FX News Today

- Bonds were supported by ongoing trade concerns, with the tensions between Japan and South Korea adding to the lingering concerns about US-Sino relations.

- A WSJ report suggested that trade negotiations between the US and China are at a “standstill.” This was followed by fresh evidence of the impact that trade tensions have been having, with Japanese trade data revealing a worse-than-expected 6.7% y/y contraction in exports, which have shrank for seven months straight now.

- South Korea’s central bank unexpectedly cut interest rates and said it has room to act again.

- The Fed’s Beige Book still said economic activity “continued to expand at a modest pace”, but globally central banks are clearly preparing for a marked slowdown as trade tensions bite.

- Concerns about a weak earnings season are putting pressure on stock markets.

- The USA100 futures dipped -0.6% so far after Netflix Inc posted a surprise loss of US customers.

- The GER30 future is underperforming as well amid a broad based decline in European and US stock futures after a weak session in Asia overnight.

- The WTI future meanwhile is trading at $56.70 per barrel.

- Fears of a no deal Brexit scenario also continue to cloud over the outlook while the ECB is expected to at least introduce an official easing bias next week, before cutting rates in September.

- ECB’s Villeroy highlighted this morning that central banks can’t perform miracles and need help from politicians and fiscal policies.

Charts of the Day

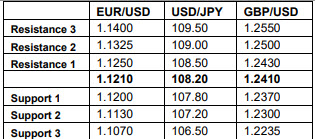

Technician’s Corner

- EURUSD recovered slightly from 7-session lows of 1.1200, peaking at 1.1243. Brexit concerns have weighed on economic activity on the continent as well as the UK, and could limit Euro gains going forward. Risk for the EUR comes from the ECB as well, with a shift to an explicit easing bias expected by many at next week’s meeting, or at subsequent meetings. EURUSD support comes at 1.1218-1.1229, with Resistance at the 61.8% Fib. level from 2-week peak, at 1.1250-1.1252.

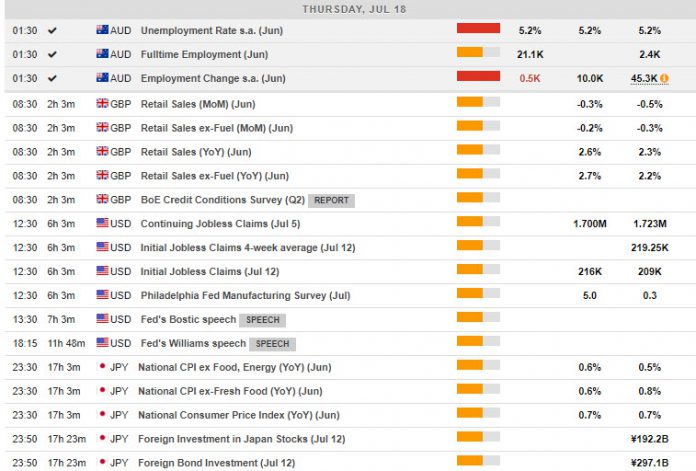

Main Macro Events Today

- Retail Sales (USD, GMT 08:30) – A -0.3%m/m contraction is expected for June retail sales, following 0.5% May loss. In the y/y comparison, sales are anticipated at 2.6% from 2.3%.

- Initial jobless claims (USD, GMT 12:30) – The initial jobless claims for the week of July 13 are estimated to fall to 204k, after falling to 209k in the week of July 6. Claims should average 215k in July, down from 222k in June and a 217k in May.

- Philly Fed Index (USD, GMT 12:30) – The Empire State index is estimated to rebound to 6.0 in July from -8.6 in June, which marked a 33-month low for the series. The producer sentiment readings all moderated through the turn of the year from elevated levels in response to global growth concerns, falling petroleum prices, fears about the ongoing trade war, and the partial government shutdown.

Support and Resistance levels

Click here to access the Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.