FX News Today

- Stock markets continued to move higher during the Asian session, once again led by China after the US-Mexico deal also revived hopes of a US-Sino deal, despite Trump’s comments.

- President Trump said that the China deal is going to work out, but no deal means more tariffs. He said that he is ready to impose another round of tariffs on Chinese imports if there is no progress in talks with China’s President at the June 28-29 G20 summit.

- The expectations that China will ramp up stimulus programs to boost the flagging economy were boosted by news that China will allow local government to use proceeds from special bonds as capital for major investment projects.

- European stock futures are also moving higher as are US futures.

- US futures are up 0.3-0.4% and the WTI future is trading at $53.74 per barrel.

- The Yen crosses lifted higher as the Japanese currency lost ground as the relief rally on easing trade tensions in equity markets continued.

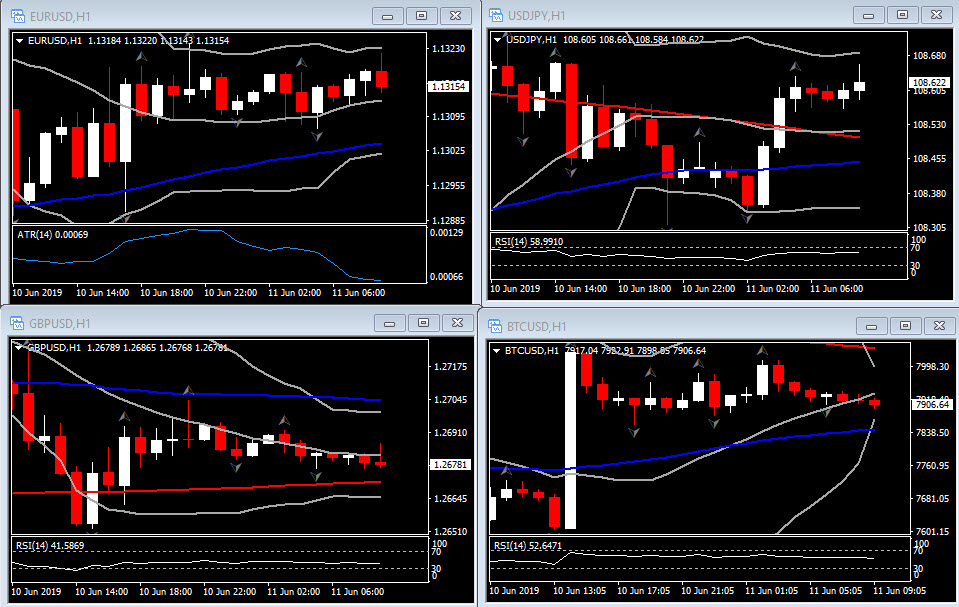

Charts of the Day

Technician’s Corner

- USDJPY lifted by over 30 pips in the hours after the Tokyo fixing today. USDJPY printed an intraday high at 108.64, but has so far remained shy of yesterday’s 11-day peak at 108.71. This week it has breached above its prior-week peak for only the second time out of the last 7 weeks. The pair could continue to hold a better footing for now, especially with the planned meeting between top-level US and Chinese officials at the upcoming G20 serving to arrest what had started to seem like an irrevocable downward spiral in relations between Washington and Beijing. It has support at 108.32-35, and resistance at 108.91-94.

- EURUSD moved back above the 1.1300 mark, though well under Friday’s near 3-month high of 1.1347. The pricing in of US rate cuts will limit EURUSD’s downside potential going forward, though the ECB’s dovish policy stance will limit the Euro’s advances. As a result, range trade mentality may be on the cards for the time being. Support comes at Friday’s 1.1252 bottom, with resistance at Friday’s high, then the 200-day moving average at 1.1367.

- Gold Futures retreated from Friday’s near 4-month high of $1,347.70, falling to $1,325. The moderate sell-off was driven by the return of risk-on conditions. The news that the US would not impose tariffs on Mexican goods helped the Dollar recover and saw yields and equity markets move higher, all gold-negatives.

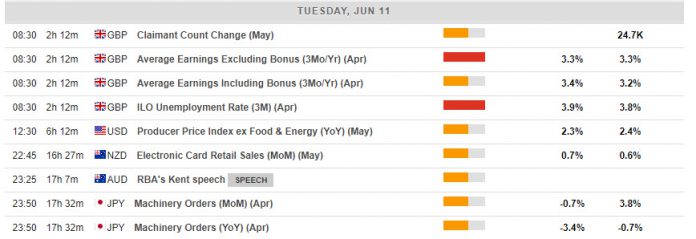

Main Macro Events Today

- Average Earnings Index 3m/y (GBP, GMT 08:30) – UK Earnings with the bonus-included figure are expected to rise to 3.4% y/y in the three months to April, up from 3.2%y/y in March.

- ILO Unemployment Rate(GBP, GMT 08:30) – UK unemployment is expected slightly higher at 3.9%, after it unexpectedly fell to 3.8% in March, which was the lowest rate seen since December 1974.

- Producer Price Index ex Food & Energy (USD, GMT 12:30) – A flat rate is anticipated for headline PPI in May, and a 0.2% rise in the core index.

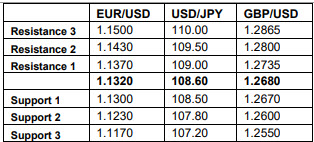

Support and Resistance levels

Click here to access the Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.