- Former US President Trump survives another assassination attempt.

- The Japanese Yen remains the best performing currency of the month adding 4.85%. Demand for safe Haven assets such as the Yen and Gold rise.

- Gold continues to increase as global banks downgrade China’s growth forecasts due to poor economic data. Gold rose to an all-time high on Monday.

- Economists advise the Federal Reserve will cut interest rates by 0.25% at this week’s meeting.

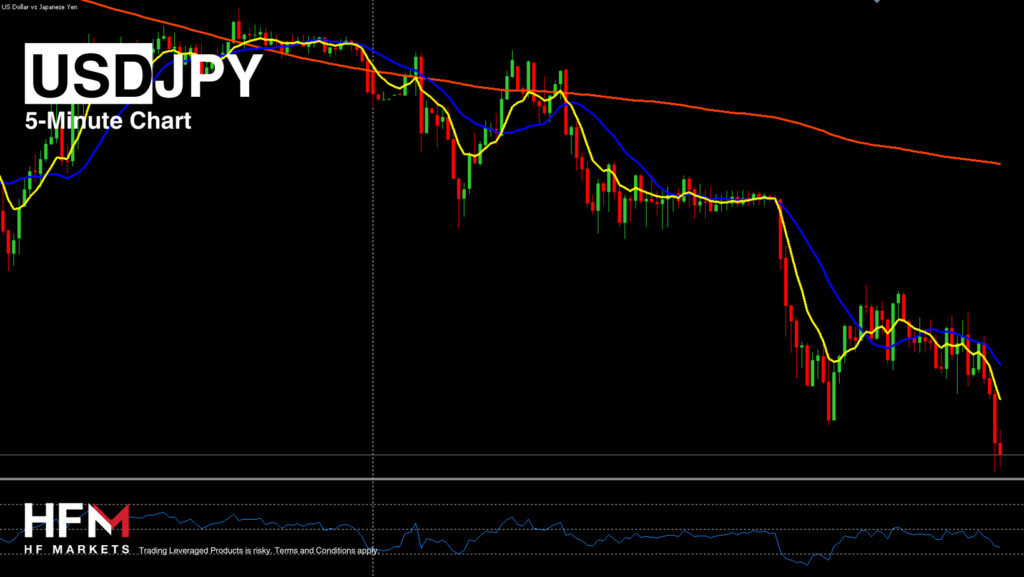

USDJPY – The Exchange Rate Declines For 5 Consecutive Days

The US Dollar index trades 0.24% lower and the Japanese Yen Index 0.47% higher during this morning’s Asian session. The exchange rate is currently trading at its lowest point since July 2023 and has fallen for 5 consecutive days. However, investors should also note that the exchange rate is known to see a change in volatility as the European session opens at 07:00 GMT.

USDJPY on a 5-Minute Chart Showing Latest Bearish Crossover.

USDJPY on a 5-Minute Chart Showing Latest Bearish Crossover.

The USDJPY is under pressure for 3 reasons; investors are pricing in a 0.25% rate cut for September, the Bank of Japan may hike again in 2024, and investors are taking advantage of the devalued Yen. According to economists, the Federal Reserve will cut interest rates by 0.25% on Wednesday evening and by the end of the year the Funds Rate will fall to 4.75%. Investors will be scrutinizing the Fed chairman’s comments on how the Fund Rate may end the year.

Investors cannot be certain of the intrinsic value of the exchange rate based on a Federal Fund Rate of 4.75%. Other factors will come into play including whether the Bank of Japan will decide to increase rates by another 0.15%. However, what can be certain is the previous support levels which can be seen at 140.090 and 129.470.

In anticipation of the Bank of Japan’s meeting this Friday, investors are closely watching statements from financial authorities for any hints about upcoming monetary policy actions. Last week, board member Mr Nakagawa said that current interest rates remain low, and there is still room to tighten policy if economic and inflation trends align with forecasts.

Board member Naoki Tamura suggests that the rate should be raised to at least 1.0%. However, economists have not backed up this forward guidance and advise this would be a step too far for the near-term future. It has been almost 30 years since the Bank of Japan held its interest rate at 1.00%.

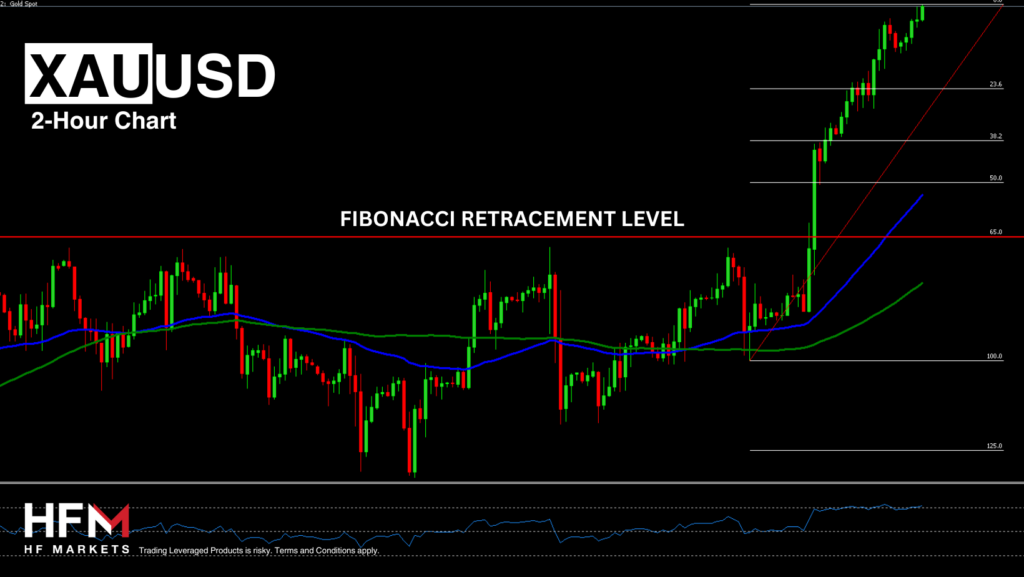

Gold – Safe Haven Demand Surges As Global Banks Cut Interest Rates!

Gold is significantly rising in value as the Federal Reserve’s rate cut is imminent and as other global central banks continue to cut. The European Central Bank is the latest regulator to cut interest rates from 4.25% to 3.65%. On Wednesday, analysts expect the Fed to adjust rates to 5.25%. Demand for Gold is rising due to lower global interest rates, but also the decline in the US Dollar. The US Dollar index trades 0.24% lower and Gold would benefit from a weaker Dollar.

The easing of monetary policy is evident in bond yields, with borrowing costs reduced by more than 25 basis points from July to September. Following the release of this data, analysts have made substantial adjustments to their forecasts. As of today, the Chicago Mercantile Exchange (CME) FedWatch Tool shows the probability of a rate change by this amount at 59.0%, down from 85.0% yesterday.

Another reason for the higher demand is the latest reports that China’s economy is not likely to reach previous growth expectations. Data released by the National Bureau of Statistics on Saturday revealed a slowdown in industrial production, retail sales, and real estate activity this month compared to July.

XAUUSD (Gold) on a 2-Hour Chart With Fibonacci Retracement Levels.

XAUUSD (Gold) on a 2-Hour Chart With Fibonacci Retracement Levels.

In terms of technical analysis, Gold is trading above the trend-line including the 75-Period EMA and 100-Period SMA. The asset is also trading higher than the Volume-weighted average price and above the 50.00 level on the RSI. For this reason, indications point towards buyer holding control and the likelihood of a continued upward trend to remain. Though investors should note that in a short period of time, Gold has risen more than 3.00% which could prompt investors to quickly cash in earned profits.

Click here to access our Webinar Schedule

Michalis Efthymiou

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.