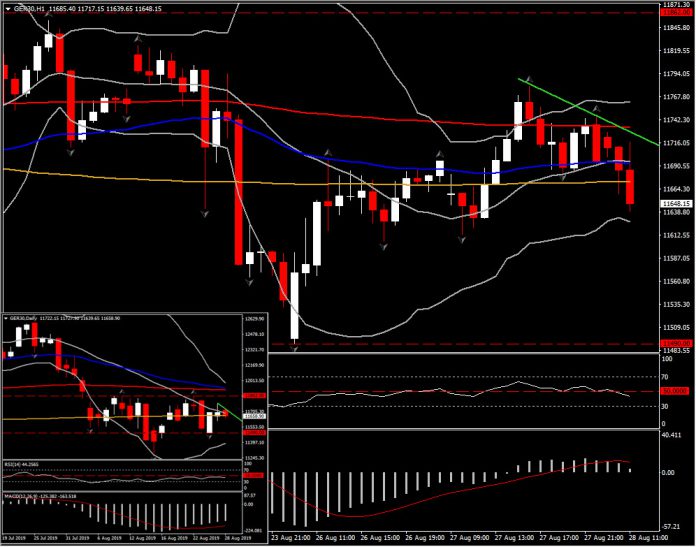

GER30, H1 and Daily

Investors are moving back into bonds as stock markets sentiment turns cautious again. Wall Street closed lower yesterday and stocks drifted in Asia, while GER30 and UK100 are currently down -0.44% and -0.38% respectively.

The decline seen in stock is mainly driven by the lessening of optimism on a US-Sino trade deal, but also on the lack of progress on the coalition talks between PD and Five Star that are stalling. Italian President Mattarella is set to meet with party leaders later today and an agreement has to be found in order to avoid snap elections.

Hence, as the uncertainty surrounding market direction continues, we have seen Indices ranging globally since the end of July. In Europe in particular, GER30 has been bouncing between 11,490-11,862 since August 5. So far this week the asset recovered slightly on the rekindled optimism seen over: trade deal, Brexit on the news that opponents of a no-deal Brexit gather to try and derail Johnson’s path and also on the hopes of a comprehensive easing package from the ECB, after the confirmation that the German economy contracted -0.1% q/q in Q2.

Equities’ gains however, are reversing so far today as stock markets sentiment turns cautious again. GER30 is currently around the mid-point of the range, retesting a pullback below 11,700 level after it opened higher today above 20-day MA. Momentum indicators have lost their near term recoveries and have rolled over to neutral zone. Intraday RSI has flattened below 50, suggesting neutral to negative behaviour in the near term. MACD lines zeroed, looking ready to turn negative.

These give a bear bias to the range for today, while it could be further confirmed if we see a close of the hourly candle below 11,700. This scenario would add pressure on range support at 11,490. Yesterday’s low at 11,613.65 is the next Support level and then the key low at 11,490. Yesterday’s high at 11,779.65 is initial Resistance.

However, in the overall outlook of the asset there is an increasing lack of direction as seen in the indecisive 3-week range formation, while momentum remains bearish with RSI and MACD holding at negative territory. Hence, only a break outside the range could clear the long term direction of the DAX.

Click here to access the Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.