Last week, Alphabet.Inc released its latest Pixel 9 series (Pixel 9, Pixel 9 Pro, Pixel 9 Pro XL and Pixel 9 Pro Fold), smart watches (Pixel Watch 3) and other new products (Pixel Buds Pro 2), two months ahead of schedule. According to the officials, in addition to being equipped with more advanced cameras and improved performance, what will make the phones outstanding will be the deeply integrated AI technology – Gemini.

“We have fully entered the Gemini era.”

– Rick Osterloh, Senior Vice President of Google Devices and Services

Some of the AI-driven features of the Pixel 9 series include the built-in AI assistant Gemini Live (users may communicate with it via text, image or voice – similar to ChatGPT, but with stronger memory capabilities and the ability to handle large amounts of data for long conversations), image generator, enhanced photo processing tools, customized weather forecast, saving records and details during calls, photos merging via the “add me” feature which utilizes real-time augmented reality technology, etc.

In addition, according to the management team, more apps shall be connected with Gemini in the coming weeks, including the Calendar, YouTube Music and Keep. Furthermore, the team is preparing to reconstruct the Android system, by integrating Gemini directly into the structure of the entire system, so that it could be further used by other brands (eg. Samsung) that are operating via the Android kernels.

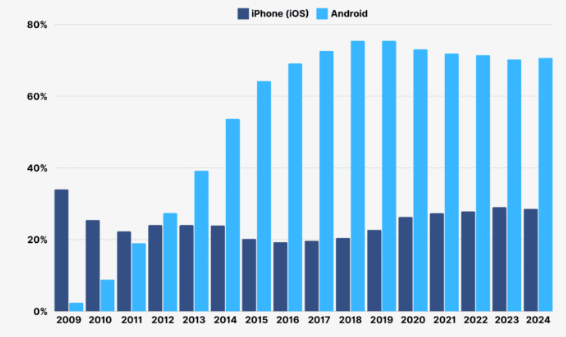

iOS vs Android Market Share Worldwide. Source: Backlinko

In general, statistics showed that Android held more than half of the market share worldwide for the first time in 2014, at 53.65%. From the graph above, we can also see that Android has continued dominating the market since then, remaining above 70% since 2017. On the other hand, its competitor, iOS, remains stagnant in terms of market share, below 30% for decades.

Google’s integration of generative AI into its hardware and smartphone businesses (including expansion to older and non-flagship Android devices, allowing more users to experience the latest AI services) will be a major breakthrough for the company, which may possibly reignite consumers’ interest and demand worldwide.

Technical Analysis:

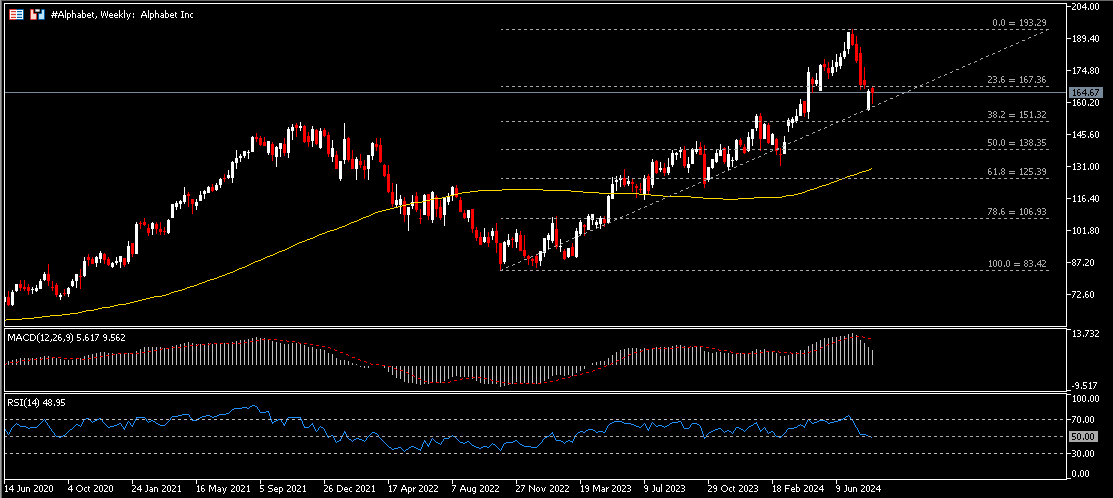

#Alphabet, Weekly: The #Alphabet share price slightly closed below resistance $167 (FR 23.6% extended from the lows of October 2022 to the ATH $193.29 seen in early July this year). Overall the trend remains bullish in general. Despite the MACD indicator trending downward, a diminishing bearish momentum of the candlesticks in the last two weeks, plus RSI that is hovering near 50.0, may suggest price consolidation in near term. Bullish continuation may be validated if the asset breaks above $167, then towards the next target at the ATH. On the other hand, $151 (FR 38.2%) serves as the nearest support, followed by $138 (FR 50.0%).

Click here to access our Economic Calendar

Larince Zhang

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.