FX News Today

- Stock markets remained in the red during the Asian session, with Draghi’s failure to deliver a rate cut yesterday leaving markets concerned about their bets for the Fed next week.

- JPN225 lost -0.57%, after a lower close on Wall Street yesterday.

- The ECB was actually very dovish yesterday, but failed to cut immediately and the reaction on stock markets highlighted that markets have already priced in so much easing that there may not be much upside, even if the Fed cuts rates next week.

- The strong US durables data trimmed the chances for an aggressive Fed rate cut ahead. It may need stronger fundamentals, rather than additional policy measures for stocks to extend much higher.

- US futures are posting slight gains, however, with earnings reports coming into the mix and lower than forecast earnings from Alphabet balanced with higher revenue estimates from Alphabet.

- The front end WTI future is trading at $56.29 per barrel.

- German import price inflation fell to just -2.0% y/y in June reading. However, excluding energy, the annual rate also dipped into negative territory, which highlighted that that the weakness is spreading and signals further downward pressure for consumer prices ahead.

Charts of the Day

Technician’s Corner

- USDCAD touched session highs of 1.3166, coming from 1.3116 lows yesterday. A fading of WTI oil prices has given USDCAD a bit of a lift, though the pair broke Tuesday’s one-month high of 1.3164, and hence the next resistance level is at 50-day SMA and June 26 high at 1.3200. Reduced Fed easing expectations should keep a floor under the pairing for now, though as usual, unexpected volatility in oil prices will lead to increased CAD volatility.

Main Macro Events Today

- Gross Domestic Product (USD, GMT 12:30) – Gross Domestic Product is expected to grow 1.8% in Q2, with a sturdy 2.4% growth rate for final sales thanks to solid growth rates of 3.9% for personal consumption and 4.3% for government purchases, alongside a big $27 bln unwind of the Q1 inventory pop.

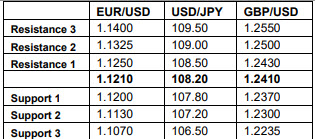

Support and Resistance levels

Click here to access the Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.