- Oil prices drop to a 4-week low as Israel’s strike against Iran is viewed as relatively weak. Analysts advise Iran is not likely to react.

- Crude Oil prices fell 4.5% on Monday, supporting the stock market. All global indices are trading higher with the NIKKEI225 1.44% higher.

- The Japanese Yen drops to a 3-month low as Japan’s ruling coalition is unable to win a majority.

Crude Oil – Israel’s Conservative Retaliation Pressures Oil!

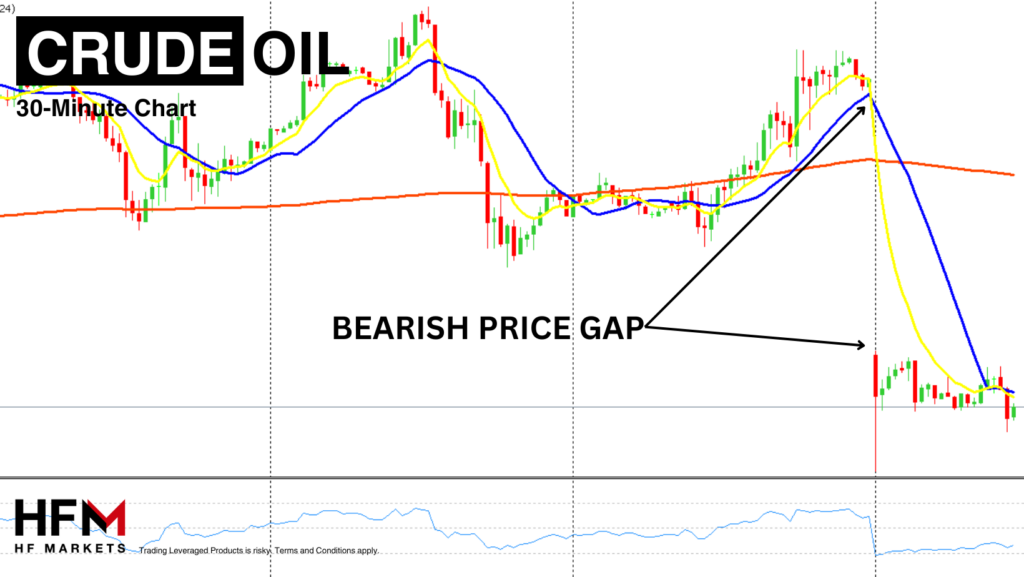

The price of Crude Oil opened on a bearish price gap measuring 4.5%, taking the price to a 4-week low. The bearish price movement is primarily due to the limited retaliation from Israel on Iran and experts advising the two countries are now likely to opt for de-escalation. As a result, traders are contemplating whether the price will continue to decline to recent support levels at $66.85 and $65.10.

Though investors should note that experts do not rule out the possibility of renewed regional tensions following the US presidential elections. Currently there is downward price movement and these support levels are possible. However, new escalations can significantly change the price action. Notably, yesterday, analysts at Goldman Sachs maintained their 2025 Brent oil price forecast at $70–$85 per barrel, believing that any market impact from China’s stimulus measures will likely be minimal.

The economy is also another factor which oil traders will continue to monitor. Particularly, the US, Japan and China. Investors will be monitoring how the new US President will change or support the oil market. In addition to this, market participants will also evaluate how China reacts to the current Chinese stimulus.

Since the bearish price gap Crude oil has been trading sideways with the latest wave on the 1-Minute time frames pointing upwards. Due to this wave the price rose above the 200-bar Moving Average and formed a bullish breakout. However, traders will concentrate on how the price reacts after the EU market opens. If the price drops below $68.44, price action will indicate a downward price movement as the price falls below the Moving Average with a bearish crossover. However, if the price increases above $68.64, the Fibonacci levels indicate upward price movement.

NASDAQ – Earnings and Lower Oil Prices Increase Sentiment Towards Stocks!

The price of the NASDAQ also reacted to the drop in the price of Crude Oil and escalations in the Middle East. The NASDAQ rose 0.94% in the Asian Session which is relatively volatile for outside of the US session and therefore investors should be cautious the price can retrace before continuing its upward price movement. Nonetheless, even with a retracement, fundamental analysis continues to point towards a bullish trend.

There are also fundamental factors such as the weaker Israel retaliation, the lower price of Oil, interest cuts and positive earnings data. A clear example of positive earnings data is Tesla’s recent quarterly figures. Since Wednesday’s earnings report release, Tesla stocks have risen an impressive 23%. Shareholders now turn their attention to earnings reports scheduled for tomorrow. These mainly include Alphabet and AMD, but also Microsoft and Meta on Wednesday. If these figures team expectations, the possibility of the bullish trend continuing improves.

If the price drops to $20,463.40 investors may look to purchase at the discounted purchase price. However, if the price does not retrace and breaks $20,540.61, volatility will again signal upward price movement.

Click here to access our Webinar Schedule

Michalis Efthymiou

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.