Tesla Inc. is a company which engages in the design, development, manufacture, and sales of fully electric vehicles, as well as power storage and photovoltaic systems (and possibly robotics in the near future?). It is currently ranked 12th by market cap, with a value of over $705B. The company is scheduled to release its Q3 2024 earnings results on 23rd October (Wednesday), after market close.

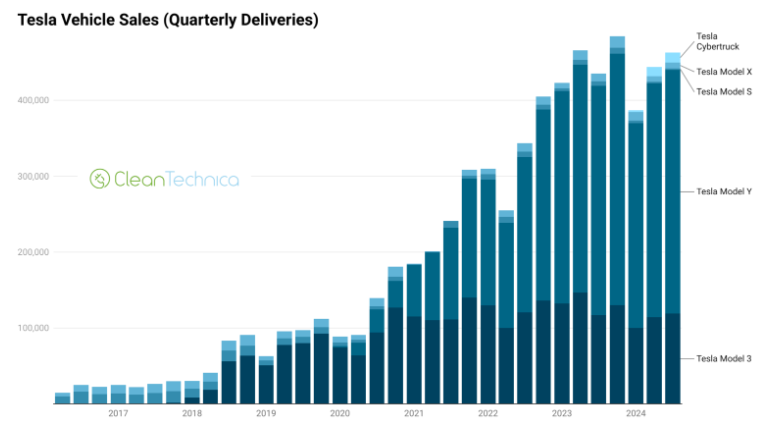

Tesla Deliveries. Source: Clean Technica

In Q3 2024, Tesla reported total vehicle production of 469,796, up over 9% from the same period last year. The previous quarter had recorded the lowest quarterly volume since Q3 2022.On the other hand, total deliveries hit 462,890, up over 6% from the same period last year (Model 3/Y deliveries has up nearly 5% (y/y), whereas other model deliveries (Model S/X, Cybertruck and Semi) up over 43% (y/y).

In general, Tesla.Inc still heavily relying on the sales of Model 3/Y, yet these two models have recently seen their sales plateau following unfavourable macroeconomic conditions. According to Clean Technica, there is potential for the Cybertruck to rise up and become a mass-market model (In Q2 2024, Tesla delivered close to 11,000 Cybertrucks), however to what extent it could stay competitive and how much potential it has in the pickup trucks market remains unknown.

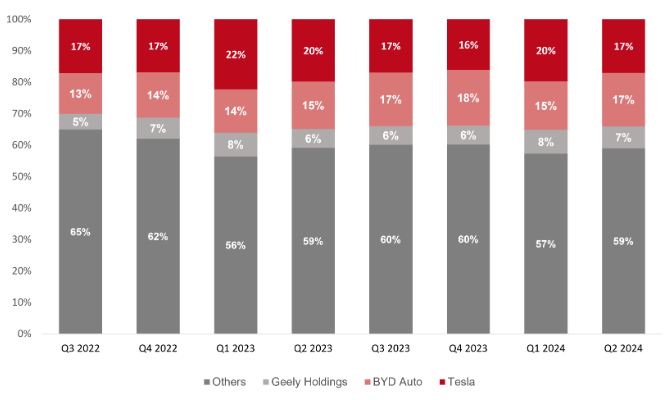

Global EV Market Share. Source: Counterpoint

Despite leading the BEV market, Tesla has seen its market share fall to 17% (down from 20% in the previous quarter), while BYD is catching up close behind, trailing by just 15,000 units. In general, the global sales of BEV increased by nearly 9% in Q2 2024, dominated by China with 56% market share, followed by the US and Germany. It is worth noting that Tesla vehicle sales in China improved by 19.2% (y/y) in September following recovery in China and government EV subsidies. The company’s effort in ramping up promotions in China which include offering zero-interest loans of up to five years and upfront discounts on selected models may serve as another tailwind for the company.

Earlier this month, Tesla’s CEO – Elon Musk revealed some new features in the ‘We, Robot’ event. Among them was the Unsupervised FSD (limited to Model 3/Y vehicles, and firstly rolling out in Texas and California some time next year), an upgraded version of the current one to Level 3 system (“hands-off, eyes-off”, but requiring a human driver ready to steer or brake). This could be another milestone achieved, yet far from reaching the ultimate goal of getting into the ride-hail business (robotaxis). Furthermore, the company is still required to go through some law regulations and acquire several permits before conducting its master plan.

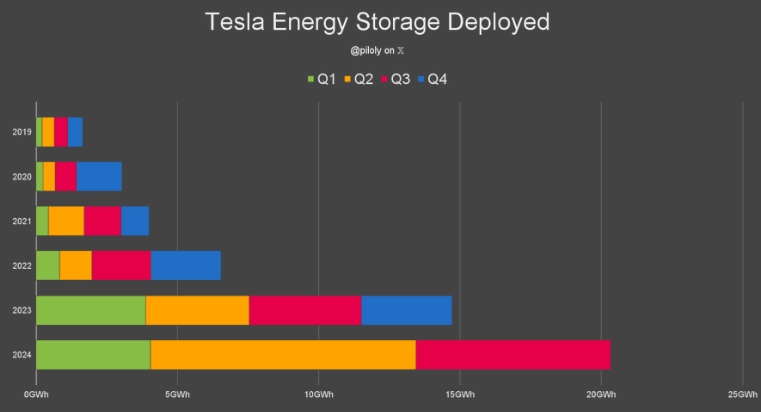

Tesla: Energy Storage Deployment. Source: Teslarati

In Q3 2024, Tesla reported 6.9 GWh (gigawatt hours) of battery energy storage, down from over 9 GWh in the previous quarter, but still marking a significant improvement from the year-ago period with energy storage deployed less than 4 GWh. Despite the fact that energy deployments can be uneven as it depends on project milestones for large-scale installations, its prospects remain bright as according to Morgan Stanley, Tesla’s energy storage business is poised to continue benefiting from investment in the US electric grid accelerated by the AI boom.

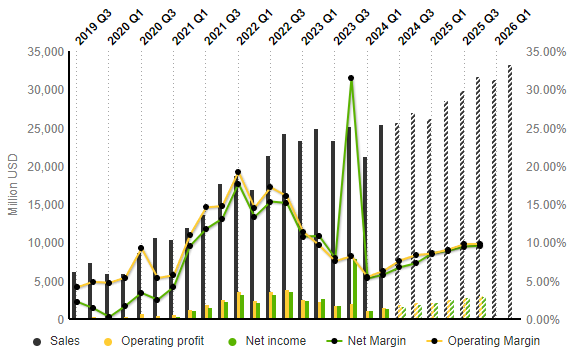

Tesla: Income Statement Evolution (Quarterly Data). Source: Market Screener

Tesla: Income Statement Evolution (Quarterly Data). Source: Market Screener

In the coming announcement, the S&P Global Market Intelligence projected the company’s sales revenue to remain flat at $25.7B, from $25.5B in the previous quarter, up nearly 10% from the same period last year. Operating profit and net income are expected to extend higher towards $1.96B and $1.74B, respectively. This would lead the operating margin and net margin to increase slightly to 7.64% (was 6.29%) and 6.76% (was 5.8%).

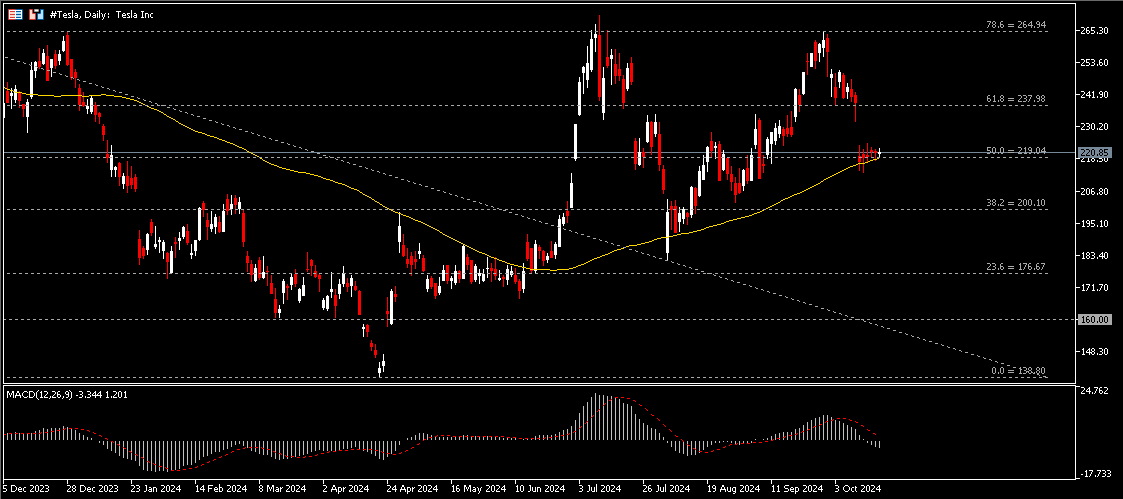

Technical Analysis:

The ‘We,Robot’ event is obviously not impressive which led to heavy selling pressure of the company shares. #Tesla share price dropped 9% and recently found support at $219 (FR 50.0% extended from the highs in July 2023 to the lows in April 2024) and the 100-day SMA. A strong break down below this support may indicate continuation of the bearish pressure, with the next target at $200 (FR 38.2%) and session low in August at $181.80. As long as the mentioned supports remain intact, nearest resistance is found at $238 (FR 61.8%), followed by $265 (FR 78.6%).

Click here to access our Economic Calendar

Larince Zhang

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.