FX News Today

- Markets take a defensive stance ahead of Powell’s testimony to Congress and the release of the minutes from the last Fed meeting.

- Speaking overnight Atlanta Fed President Bostic said the central bank is debating the risks and benefits of letting the economy run a “little hotter” and while most are still expecting a 25 bp “insurance cut” this month, there are fears that Powell may close the door to rate cut hopes.

- GER30 and UK100 futures are narrowly mixed and US futures slightly in the red, after a mixed session in Asia overnight.

- KOSPI and KOSDAQ recovered as Japan and South Korea said they are planning talks on the trade tensions. Japan’s new export restrictions on materials vital to South Korea’s tech industry, and hopes of thawing relations helped KOSDAQ to gain 1.6%, elsewhere moves were pretty muted.

- Eurozone peripheral markets are outperforming, but yields are also up across Italy, Spain and Portugal.

- Trade risks, US-Iran tensions and in Europe the risk of a no-deal Brexit scenario keep markets looking to central banks for support.

- The WTI future meanwhile surged to $58.76 per barrel, after US data showed another drop in stock piles, which dampened concerns about oversupply.

Charts of the Day

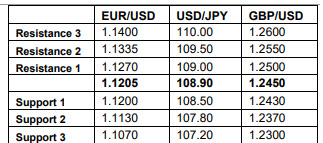

Technician’s Corner

- EURGBP has forayed above 0.9000 for the first time since early January while Cable has descended into 27-month low territory. EURGBP has now made this the 8th week out of the last nine where a new higher high has been set. The Pound has been trading with a 10-15% trade-weighted Brexit discount since the vote to leave the EU in June 2016.

- USDJPY was stopped in its tracks at 6-week highs of 108.96, the level coinciding with the 50-day Moving Average. Profit taking ensued, which took the pairing to 108.76 lows in early NY and Asia session. In addition to the noted technical resistance, Japanese exporter offers are reportedly parked from the 109.00 level, which should help cap gains going forward.

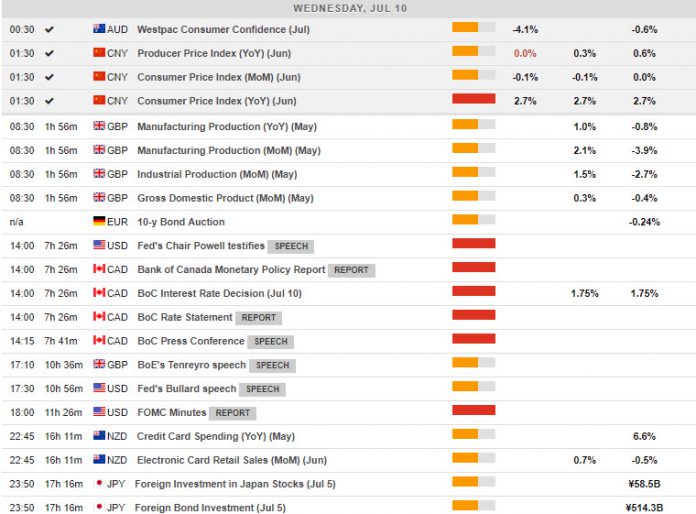

Main Macro Events Today

- Gross Domestic Product, Manufacturing & Industrial Production (GBP, GMT 08:30) – The GDP is the economy’s most important figure. May’s GDP is expected to be lower at -0.7% m/m following the -0.4% reading from last month. Meanwhile, Industrial and Manufacturing Production will be out as well. These two indices are expected to have increased, with industrial output providing an upwards contribution of 1.5% m/m in February, while manufacturing is projected to have risen to 2.3% from its -3.9% last month.

- Event of the week – Interest rate Decision and Conference (CAD, GMT 14:00) –Last time, Bank of Canada held the policy rate setting steady at 1.75%, matching widespread expectations, while the statement was largely optimistic in terms of the growth outlook. The expectations remain for no change of the policy outlook from the BoC through year-end, with the next move expected to be a modest rate hike in late 2020.

- FOMC Meeting Minutes (USD, GMT 18:00) -The FOMC Minutes report provides the FOMC Members’ opinions regarding the US economic outlook and any views regarding future rate hikes. In the last FOMC statement, on June 19, FOMC left rates unchanged but the statement, which removed the word “patient”, along with the inflation outlook, the dot-plot, and Bullard’s dissent in favor of easing, made for a dovish stance.

Support and Resistance levels

Click here to access the Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.