Gold rallied to near ATH levels on Tuesday [27/08], amid stronger expectations of a US interest rate cut this year and rising geopolitical risks. Last week, Federal Reserve Chairman Jerome Powell confirmed a rate cut in September, indicating the US central bank is ready to start lowering interest rates as inflation nears its 2% target, while also expressing concerns about a weaker labour market. In addition, dovish comments on Tuesday from ECB Governing Council members Centeno and Knot supported demand for gold as a store of value when they said they were in favour of ECB rate cuts.

San Francisco Fed President Mary Daly echoed Powell’s dovish stance on Monday, stating that ‘the time to adjust policy is in sight’. Similarly, Richmond Fed President Barkin said, that while he still sees upside risks to inflation, he supports a rate cut in response to a cooling labour market. Furthermore, rising geopolitical tensions in the Middle East have increased demand for safe haven assets such as gold.

While the market expects a rate cut in September to be highly likely, the extent of the cut remains uncertain, with a 70% probability estimated for a 25 basis point rate cut and a 30% probability for a 50 basis point rate cut. This has led investors to take a cautious approach, awaiting upcoming economic data from the US for further insight.

Fed officials advocated a gradual approach a few days earlier and Powell opened his statement by saying, that, ‘We neither seek nor welcome further cooling in the labour market.’ However, rate cuts are expected to remain gradual. We believe that the market may have overestimated the speed at which the Fed will cut rates.

Given the political conditions in the US, it is likely that the rate cut will come after the election, to avoid uncertainty. Although Chairman Powell stated that ‘it is time to adjust the policy rate,’ he did not provide a specific timetable or magnitude for the rate cut. This implies that the current inflation rate and employment data are still not mature enough to warrant a policy change, and the Fed is still in wait-and-see mode.

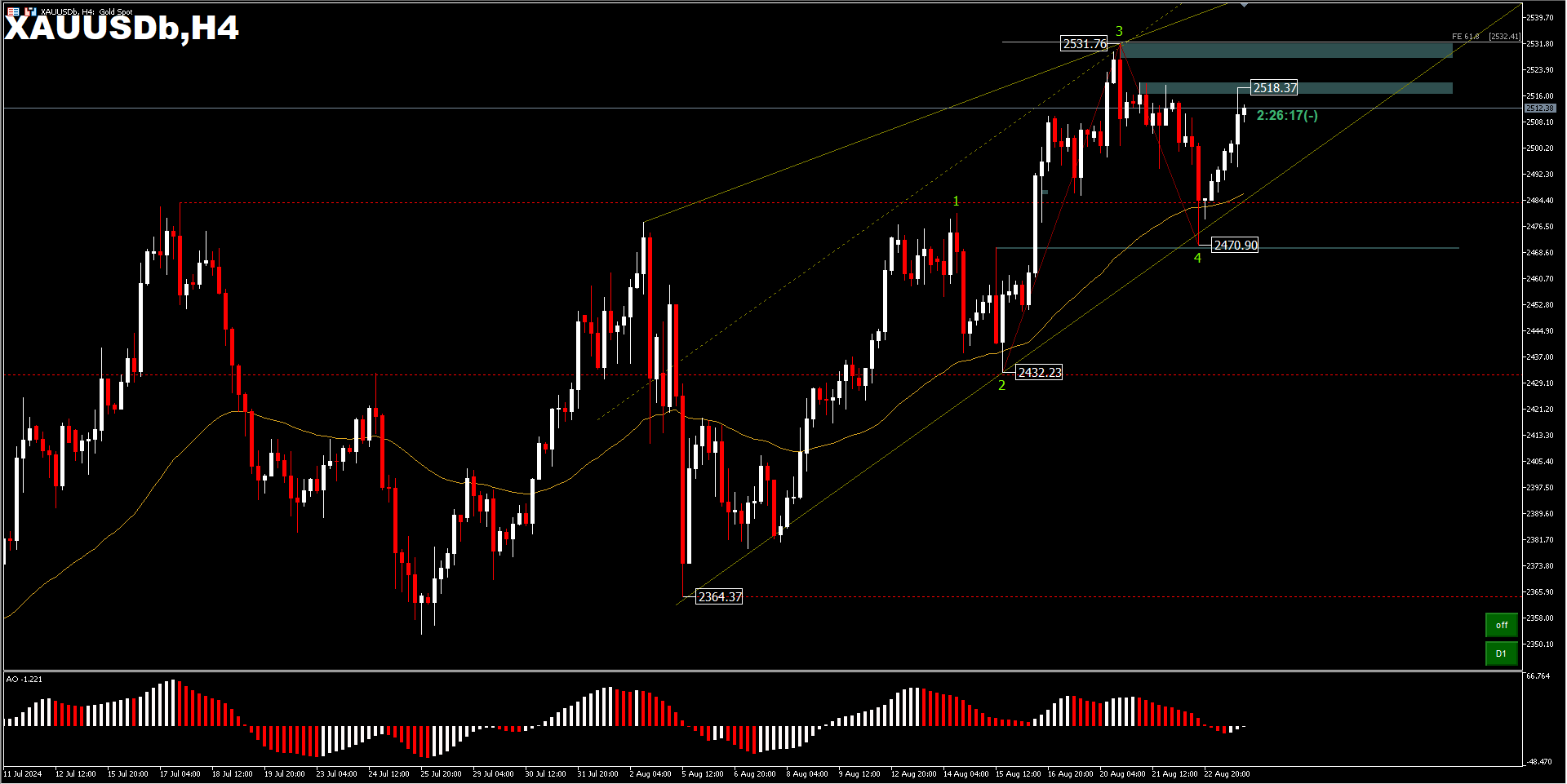

From a technical perspective, XAUUSD rallied near ATH with three peaks currently visible. Any negative development regarding the war in the Middle East could trigger a rise in gold prices as a hedge asset. A break of ATH $2531.76 on the upside, is projected for FE61.8% [$2,537] and and further FE100.0% [$2,558]. While a drop below $2503, could trigger a decline as a correction factor for $2470 and deeper for $2432.

Click here to access our Economic Calendar

Ady Phangestu

Market Analyst – HF Educational Office – Indonesia

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.