FX News Today

- As the focus shifts to the Fed announcement, stock markets remained under pressure during the Asian session.

- Reports that the Communist Party’s Politburo pledged to refrain from adding stimulus to the property market, disappointing profit reports from Samsung and comments from US President Trump criticising China just as talks are restarting all weighed on sentiment.

- US data continued to improve with a much stronger than expected print on consumer confidence.

- Topix and Nikkei dropped -0.4% and -0.7%. US futures are slightly higher though as markets expect the Fed to announce a 25 bp rate cut today and send a dovish signal as the global outlook deteriorates.

- The WTI future lifted to USD 58.42 per barrel on larger than expected to draw of private inventories.

- In Europe, German retail sales may have rebounded in July, but the annual rate still fell into negative territory. At the same time, the improvement in jobless numbers is fading and we are looking for a slight uptick in the total for July.

Charts of the Day

Technician’s Corner

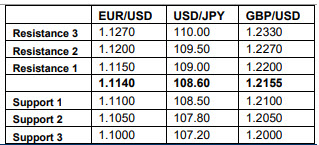

- USDJPY has continued to ply a relatively narrow range in the mid 108.00s, in part reflecting a hunkering down of markets ahead of the Fed policy announcement later on Wednesday. A 25bp cut is fully factored, so focus will be on the central bank’s forward guidance. Given recent data, and given recent remarks by some of the more dovish members at the Fed, markets might be disappointed, having, overly priced in an aggressive easing path. Chairman Powell will leave the door open for additional easing, but won’t likely satisfy expectations for a string of easings into 2020. If this happens, USDJPY has scope to rally, near-term. Support comes in at 108.40-42.

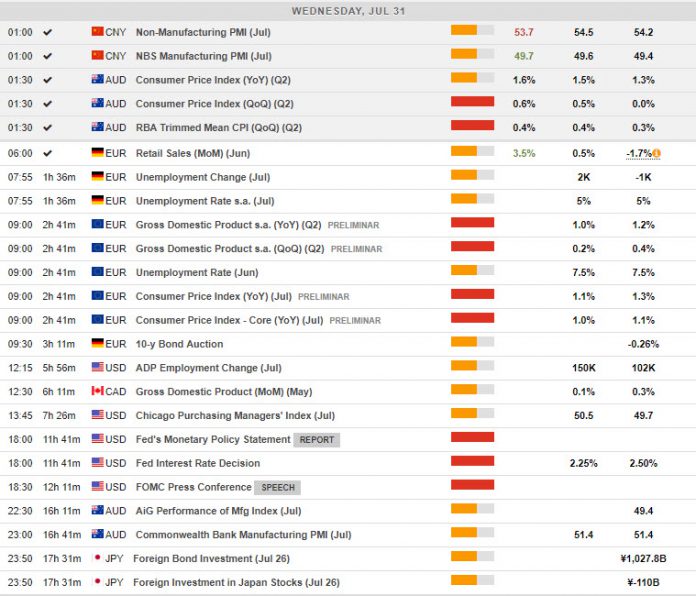

Main Macro Events Today

- Consumer Price Index (EUR, GMT 09:00) – The Euro Area CPI for July is expected to slow down slightly, at 1.2% y/y from 1.3% y/y last month. The annual rate is still below readings seen in the first quarter of the year and far below the 2% limit for price stability, thus giving the doves at the ECB something to argue with. Core inflation is expected to release at 1.0% y/y.

- ADP Employment Change (USD, GMT 12:15) – Employment change is seen spiking to 153k in the number of employed people in July, compared to the 102k reading seen last month.

- Gross Domestic Product (CAD, GMT 12:30) – The 0.1% gain that is expected for May GDP will keep Q2 GDP on track to come in near the BoC’s 2.3% Q2 GDP estimate, as the economy rebounds following softness in Q4 and Q1. However, the second half growth outlook is subject to considerable uncertainty, notably from the potential fallout of ongoing trade turmoil and geopolitical tensions on Canada’s exports.

- Interest rate Decision and Conference (USD, GMT 18:00) – Fed expected to cut 25 bps, largely “confirmed” after NY Fed walked back President Williams’ comments. Beige Book for July 30, 31 FOMC reiterated economy continued to expand at “moderate” pace, inflation stable to lower. FOMC Minutes to June 18, 19 meeting said “many” saw significant odds of less favorable outcomes, and nearly all had cut their projections of Fed rate path.

Support and Resistance levels

Click here to access the Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.