Asia & European Sessions:

- Wall Street recovered slightly from Friday’s dip. Dip buying got the ball rolling and short covering has added to the bullish momentum.

- Expectations for a soft, rather than hard landing, with the FOMC expected to cut rates by only -25 bps rather than -50 bps have supported as well. The advent of the Treasury’s $119 bln in auctions, along with a heavy corporate calendar also weighed.

- Nvidia and Tesla have paced the strength in big tech. The Dow advanced 1.2%, with the S&P500 and NASDAQ climbing 1.16%. Strength was broadbased. Five of the 11 S&P 500 sectors posted gains of better than 1%, led by consumer discretionary and IT.

- Sights are on today’s presidential debate and then CPI Wednesday.

- European stock markets are narrowly mixed in early trade, with the FTSE 100 underperforming, after a drop in the ILO unemployment rate. The overall labor market report was not as clear-cut, but the data will add to the arguments against back to back cuts and another move from the BoE this month.

- German HICP inflation was confirmed at 2.0% y/y. The data will add to the arguments in favor of a cautious cut from the ECB on Thursday.

Financial Markets Performance:

- The USDindex found its footing and rose to 101.68 from an overnight low of 101.14.

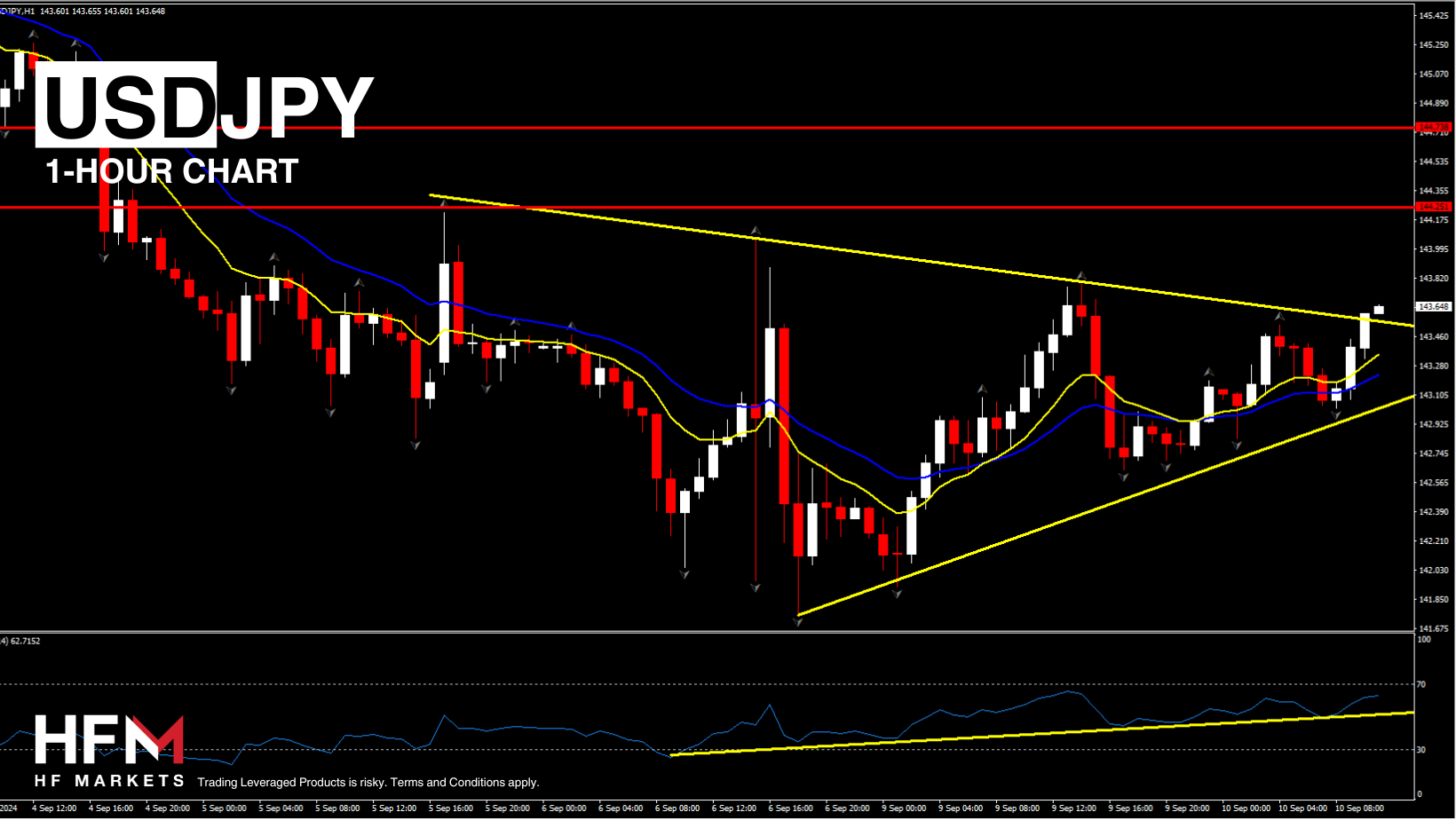

- The USDJPY lifted to 143.21. The Yen corrected, which helped to limit the slide in the Nikkei.

- Oil returned to $67.60 after Monday’s gain, driven by the return of a risk-on tone to wider markets.

- Gold edged up 0.36% to $2506.38 ahead of US Inflation tomorrow.

Click here to access our Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.