FX News Today

- Market sentiment turned cautious again ahead of the G-20 summit.

- Bund yields declined from the off, as Treasuries rallied following President Trump’s criticism.

- President Trump said it is he who is holding up the China trade deal until the country returns to agreed terms. He also stepped up his criticism of the Fed, saying rates are “way too high“.

- He also stated that the EUR and other currencies devalued against the Dollar.

- Stock market sentiment turned cautious again and Asian markets are mostly in the red, as are European and US futures.

- This underpinned Treasury yields and saw yields coming down again. A -1.74% decline in the Hang Seng led broad losses in Asian stock markets, amid protests in the city and signs of rising funding costs.

- The WTI future fell back below the $53 per barrel market.

- The European data calendar is focusing on UK inflation numbers and ECB’s Draghi is set to speak amid signs that council members are split on the assessment of inflation expectations.

Charts of the Day

Technician’s Corner

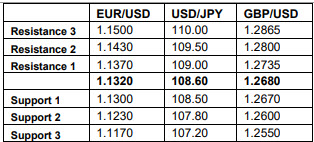

- EURUSD is trading at 1.3335 maintaining a narrow trading band, with the Dollar overall largely in a holding pattern, following fairly steep losses seen over the past week or so. The pricing in of US rate cuts will limit EURUSD’s downside potential going forward, though the ECB’s dovish policy stance will limit the Euro’s advances. As a result, range trade mentality may be in the cards for the time being. Support comes at Friday’s 1.1252 bottom, with Resistance at Friday’s high of 1.1347, then the 200-day moving average at 1.1367.

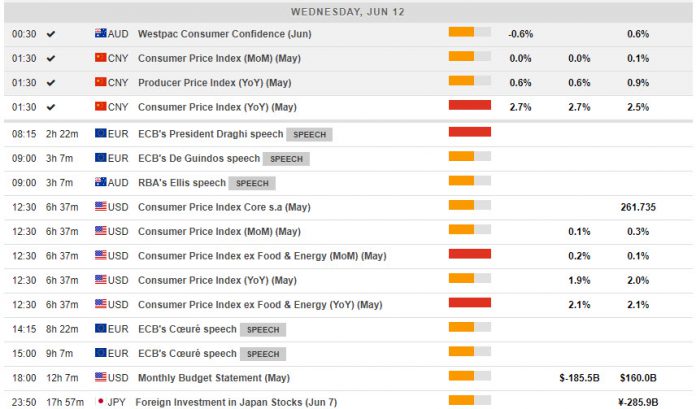

Main Macro Events Today

- ECB’s President Draghi speech (EUR, GMT 08:15)

- Consumer Price Index and Core (USD, GMT 12:30) – May’s CPI has been estimated at a 0.1% gain in headline CPI with a 0.2% increase in core prices, following respective April readings of 0.3% and 0.1%. As-expected gains would result in a headline y/y gain of 1.9%, down from 2.0% in April, while core prices should rise 2.1%, a steady pace from April. Overall, the inflation outlook remains benign, though with an updraft into the end of Q1 and early Q2 from a petroleum price rebound that lost steam into May.

Support and Resistance levels

Click here to access the Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.