FX News Today

- Bond as well as stock markets were under pressure during the Asian session.

- Global equities in general, continued to get hammered by the escalation in trade tensions.

- Data was thin, but the disappointing ISM services report added marginally to the bearish tone in stocks.

- RBA left rates on hold amid a “reasonable” outlook for the global economy, but also highlighted downside risks from trade tensions.

- The US officially labelled China a “currency manipulator“.

- The JPN225 are down 0.9%, the ASX slumped -2.4%, while the Hang Seng corrected -0.9%.

- With the US-Sino trade spat rapidly escalating investors are heading for cover amid fears that the U.S. will up the threatened additional tariffs to 25% from the 10% President Trump had mentioned so far.

- German manufacturing orders jumped 2.5% m/m in June, a much stronger than expected reading, that partly compensated for the -2.0% m/m decline in May.

- The front end WTI future is currently trading at $55.29 per barrel.

Charts of the Day

Technician’s Corner

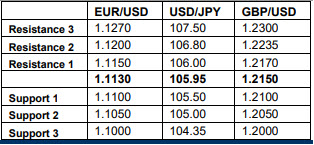

- EURUSD printed 2-week highs of 1.1249, up from lows of 1.1170 yesterday. The latest trade was escalations between the US and China, have ramped up Fed easing speculation, with a September 25 bp rate cut fully priced into the market. This has given the Dollar a hard time of late, resulting in the DXY dropping from over 2-year highs last week, to 2-week lows on Monday. The Euro is currently over its 20-day moving average at 1.1185 for the first time in nearly a month, and now has sights set on the 50-day MA at 1.1235 and 200-day MA at 1.1295.

- USOIL is down near 6% versus last week’s peak. The ramping up of the U.S. China trade war overnight, as China devalued its Yuan, and halted purchases of US agricultural goods weighed on oil prices, with traders focused on prospects for lower global growth, and oil demand destruction. Last Thursday’s six-week low of $53.59 remains the next support level, while Resistance is at Friday’s high and 10-day EMA at 56.00 .

- USDCAD pulled back from overnight highs of 1.3220, falling to 1.3202. Oil prices remain a driver of USDCAD direction, while concerns over slowing global growth could keep crude prices under pressure, resulting in a higher USDCAD.

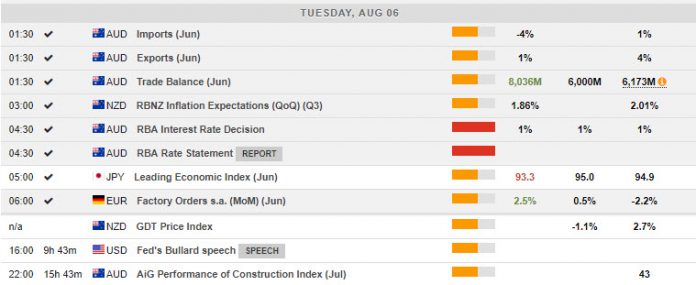

Main Macro Events Today

- JOLTS Job Openings (USD, GMT 14:00) – JOLTS define Job Openings as all positions that have not been filled on the last business day of the month. June’s JOLTS job openings is expected to fall slightly at 7.268M, following the 7.32M in May.

Support and Resistance levels

Click here to access the Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.