FX News Today

- Treasury yields came down from overnight highs and fell back to 2.04%, unchanged from yesterday’s close.

- Aussie and Australia’s benchmark bond yields hit record lows after RBA Governor Lowe signalled that he is prepared to cut rates again if needed and Asian stock markets moved cautiously higher.

- Earnings reports and expectations for further central bank support have helped to underpin equity markets this week, but while markets are looking for a clear easing signal if not a cut from the ECB today, Asian equity markets moved only cautiously higher.

- Worse than expected losses from Tesla and reports that North Korea resumed missile launches highlighted not only that geopolitical risks remain high, but also that overall valuations are already lofty.

- US futures are mixed, with NASDAQ futures underperforming and down -0.2%.

- USOIL spiked to $57.60 on another 10 million barrel draw-down but sank to $56 on weak global economic outlook on the back of the manufacturing PMI data.

- Euro touched its lowest since May 31 following the weak Eurozone PMIs during the London morning session, printing 1.1127.

- Gold continues to track sideways with Support at 1,420 and Resistance at 1427.

Charts of the Day

Technician’s Corner

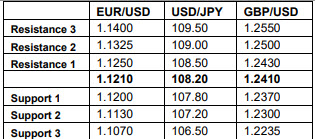

- EURUSD touched its lowest since May 31, following the weak Eurozone PMIs during the London morning session. Euro weakness has been a feature this week, in anticipation of ECB meeting, where a shift to an easing bias is universally anticipated. Given the weak PMIs, there is a chance the Bank may even cut rates modestly, which would likely weigh further on EURUSD. Next support comes at the June low, of 1.1159 and the 2019 low of 1.1107 seen on May 23.

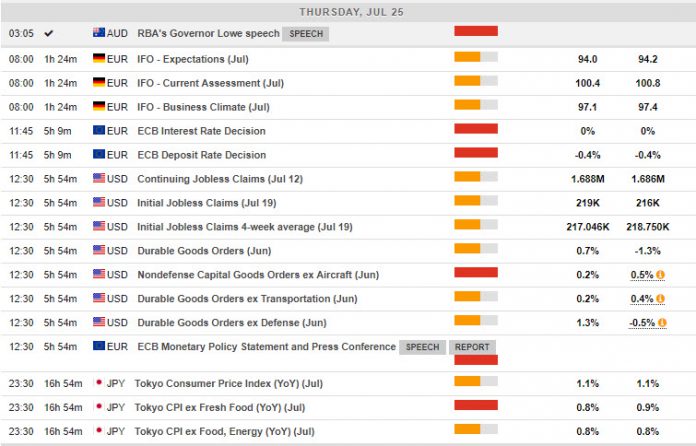

Main Macro Events Today

- German IFO (EUR, GMT 08:00) – German IFO business confidence is expected to slip to 96.7, after it held steady the past 2 months around the 97 barrier.

- Event of the week – Interest rate Decision and Conference (EUR, GMT 11:45) –The ECB is meeting on July 25, – shortly after the confirmation of the new PM in London and ahead of the Fed, which is widely expected to cut rates again at the end of the month. On balance, markets see more merit in keeping official rates unchanged next week, while moving to an official easing bias and promising that rates will be at “current or lower” levels well into next year.

- ECB Monetary Policy Statement (EUR, GMT 12:30) – The July meeting will clearly be a “live” one with doves and hawks battling it out over when to deliver the now widely expected easing measures. It is expected that the majority will see more merit in keeping policy settings unchanged, but change the guidance to introduce a clear easing bias.

- Durable Goods (USD, GMT 12:30) – Durable goods orders are expected to rise 1.0% in June, after a -1.3% figure in May. Transportation orders should rise 2.7%. Boeing orders rose to only 9 from just zero in May, with weakness due to the hit from problems with the Boeing 737 Max that prompted buyers to delay new purchase commitments. Vehicle assemblies should ease to 11.1 mln from an 11.3 mln pace in May. Durable shipments are expected to rise 0.5%, and inventories should rise 0.6%. The I/S ratio is expected to hold steady at 1.67 since April.

Support and Resistance levels

Click here to access the Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.