Spot gold prices rose above $2,500/oz on Friday afternoon, surpassing the previous record reached last month. The rise followed disappointing US housing data, reinforcing bets of faster and bigger interest rate cuts from the Federal Reserve.

Markets continue to show a broad consensus of a 100bps interest rate cut by the Federal Reserve throughout their remaining three decisions this year, although the release of strong retail sales has prompted investors to trim bets of a stronger cut of 50bps next month, followed by a series of 25bps cuts that would bring the Fed funds rate back to around 3.5% by next summer.

The Fed has kept its key policy rate within its target range of 5.25% to 5.5%; its highest level in more than two decades since last July. Our US economists now forecast a 50bps cut in September. Gold is up more than 20% this year amid geopolitical uncertainty, rate cut expectations from the Fed and strong interest from central banks.

The focus for gold will remain strong on the scope and timing of the Fed’s possible move to cut interest rates. Geopolitics will also remain one of the main factors driving gold prices. The war in Ukraine and ongoing conflicts in the Middle East, alongside tensions between the US and China, suggest that safe haven demand will continue to support gold prices in the short to medium term. The US presidential election in November will also continue to add to gold’s upward momentum until the end of the year. Central banks are also expected to continue adding to their holdings, which should provide support to gold prices.

Jackson Hole and PMI data are in the spotlight this week. This year’s Jackson Hole symposium has significant importance as a gathering of central bankers, economists, and global financial market participants. This year, the focus of the symposium is once again on navigating the post-pandemic economic recovery and addressing the challenges posed by higher interest rates and geopolitical tensions.

Key topics include strategies for sustainable growth, monetary policy adjustments, and the implications of digital currencies on the global financial system. Prominent speakers at this year’s event include Federal Reserve Chairman Jerome Powell, European Central Bank President Christine Lagarde, and Bank of England Governor Andrew Bailey. Their insights are expected to shape market expectations and policy direction for the coming year. The symposium can trigger volatility in a number of currency pairs and commodities, so it is worth monitoring closely.

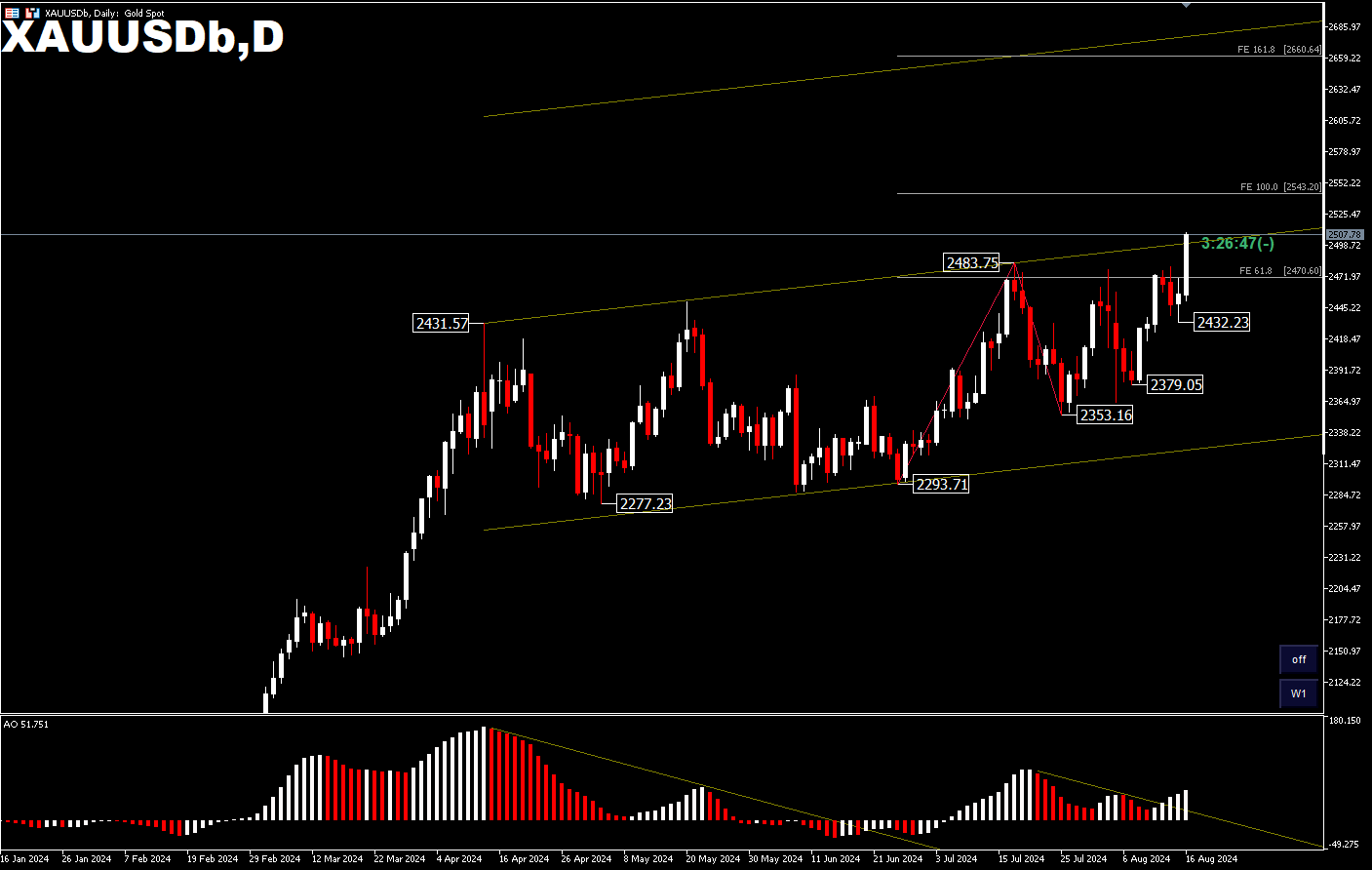

XAUUSD Technical Review

Higher highs on the gold chart and weakening selling pressure brought gold prices higher above the $2,500 psychological level. A continued rally is projected for FE100% and further FE161.8% [from 2,293 – 2,483 and 2,353 drawdown at 2,543 and 2,660]. While the previous ATH of $2,483 will be the support on the downside. A drop below this level could be possible, due to profit-taking from traders and attempts to re-buy at more skewed prices. Support is seen at 2,432; 2,379 and 2,353.

Click here to access our Economic Calendar

Ady Phangestu

Market Analyst – HF Educational Office – Indonesia

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.