FX News Today

- Trade talk hopes and expectations of further stimulus measures kept stock markets underpinned during the Asian session.

- Treasury yields fell back as hopes of fiscal easing were scaled back somewhat.

- The US administration denied plans to cut payroll taxes to support growth and Germany’s reported contingency plan for a fiscal package in case of a deep recession, are clearly not the central scenario for now.

- The 10-year rate is down 1.5 bp at 1.591%, JGB yields dipped -0.1 bp to -0.241%.

- US President Trump called on the Fed to cut rates by “at least 100 basis points“. Fed’s Rosengren meanwhile pushed back against further rate cuts, saying that he is not convinced that slowing trade and global growth will significantly dent the economy.

- Comments from US Commerce Secretary Ross that the US will delay restrictions imposed on some of Huawei’s business operations helped to underpin sentiment, although.

- RBA Minutes: The minutes to the early-August RBA policy meeting were released without surprises, affirming its wait-and-see-easing-bias stance while repeating its view that the weaker currency will help exports and tourism.

- Italian BTPs are underperforming this morning, ahead of PM Conte’s showdown in the Senate, although it seems Salvini’s attempt at a power grab may be backfiring as his coalition partner is trying to form an alliance with opposition parties.

- Topix and Nikkei are currently up 0.7% and 0.5% respectively. The Hang Seng is up 0.09% but the Shanghai Comp down 0.01%.

- European stock futures are slightly higher, as are US futures after a largely positive session in Asia.

- The WTI future is trading at USD 56.30 per barrel.

Charts of the Day

Technician’s Corner

- The Australian Dollar has traded firmer and, to a lesser extent, the New Zealand buck. AUDUSD printed a 5-day high, at 0.6795, as did AUDJPY, at 72.36. Among the other main currencies, there has remained a lack of directional impulse. EURUSD has remained settled in the upper 1.1000s, holding below 1.1100, and USDJPY has become anchored around 106.50. The Dollar hasn’t been much affected by US President Trump’s call for the Fed to cut rates by “at least 100 basis points”. Overall investor sentiment is much less frayed that it was last week, with expectations for stimulus in major economies, along with Trump’s partial climbdown in his trade war with China, assuaging recession fears.

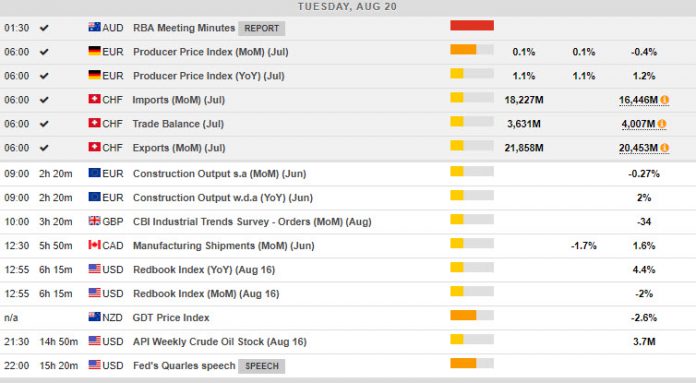

Main Macro Events Today

- Manufacturing Sales (CAD, GMT 12:30) – Manufacturing sales are anticipated to grow 2.0% in June after a 1.6% rebound in shipment values was revealed during May and following a 0.4% decline in April. The surge in transport equipment sales is consistent with the improving economy and as such fits with the BoC’s overall view that the economy is improving after temporary weakness in Q4/Q1.

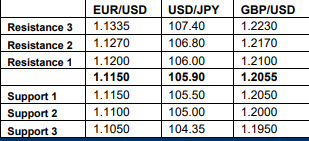

Support and Resistance levels

Click here to access the Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.