FX News Today

- Expectations that global central banks will add further stimulus to underpin the global economy and fresh hopes that global trade tensions will be resolved through talks after all underpinned stock markets during the Asian session.

- US President Trump tweeted yesterday that he will meet China’s President Xi Jinping at the G-20 meeting, which helped to lift CSI 300 and Shanghai Comp 1.96% and 1.50% respectively.

- Bond markets closed below highs yesterday and the gains are likely to erode further today as the focus shifts to the FOMC announcement.

- GER30 and UK100 futures are slightly in the red with profit taking and renewed caution capping the room for further gains.

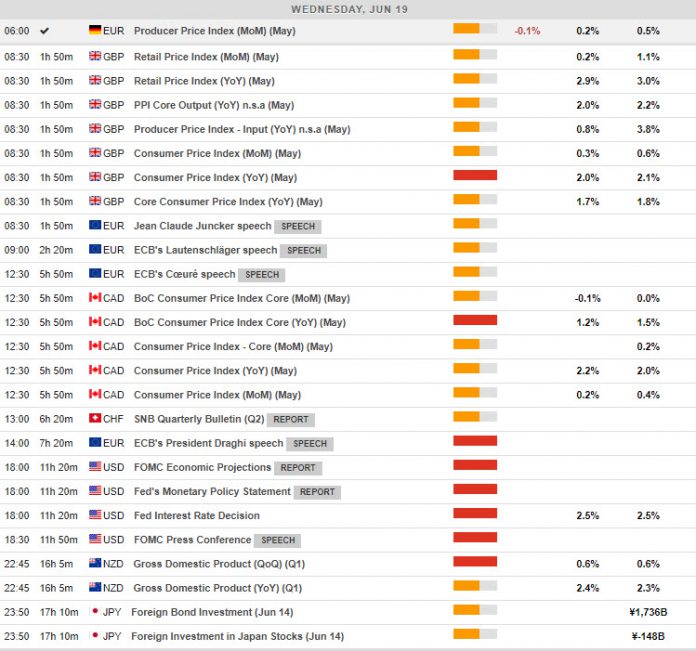

- German PPI data at the start of the session came in lower than anticipated.

- The WTI future benefited from fresh trade talk hopes and is trading marginally above the USD 54 per barrel mark.

Charts of the Day

Technician’s Corner

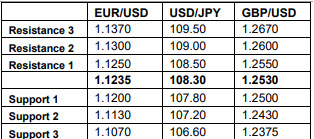

- USDJPY has drifted moderately lower, to levels around 108.26. The dip reflects a pick up in demand for the Yen. Overall, directional impulse has been limited in forex markets with participants hunkered down ahead of the Fed policy announcement later on Wednesday. All eyes will be on the Fed, where there is risk of disappointment given the level of expectation for a strong dovish guidance. USDJPY is presently sitting near the midway of a choppy sideways range that’s been unfolding for nearly 3 weeks now. The range over this time has been 107.81 – 108.80. Support comes in at 108.00-06.

- USDCAD – The Canadian Dollar, buoyed by a 4.5%-plus rally in Oil prices over the last day, has seen some moderate outperformance, which has taken USDCAD to a 3-session low at 1.3365. Mideast geopolitics underpinned oil prices, along with hopes for a strongly dovish signal from the Fed today, yesterday’s dovish shift by the ECB chief, news that President Trump will be meeting with President Xi at the upcoming G20, and that ministerial-level trade negotiations will be recommencing. This is a bullish mix of developments for currency’s with higher beta characteristics, such as the Canadian buck. Support holds at 1.3354 and 1.3336, while Resistance is at 1.3390-1.3400.

Main Macro Events Today

- Consumer Price Index (GBP, GMT 08:30) – Prices are expected to move up in May, with overall inflation to increase at 2.2% y/y, compared to 2.1% y/y last month.

- Consumer Price Index and Core (CAD, GMT 12:30) – May CPI is expected to run at a 2.0% y/y pace, matching the 2.0% clip in April and coming in just ahead of the 1.9% clip in March. Hence, the focus is on the “core” CPI figures.

- Event of the week – Interest rate Decision and Conference (USD, GMT 18:00) –Fed easing expectations have plateaued (Fed funds futures now fully discounting a 25 bp rate cut by the July FOMC). Although there is not much of a chance for a rate move next week the FOMC is anticipated to make an important change in its statement, removing the word “patient” and likely replacing it with language similar to Powell’s comment from June 4 where he said the Fed will be “closely monitoring the implications of these developments” on trade and other matters.

- Gross Domestic Product (NZD, GMT 22:45) – The Q1 GDP is expected to grow at 0.7% compared to 0.6% last quarter, while the annualised rate should fall to 1.8% from 2.3%.

Support and Resistance levels

Click here to access the Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.