FX News Today

- Treasury yields have fallen back -1.2 bp to 2.108%, as weaker than expected CPI numbers out of the U.S. yesterday adding to speculation of rate cuts in the US.

- Fed funds futures price in about 80% chance for rate cut by by end of July.

- Asian bond markets were mostly supported, although JGBs corrected and the 10-year yield moved up 0.5 bp to -0.118% as a stronger Yen curbed investor appetite for Japanese assets.

- Stock markets mostly remained under pressure in Asia, with the Hang Seng declining -0.79% as large political demonstrations continue to unsettle investors.

- In Europe German HICP for May was confirmed at just 1.3% y/y this morning, which together with the decline in market based indicators for inflation expectations will also keep easing speculation alive as stock markets remain weighed down by geopolitical trade jitters.

- Oil prices continued to decline, with trade jitters continuing to weigh on sentiment and the WTI future is currently trading at USD 51.43 per barrel, up from yesterday’s lows, following the EIA inventory data which showed a 2.2 mln bbl rise in crude stocks.

Charts of the Day

Technician’s Corner

- WTI crude fell at $50.70 following the EIA inventory data which showed a 2.2 mln bbl rise in crude stocks. The street had been expecting a 0.5 mln bbl decrease, though the API revealed a 4.9 mln bbl build after the close on Tuesday. Overall, a fairly bearish report, which added further pressure on the USOIL downtrend. In the near-term the outlook remains bearish as well, while only a break above 52.80 could suggest a short term reversal to the upside.

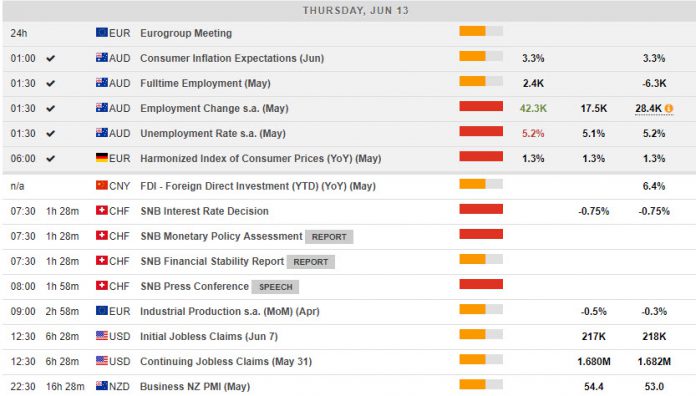

Main Macro Events Today

- SNB Interest Rate Decision and Press Conference (CHF, GMT 07:30) – The SNB is not expected to surprise markets as the Swiss rate is forecast to remain at -0.75%. However, the recent strengthening of the Swiss franc will have rekindled SNB concerns of its disinflationary impact.

- Unemployment Claims (USD, GMT 12:30) – Initial jobless claims for the week of June 7 are estimated to fall to 217k, after holding at 218k in the week of June 1.

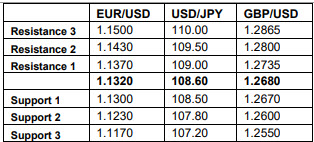

Support and Resistance levels

Click here to access the Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.