It was another volatile day in the markets after Wednesday’s post FOMC gyrations. Stocks sold off in Asia overnight,with the Australian 10-year rate dropping nearly 12 bp, GER30 futures are down -1.8 bp, CAC 40 futures down -2.1% as fresh China-tariff threats from US President Trump spooked markets. US futures are also broadly lower, and the WTI future is trading at just USD 54.88 per barrel.

Trump Twitter announced on Twitter that another 10% in tariffs will be imposed on the remaining $300 bln in Chinese goods that haven’t already been hit. Trump has before announced tariffs only to subsequently reverse course, though the September-1 implementation date is before the next round of talks start. Also, the threatened new tariffs would hit consumers much harder than earlier tariffs have, which deliberately focused on industrial goods to minimise the impact on consumer goods.

Fears are that Trump’s China threat is a sign of a further escalation in global trade tensions and markets are nervous ahead of a scheduled announcement by the US President on EU trade today.

Fed funds futures have spiked in conjunction with the drop in yields and stocks, on the worries over increased trade tensions. The 2020 contracts are outperforming and have priced in almost 60 bps of additional easing this year, on top of yesterday’s 25 bp reduction. The market now sees about 80% risk for another 25 bp rate cut by the end of October (which also includes the September 17, 18 FOMC), and is about 75% of the way to pricing in a 1.625% December funds rate.

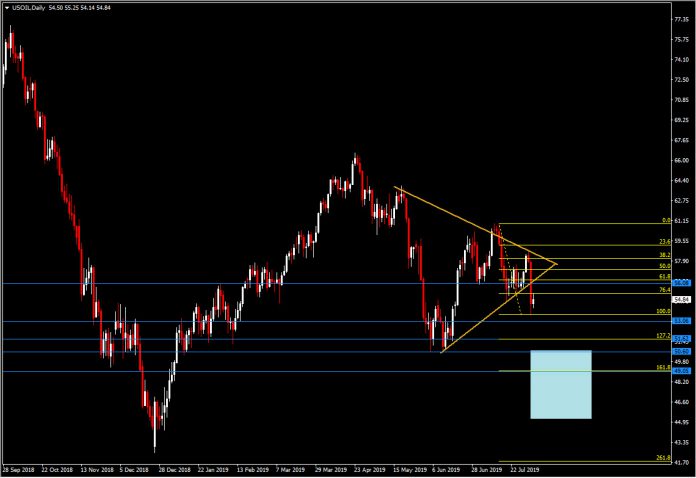

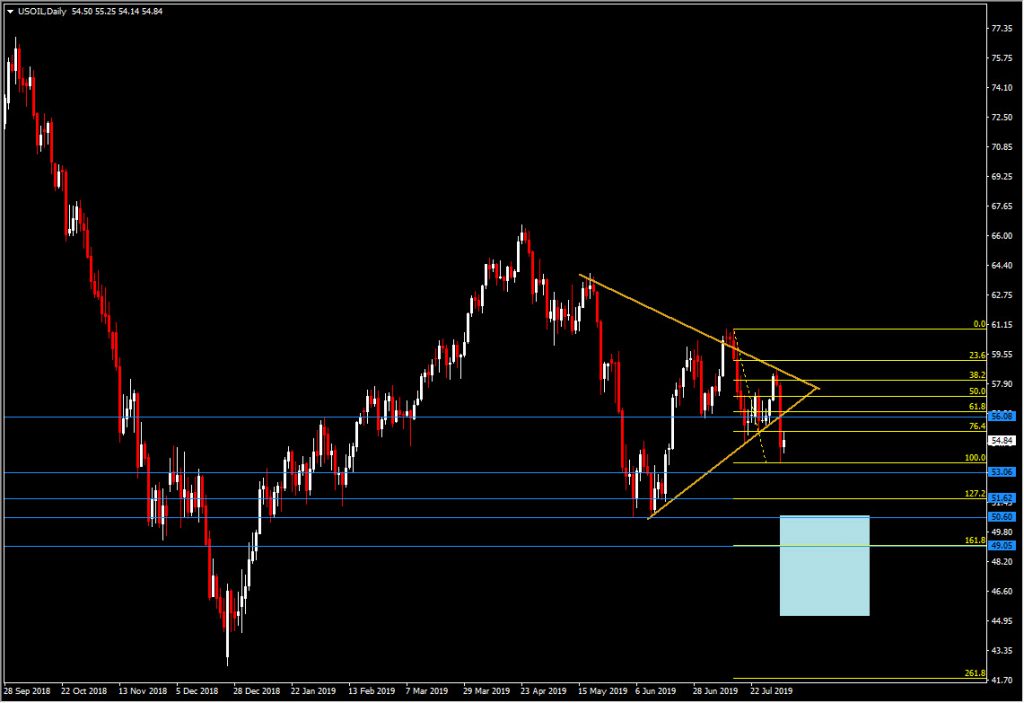

Oil Action: USOIL has been slammed lower in the aftermath of Trump’s tweet. The asset is down over 8% on the day, printing 7-week lows of $53.59, and down from pre-open highs near $57.85. The fresh tariffs will add further concerns to the global growth outlook, leading to demand destruction for crude oil. Currently it is trading at 54.80 , however, the decisive breakout yesterday below 2 months descending triangle along with the break below July’s Support at 54.73, adds further negative bias into the medium term USOIL outlook and suggests the retest for years 2019 and 2018 lows, i.e. immediate Support at $53, next at $50.60-$51.60 area ( 27.2 Fib. extension and June 2019 Support area) and latest the December 2018 lows.

USDCAD tracked higher amid an 8% pull-back in crude prices.

Safe Havens

The development sent global stock markets tumbling, boosting the demand for safe havens, including the Japanese currency.

YEN: The Yen has rallied sharply amid fresh trade warring versus the underperforming Australian Dollar while losing ground to the outperforming Yen, and softening moderately in the case against the Euro. The biggest mover has been AUDJPY, which plummeted over 2% and reaching the lowest levels since the flash crash of early January. The cross is widely seen as a forex market barometer of global investor risk appetite, partly as the Australian Dollar serves as a liquid currency market proxy on China. USDJPY, meanwhile, dove by over 1%, making a near 6-week low earlier Tokyo at 106.85. EURJPY and other Yen crosses have seen similar price actions.

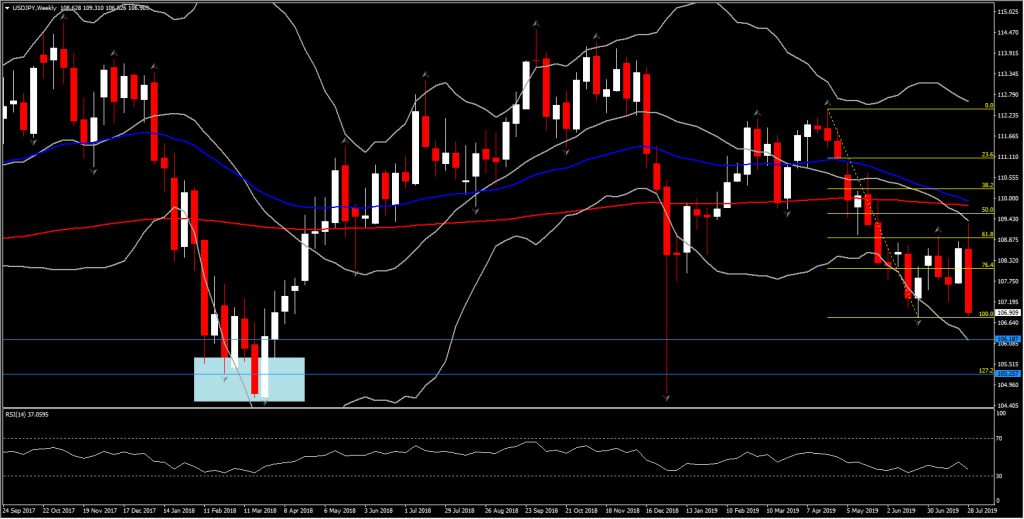

However, as 107.20 (double bottom in July) was rejected from Support, the sharp decline for USDJPY erase bullish momentum spotted last week. The asset looks quite mixed as it retests once again year’s low. Volume decreases suggesting a possible trend reversal of the existing downtrend to the upside but on the other hand the 50-week EMA is sloping lower looking ready to cross below 200-week, suggesting further decline for the asset. Hence, a confirmed strong close below 106.80 could open the doors towards January – March 2018 area, i.e. 105.25 – 106.20 area (latest weekly down fractal and Lower BB line).

There is now initial resistance at 107.70 and a further barrier to recovery at 108.00. However a spike up to these barriers could imply a correction on the sharp decline.

Click here to access the Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.