FX News Today

- A less than dovish comment from Fed dove Bullard, with the Chairman Powell soothed a bit, and along with the usual trade uncertainty and US-Iran concerns, all combined with softer US data to take Wall Street and Treasury yields lower overnight.

- Hence in Asia session, the rally on bond markets run out of steam and stocks struggled as optimism on an immediate rate cut from the Fed and a breakthrough in US-Sino trade talk fades.

- Fed Chair Powell repeated the phrase the Fed is “closely monitoring“. He highlighted downside risks to the economy again, but didn’t go beyond last week’s guidance on rates.

- Presidents Trump and Xi are likely to meet on Saturday, where they may agree to reopen trade talks.

- Source stories meanwhile suggest that the US is willing to suspend the next round of China tariffs if trade talks resume, but Trump and Xi Jinping are not expected to agree on a detailed trade deal at the G-20 meeting.

- Against that background stock markets struggled during the Asian session. Topix and Nikkei corrected -0.71% and -0.70% respectively

- The RBNZ kept rates at record lows, but said further cuts may be needed.

- The WTI future is trading at $59.10 per barrel amid US-Iran tensions.

- German consumer confidence deteriorates. It fell back to 9.8 in the advance July reading. This is the lowest number since April 2017.

Charts of the Day

Technician’s Corner

- EURCHF has found a footing into 1.10 area after coming under significant pressure last week, in the wake of ECB President Draghi’s eyebrow raising dovish shift, which has been the most notable of a growing chorus of dovish voices on the central bank’s governing council. Assuming the ECB remains on the path of further monetary policy easing ,the EURCHF is expected to retain a declining bias. The SNB’s -0.75% deposit rate and threat of tactical intervention hasn’t been sufficient to arrest recent appreciation of the Franc.

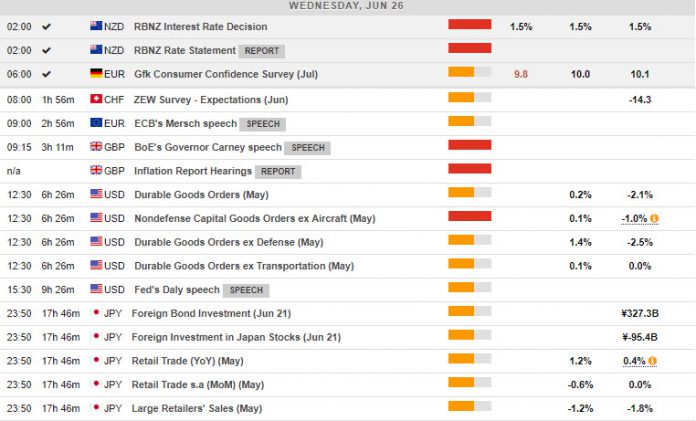

Main Macro Events Today

- ECB’s Mersch speech (EUR, GMT 08:00)

- BoE’s Governor Carney speech (GBP, GMT 09:00)

- Durable Goods (USD, GMT 12:30) – Durable goods orders are expected to be flat in May, after a -2.1% figure in April. Transportation orders should fall -0.5%. Boeing orders fell to just zero from a dismal 4 in April, with the hit from problems with the Boeing 737 Max that prompted buyers to delay new purchase commitments.

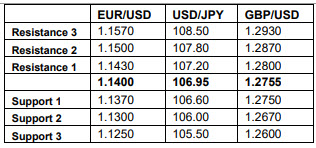

Support and Resistance levels

Click here to access the Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.