FX News Today

- Australia’s 10-year rate fell -2.7 bp, as the RBA slashed the cash rate by 25 bps to a record low of 1.00%, citing the slowdown in global trade.

- US President Trump may have signaled that talks with China have already restarted, but the US reportedly also expanded a list of European products that may get hit with tariffs, which highlights that the restart of US-Sino trade talks doesn’t mark the end of global trade tensions.

- Stock markets already turned cautious again in Asian trade.

- US futures are marginally higher and the WTI future is trading at $59.13 per barrel.

- European stock futures are moving higher in tandem with US futures after a lacklustre session in Asia.

- Meanwhile, weaker than expected German retail sales at the start of the session confirmed that the weakness in the manufacturing sector is spreading to the rest of the economy, which will keep the ECB on course for further easing.

- EU leaders will meet again to resume discussion on the next president of the European Commission and other top posts that will become vacant this year, including the ECB presidency.

Charts of the Day

Technician’s Corner

- AUDUSD jumped to 0.6985 inthe Asia session amid the RBA announcement, after the decline seen yesterday on Dollar strength. The asset manage to hold above 20- and 50-day SMA. A trade above 0.7000 which is the midpoint on yesterday’s decline could suggest further upside path for AUDUSD. Support comes at 2-day low, at 0.6955. A shift back to the latter could open the doors towards June’s values.

- EURUSD faded to 7-session lows of 1.1275, down from the 1.1360 highs seen ahead of the NY open. Weaker European PMI data, along with more dovish ECB speak, saw sentiment toward the Euro sour. For the USD side of the equation, markets have toned down their Fed rate cut expectations, leaving the odds of a 50 bp cut in July a long shot. As a result, the Dollar has posted gains, helped by the trade truce agreed over the weekend. There are still likely to be further trade fireworks going forward, but as long as the US economy continues to outperform rivals, USD downside should be limited going forward.

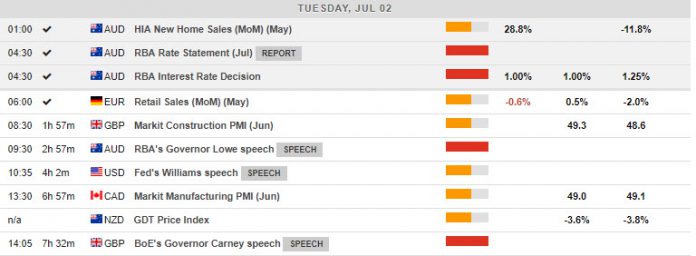

Main Macro Events Today

- Construction PMI (GBP, GMT 09:30) –The June construction PMI is seen rebounding to 49.4 after 48.6 in May.

- Manufacturing PMI (CAD, GMT 14:00) – The Markit Manufacturing PMI in the Canada is expected to come out at about 49.0 in June, slightly below the 49.1 in May.

- BoE’s Governor Carney speech (GBP, GMT 14:05)

Click here to access the Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.