FX News Today

- Stronger than expected US retail sales data put some pressure on bond markets.

- However, Equities turned lower as trade uncertainty returns.

- After the Chicago Fed President Evans flagged two rate cuts this year and US President Trump threatened to put another USD 325 bln of tariffs on Chinese goods, Stock markets were nervous and risk aversion lingered.

- US stock futures are posting fractional gains and Topix and Nikkei are currently down -0.05% and -0.27% respectively.

- Released overnight, a -17.3% decline in Singapore non-oil exports highlighted the damaging impact of global trade tensions.

- WTI crude dives near 3%, after Pompeo indicated that Iran is willing to negotiate on missiles. Oil prices are now trading at USD 57.69 per barrel, on yesterday’s indications that US-Iran tensions could be easing.

- Germany’s Von der Leyen confirmed as new EU Commission President. Von der Leyen will succeed Juncker and IMF head Lagarde today is tendering her resignation as her nomination for Draghi’s post looks more certain

- Bunds rallied from the off today and European stock futures are in the red after a mixed session in Asia, despite the prospect of additional easing measures.

- Bank of America and Netflix are due to report results today.

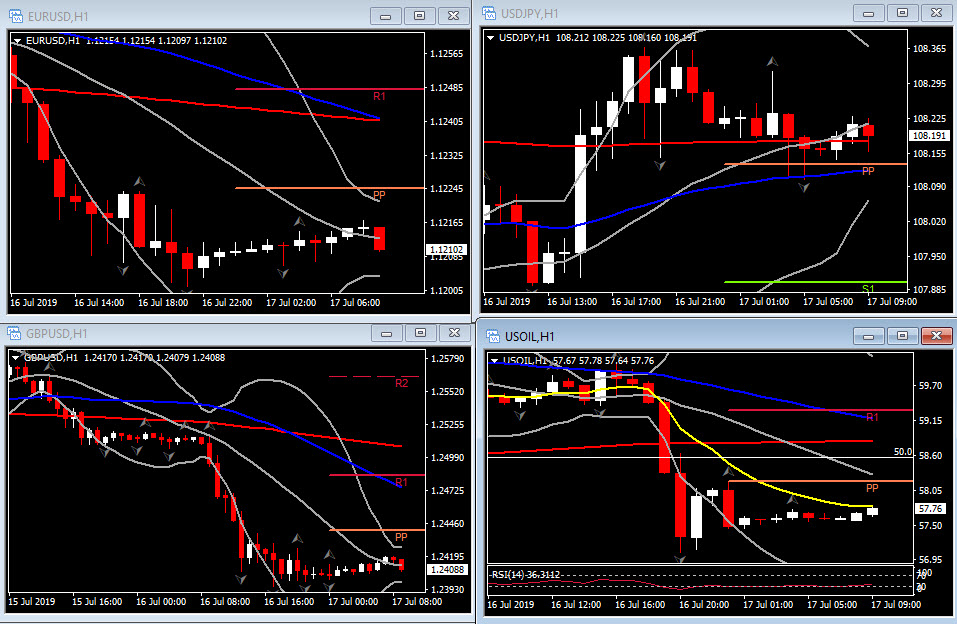

Charts of the Day

Technician’s Corner

- USOIL: WTI crude has fallen 3% on the session following comments from US Secretary of State Pompeo in a cabinet meeting, who said for the first time, Iran is prepared to negotiate on its missile program. This news may signal a shift of policy in Iran, perhaps set to lower geopolitical tensions in the Mideast. The WTI contract has fallen from earlier highs just over $60.00 to $57.06 lows. Support now holds at $57.30 and $56.30. Resistance is set at $58.07 and $58.75.

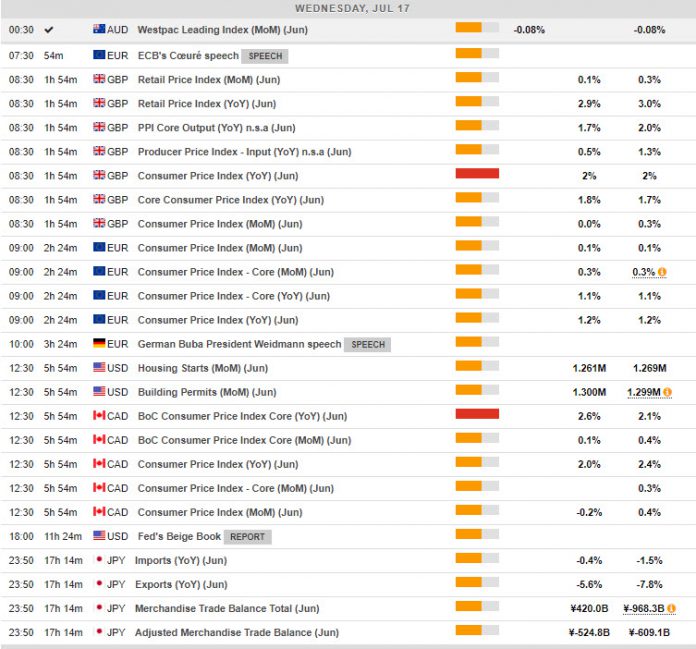

Main Macro Events Today

- Consumer Price Index (GBP, GMT 08:30) – May CPI came in on the nose at 2.0% y/y, ebbing from 2.1% y/y in April and marking a return to the upper bound of the BoE’s target. Next week’s reading for June is expected to remain unchanged. The same stands for core CPI.

- Consumer Price Index (EUR, GMT 09:00) – The Euro Area CPI for June is expected to hold steady at 0.3% m/m, with the headline inflation at 1.2% y/y unchanged from the previous month. Still, as the weakness in manufacturing is now starting to reach the labour market, this means the prospect that underlying inflation pressures will build up soon look slim. This will keep the ECB on course for additional easing measures, unless there are major breakthroughs on the US-Sino trade and the Brexit front.

- Consumer Price Index and Core (CAD, GMT 12:30) – CPI is expected to decline at a 2.1% y/y pace in June.

- Housing Data (USD, GMT 12:30) – Housing starts should slow to a 1.260 mln pace in June, after a dip to 1.269 mln in May. Permits are expected to improve to 1.300 mln in June, after rising to 1.299 mln in May. Overall, we see a stronger trajectory for starts with a positive but slower pace for permits, as starts play catch-up with the higher permits trajectory.

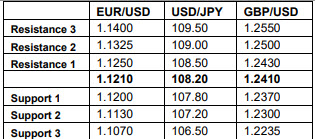

Support and Resistance levels

Click here to access the Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.