Markets assume the Bank of England (BoE) will accelerate the pace of interest rate cuts which will weaken the Pound, whilst the Australian Dollar looks set to benefit from the Reserve Bank of Australia’s long-term high interest rate approach.

Bank of England Governor Andrew Bailey’s statement, largely stuck to familiar themes from recent public statements. However, he admitted some regret over the BoE’s past complacency in dealing with financial stability risks, adding a bit of nuance to his usual tone.

With several more appearances this week, Cable traders will be closely scrutinising Bailey’s speech for any recurring themes or signals. His next appearance is scheduled for Wednesday afternoon, followed by the release of UK Purchasing Managers’ Index (PMI) data on Thursday. Markets expect a slight slowdown in UK economic activity, with October’s services PMI expected to fall to 52.2 from 52.4 in September.

On the jobs front, the UK unemployment rate fell to 4.0% in the three months to August, down from 4.1% in the previous quarter and beating expectations. Over the same period, employment expanded by 373,000, up from 265,000, while average earnings were in line with estimates. Of particular concern, however, was the number of claimants in September, which rose to 27,900, well above the estimate of 20,200 and 23,700 for the previous month.

In the forex market, GBPUSD fell sharply to below $1.3, the lowest since 19 August, after inflation in the UK fell more than expected, strengthening the case for additional interest rate cuts by the Bank of England. The annual inflation rate slowed to 1.7%, the lowest since April 2021 and below the 1.9% forecast. Core inflation fell to 3.2% from 3.6% and services inflation fell to 4.9%, the lowest since May 2022. Meanwhile, wage growth continued to slow and hit a new two-year low, indicating easing wage pressures in the economy.

Investors are now anticipating a 45bps rate cut by the BoE by the end of the year, up from 37bps before the inflation report. The central bank is expected to lower borrowing costs by 25bps next month. Additionally, attention is on the Budget 2025 announcement for insights on government and tax policies.

Meanwhile in the South, Australia’s stellar September jobs report last week briefly helped AUD regain the upper hand. Employment grew by a whopping 64.1k, an impressive gain after 5 consecutive stronger-than-expected monthly figures totalling over 200k. Unemployment was unchanged on the month, however it revised down at 4.1% last month.

The local interest rate market reduced RBA rate cut expectations on the strong jobs data, trimming the price for their meeting in February 2025 to -20bp, from -25bp. For the whole of 2025, the interest rate market now expects 3x25bp rate cuts, after factoring in some risk that the RBA could make a 4x25bp rate cut before the jobs data.

In the forex market, AUDUSD stabilised around $0.664 on Thursday, but traded near its lowest level in two months as the greenback and Treasury yields rallied further on expectations of a more cautious Federal Reserve rate cut and bets that Trump will win in November.

On the monetary policy front, Reserve Bank of Australia Deputy Governor Andrew Hauser said earlier this week, that strong employment growth came as a bit of a surprise, while indicating that the central bank is ready to respond in either direction depending on incoming data. Markets expect the RBA to keep policy on hold this year, with the first rate cut not fully priced in until May next year.

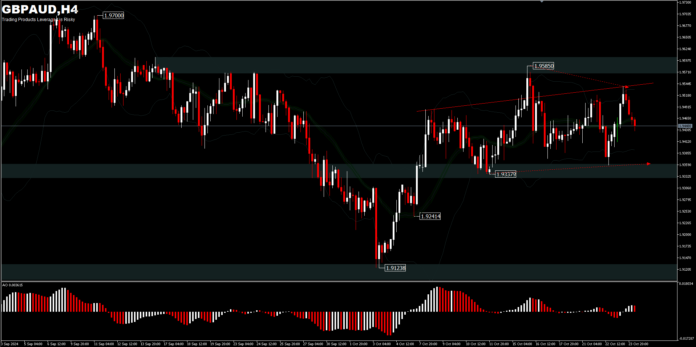

The GBPAUD cross pair is quite eye-catching, as both of these currencies are exposed to global risk sentiment to the same degree, meaning they tend to rise in times of optimistic markets and fall when markets are fearful. This could explain why price movements in the GBPAUD exchange rate have been relatively confined within a tight range over the past two months.

From a technical perspective, the 1.9123 rebound looks to be struggling to extend its rally above 1.9585; while sellers are not yet in the mood to take the price below 1.9337. This consolidation might last longer, but the end will still give room for a wider trend. A move below 1.9337 will bring the desired decline from traders who have noticed the right shoulder pattern, to move further to test 1.9241 or 1.9123 support. But as long as 1.9337 support holds, the flat trading range will consolidate for longer. On the upside, a move above 1.9585 carries the implication of an unfinished bullish trend with a possibility to test 1.9700.

Current price position is moving below the middle BB band, a sign that price conditions remain stable.

Click here to access our Economic Calendar

Ady Phangestu

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.