FX News Today

- FOMC delivered with a 25 bp cut, but signalled not starting an easing cycle.

- The Fed did not suggest the path ahead, saying it will “monitor” incoming information and will “act as appropriate to sustain the expansion.” – failed to signal that further cuts are in the pipeline.

- Chair Powell concluded his press conference by reiterating the outlook on the US economy is a positive one and there’s no prominent threat. The economy is healthy. The downside risks are coming from abroad, which are also affecting the manufacturing sector and business investment. And of course we’re concerned about low inflation.

- The sell-off in stock markets eased somewhat during the Asian session, but indices are still mostly lower.

- Topix and Nikkei benefited from a stronger USD and are little changed, while Hang Seng and Shanghai Comp lost -0.72% and -0.88% respectively.

- With the “hawkish cut” from the Fed out of the way the focus returns to the earnings season ahead of US jobs data on Friday.

- US and Chinese negotiators plan to meet again in early September with the negative impact of geopolitical trade tensions increasingly evident.

- The WTI future is trading at USD 57.87 per barrel.

Charts of the Day

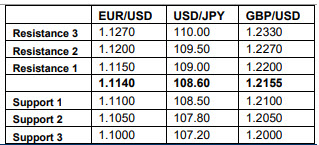

Technician’s Corner

- EURUSD eased from early highs of 1.1152 through the morning session, bottoming at 1.1120 ahead of the FOMC, then falling under 1.1039 following the rate cut, and after Powell said today’s cut isn’t necessarily the start of an easing cycle. The less dovish than expected FOMC statement and Powell press conference supported the Dollar, allowing the Euro to print 26-month lows. Powell left the door open for additional easing, but he won’t likely satisfy expectations for a string of rate cuts into 2020.

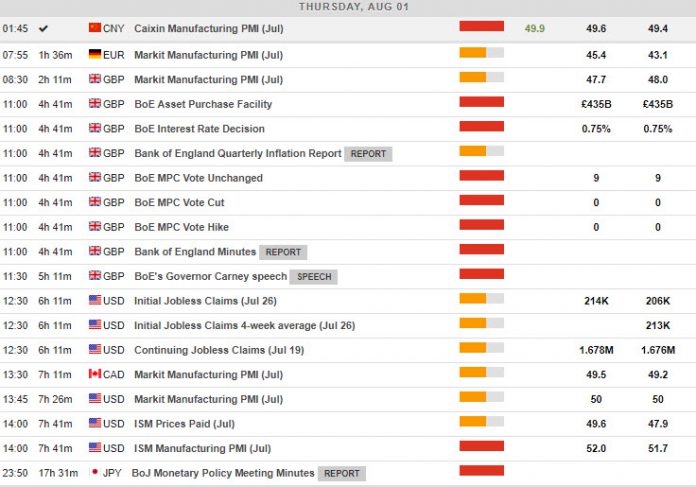

Main Macro Events Today

- Markit Manufacturing PMI (EUR and GBP, GMT 07:55-08:30) – In July, the German and UK PMI are expected to remain unchanged in the negative region, 45.4 and 49.2 respectively.

- Interest rate Decision and Conference (GBP, GMT 11:00) – The BoE left policy unchanged at the June Policy Committee meeting, leaving the repo rate at 0.75% and QE totals unchanged by unanimous 9-0 votes, as had been widely expected. The same is expected to be confirmed in July’s meeting as the BoE has cautioned that the outlook will depend significantly on the nature of EU withdrawal, and noted that downside risks have increased.

- ISM Manufacturing PMI (USD, GMT 14:00) – The ISM index is expected to rise to 52.7 in July from 51.7 in June, compared to a 14-year high of 61.4 in August. The ISM-NMI index is expected to rise to 55.5 in July from 55.1 in June and a 19-month low of 56.1 in March, versus a 13-year high of 60.8 in September. In the first half of the year we saw a stabilization in sentiment since the late-2018 pull-back.

Support and Resistance levels

Click here to access the Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.