EURGBP

Sterling vaulted higher on the perky UK wage data, which prompted interbank and short-term speculative participants to put a squeeze on short positions, especially with the data coming after BoE MPC hawk Saunders reminded markets that prevailing Brexit uncertainty won’t necessarily stop the central bank from tightening policy, if it were necessary to anchor inflation. The Pound had taken a wallop yesterday following the big miss in April GDP and production data out of the UK.

UK wages rose a tad more than expected in an overall near-expectations labour report for April. The unemployment rate remained unchanged at 3.8%, which is the lowest rate since October-December 1974, while the employment rate was 76.1%, the joint-highest on record. Average household income in the three months to April came in at 3.1% y/y in the including-bonus metric, slightly surpassing the median forecast for 3.0% and following a 3.3% y/y in March, which was revised up from 3.2%.

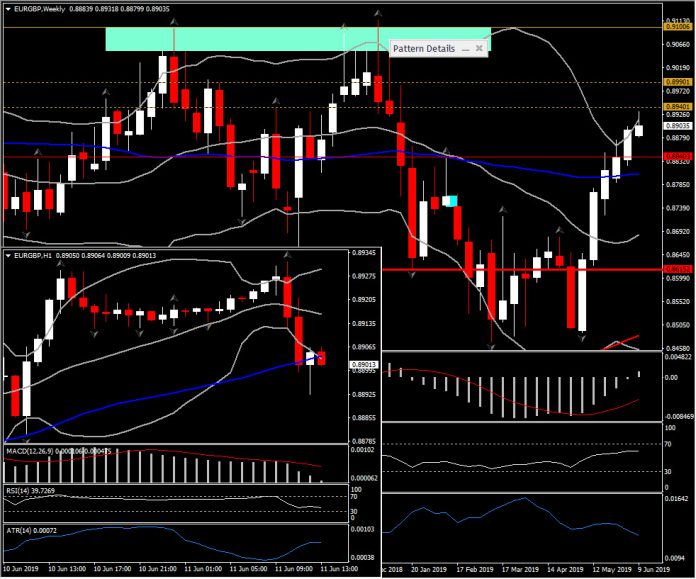

Cable lifted to 1.2710 above the 20-day SMA, while EURGBP rotated lower below 0.8900 from its 5-month’s high. Despite today’s small Pound strength, the Pound remains close to the 5-month low against the Euro in what is now the sixth consecutive week the UK currency has breached its prior-week low versus the common currency.

With the 5 consecutive weekly bullish candles, the market eventually broke the key handle at 0.8840 and now attention could turn to the 0.8940 level which reflects another key Resistance level seen in the last quarter of 2019. The trigger point is currently just 40 pips above the current move, as the positive momentum increases.

Looking at the daily chart, technical indicators are headed higher, with RSI consolidating around 70 and MACD lines rolling over above the signal live and well above neutral zone, suggesting that today’s recovery for Pound was temporary. Hence the jump higher for Sterling on the perky UK wage data couldn’t be sustained as the overall outlook is against the Sterling.

Hence given that EURGBP holds above 0.8825-0.8840 area (0.8800 is the 20-day SMA), and amid prolonged political and associated Brexit uncertainty, along with a slowing economies in continental Europe, the trend looks to remain intact in EURGBP.

A decisive break of the 0.8940 level could raise hopes for further increase of the positive bias and could open the doors towards 0.9000-0.9100 area. Immediate Support is set at 200-week EMA, at 0.8550. Meanwhile, intraday Support is set at 0.8880.

Click here to access the Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.