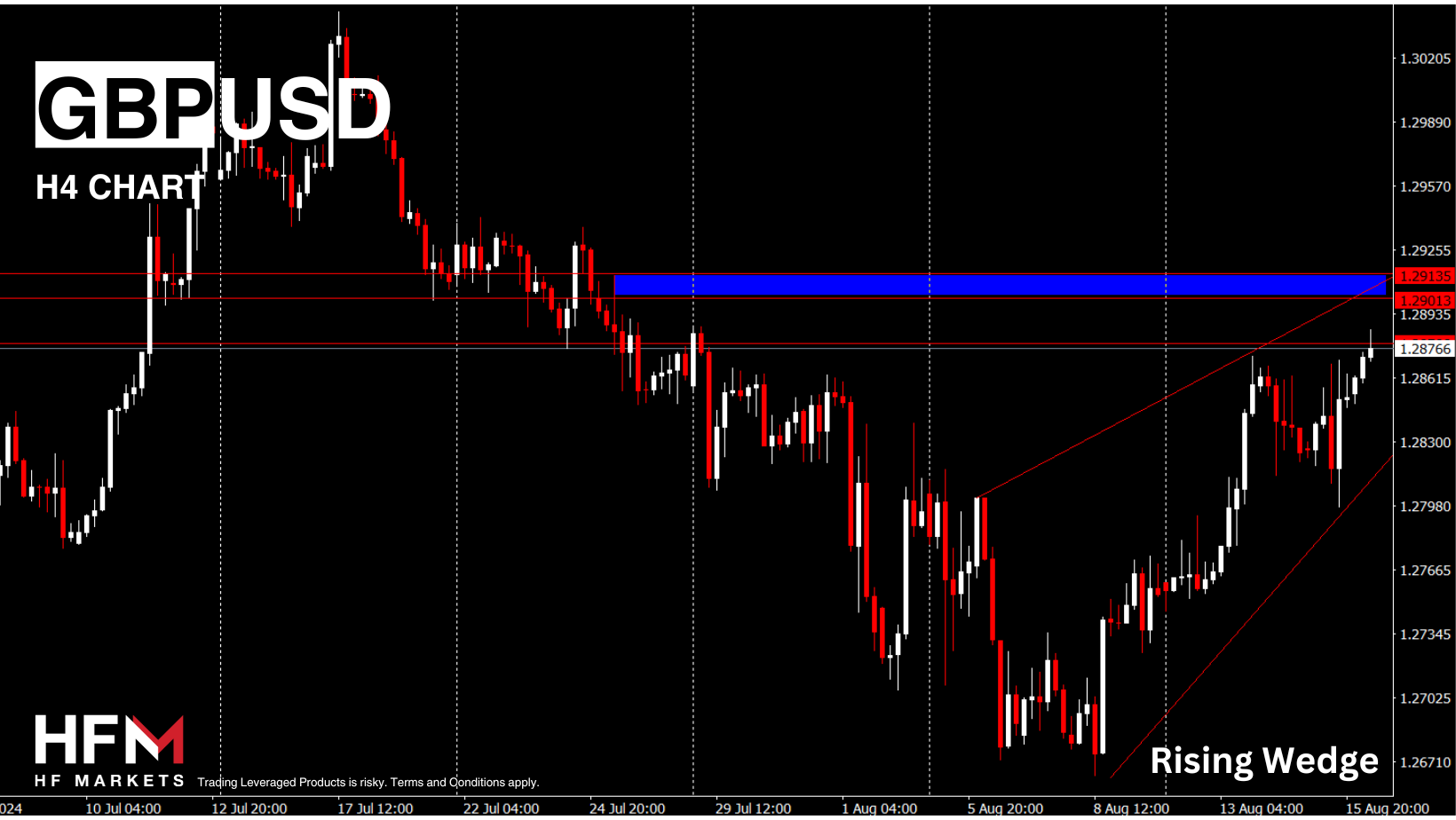

- GBP strengthened as GDP data confirmed robust growth through the second quarter of the year, which weighed on Gilts and saw yields moving higher.

- The AUD strengthened as job gains beat expectations.

- USOil climbed 1.3% to $77.99 per barrel on the improved growth outlook.

- Gold rallied 0.34% to $2456.24 after slumping to $2432 on the data.

Click here to access our Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.