Qualcomm., an American multinational corporation which engages in developing and commercializing foundational technologies and products used in mobile devices and other wireless products, shall report its earnings for Q4 2024 on 6th November (Wednesday), after market close.

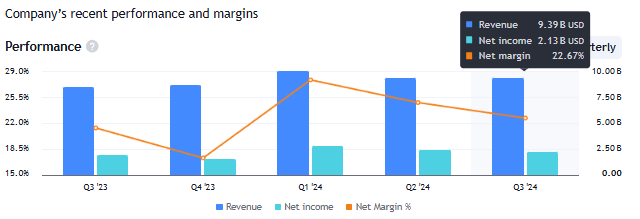

In the previous quarter, Qualcomm reported sales revenue at $9.4B, unchanged from the previous quarter, and up 11% from the same period last year. Net income hit $2.1B, slightly down over -8.5% from the previous quarter, up over 18% from Q3 2023.

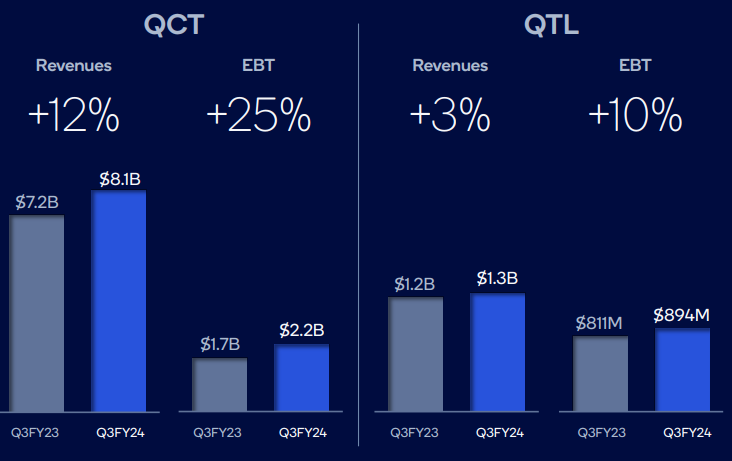

By segment, Qualcomm CDMA Technologies (QCT) which develops and supplies integrated circuits and system software based on technologies for use in voice and data communications, networking, application processing, multimedia and global positioning system products, reported sales revenue at $8.1B, up 12% (y/y); whereas Qualcomm Technology Licensing (QTL) which grants licenses and provides rights to use portions of the firm’s intellectual property portfolio, reported sales revenue up 3% (y/y), at $1.3B. Both segments reported earnings before tax (EBT) at $2.2B and $894 million, respectively.

Looking forward, the management remains optimistic. In the last two weeks, Qualcomm unveiled its latest mobile platform, Snapdragon 8 Elite with fastest mobile CPU at 4.32GHz peak speeds, thus boosting performance and power efficiency in general. The Snapdragon 8 Elite also claimed to be offering the best-in-class wireless connectivity which supports 5G up to 10Gbps download and up to 3.5Gbps upload. Recently, Qualcomm also launched the Snapdragon X Plus 8-core processor, as it looks to ramp up its push into the AI PC space instead of just mobile chipsets alone. In addition, the company’s relentless efforts in extending its industry-leading on-device AI solutions to the Snapdragon Digital Chassis is another tailwind which keeps the company competitive in various markets.

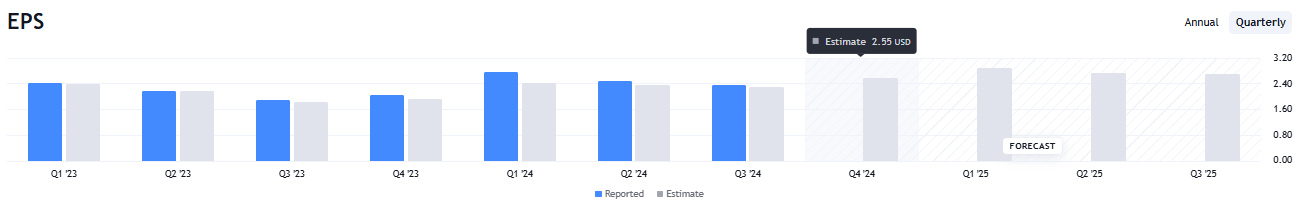

In the upcoming announcement, it is estimated that the company shall deliver $9.86B in sales revenue, up 5% from the previous quarter, and up over 13% from the same period last year. EPS, on the other hand, is expected to hit $2.55, up 22 cents from the previous quarter. It was $2.02 in Q4 2023.

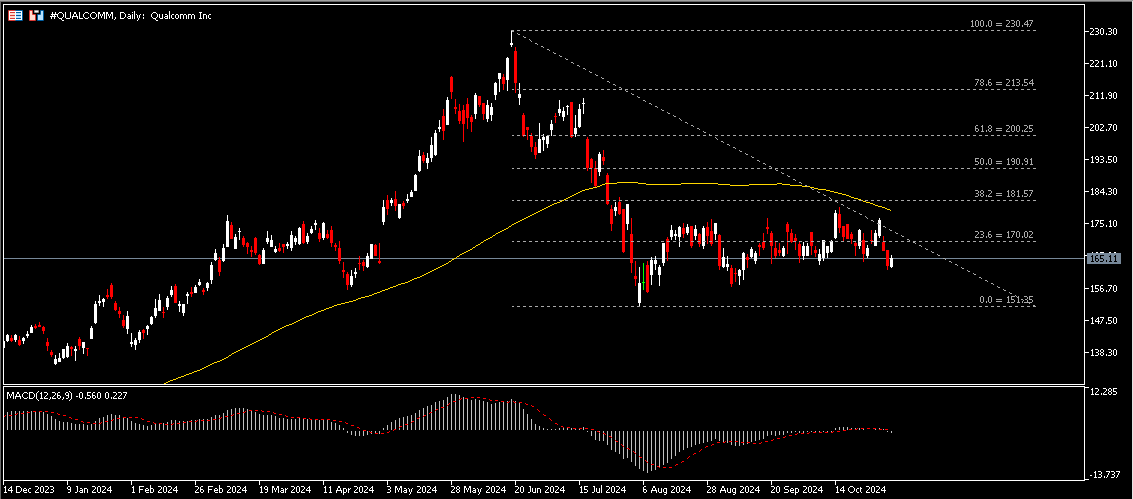

Technical Analysis:

#QUALCOMM, Daily: The company share price last closed bearish, testing minor support $165. The asset remains pressured below the 100-day SMA since late July. A break below the said support may extend the bearish pressure towards the next level at $157, followed by $151. On the other hand, $170 serves as the nearest resistance. A close above the said level may encourage the rebound towards the 100-day SMA dynamic resistance, and then $181.50.

Click here to access our Economic Calendar

Larince Zhang

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.