- Economists advise the Federal Reserve will cut interest rates by 0.25%. A 0.50% rate cut is off the table for now.

- The ECB decreases its interest rate from 4.25% to 3.65%. This is the largest cut seen by one of the major global banks.

- The DAX continues to trade 1.37% higher on Wednesday even after a small retracement.

- Markets expect a 0.25% cut by the Fed and a 0.75% cut by the end of 2024.

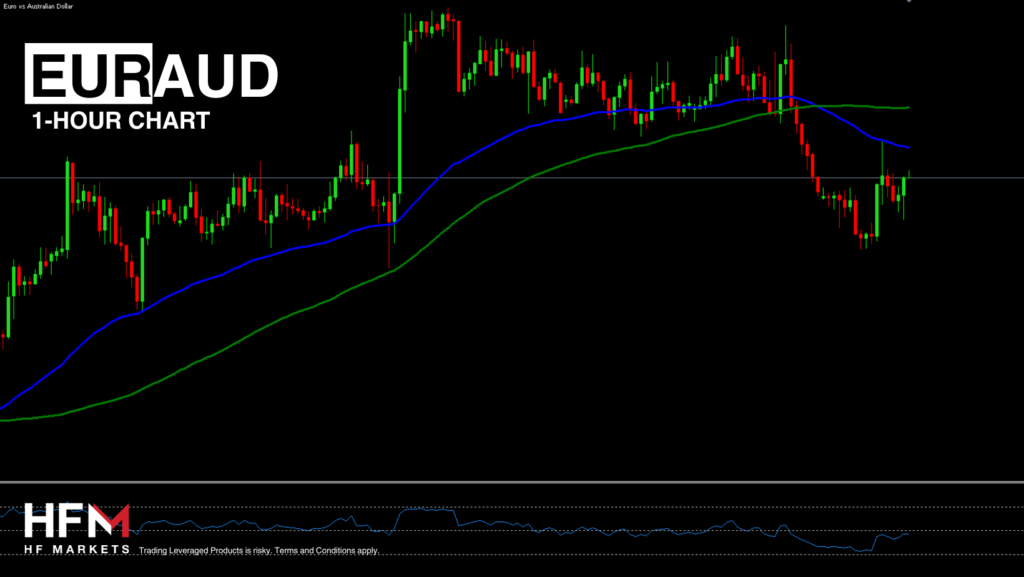

EURAUD – The ECB Cuts Interest Rate!

The Euro is trading slightly lower after the European Central Bank’s decision to cut their Main Refinancing Rate by 0.60%. The Euro index is trading 0.07% lower. Individuals looking to speculate that the Euro will decline due to the latest interest rate cut, may look at which currencies are currently the best performing. This way investors avoid conflicting price actions. The best performing currency of the day and of the week so far is the Australian Dollar. The Australian Dollar is trading 0.17% higher this week and is up 0.15% so far today.

The European Central Bank has taken the decision to decrease their interest rate for the second time in 2024 and to the lowest level since March 2023. Lower interest rates are known to pressure the currency in the long-term. Investors will now turn to the press conference of the ECB President, Mrs Lagarde, who will confirm if more cuts are likely throughout the rest of the year. In turn, ECB President Christine Lagarde will likely stick to the rhetoric about the need to make decisions at each specific meeting based on incoming macroeconomic data. Up to now most economists believed the policy committee would opt for a 0.60% cut, but a portion of the market were expecting the ECB to follow the Fed.

The Australian Dollar on the other hand is largely performing well against most currencies. The currency’s movement is influenced by macroeconomic data and a steady monetary policy. The Reserve Bank of Australia has not yet cut interest rates like the ECB, Fed and BoE. The RBA’s interest rate has remained at 4.35% since its latest interest rate hike.

The September Westpac Banking Corp. consumer sentiment index dropped from 2.8% to –0.5%, its lowest level since February. Meanwhile, the Australian Bureau of Statistics (ABS) reported a 5.4% increase in short-term arrivals to 658,970, with total arrivals reaching 1.146 million, up 10.4%. Departures abroad also rose by 10.4%, totaling 1.650 million.

DAX – Can The DAX’s Trend Change?

The ECB’s decision to cut interest rates will also influence the German DAX. The traditional pathway would indicate lower interest rates would signal a stronger stock market. However, investors will continue to monitor the VIX, European economic growth and the performance of the global stock market.

Macroeconomic statistics continue to play a key role in stock market dynamics. Yesterday, investors focused on Germany’s inflation data, where the August consumer price index (CPI) shifted from 0.3% to -0.1%, after a 0.3% rise the previous month. This caused the annual rate to slow from 2.3% to 1.9%, the lowest since March 2021. The data reflects a steady recovery in the national economy.

The price of the DAX for the first time since August is trading above the trend-line. For this reason, investors are contemplating whether the price’s trend can potentially change. However, the price since the ECB’s decision forms a retracement. Investors will be looking for the price to rebound and break above the Fibonacci’s 65.00 level at 18,544.40.

Click here to access our Economic Calendar

Michalis Efthymiou

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.