FX News Today

- In Europe, Core EGB yields declined in the PM session with Gilts outperforming Bunds after the crowning of Boris Johnson as the new leader of the UK Conservative Party.

- Johnson is now set to be confirmed as Prime Minister tomorrow and investors are raising their no-deal Brexit bets, which is also fuelling easing expectations.

- A weaker than expected UK CBI industrial confidence survey as well as dovish leaning comments from BoE’s Saunders underpinned the rebound in Gilts and saw the UK 10-year rate falling back -1.6 bp to 0.688%.

- The ECB’s latest credit conditions survey also played into the hands of the doves at the council as it showed that credit conditions tightened in the second quarter.

- Stock markets meanwhile rallied on the combination of positive earnings reports and hopes of further central bank support.

Charts of the Day

Technician’s Corner

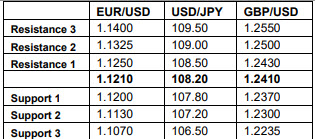

- USDJPY recovered to 1-week highs of 108.28 overnight, gaining ground from Asian lows of 107.83 but it gave back some gains today by turning back to low 108 area into London open. Overall, risk-on conditions have supported, with USDJPY advances coming on the back of rallying equities. Last week’s 108.37 is a key next resistance level, and above there, market participants could turn their attention to the 50-day MA, which currently sits at 108.50. On the flipside, on the break of 20-day MA at 108.07, next Support comes at 107.79 (June 15 low).

- USDCAD rallied to July highs, topping at 1.3162 in early North American trade, and up from post-Monday close lows of 1.3111. General USD strength, coming as the market scales back its Fed easing expectations, has provided support to the pair. In addition, a lack of upside in WTI crude, despite geopolitical concerns, largely with Iran, has weighed on the CAD as well. The June 26 high of 1.3196 is the next resistance level if the asset moves above 1.3160, though buy-stops are expected over the 1.3200 level. On the flipside Support is set at 1.3120-1.3125 area. A move below the latter could open the doors below 1.3100 area.

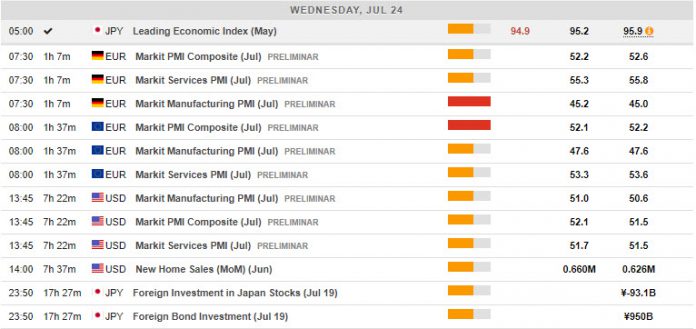

Main Macro Events Today

- Services and Manufacturing PMI (EUR, GMT 07:30) – Preliminary Composite PMIs for Eurozone and Germany are expected to fall in July, to 51.8 and 52.5 respectively, while the Manufacturing PMIs are forecasted at 48.0 and 45.4 respectively.

- Services and Manufacturing PMI (USD, GMT 13:45) – Preliminary Manufacturing and Services PMIs are expected to decline in July, to 50.4 from 50.6 and 51.0 from 51.5 respectively.

Support and Resistance levels

Click here to access the Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.