The Yen has reversed all the gains seen since last night’s peak versus most other currencies today as the risk mood improved.

Risk appetite has been kindled by remarks from China’s commerce ministry, which affirmed September trade talks are not off the table, saying that they are in discussions with US counterparts about another round of face-to-face discussions. There was a palpable sigh of relief in markets after the Trump administration yesterday made official its extra 5% tariff on $300 bln in Chinese goods imports, affirming collection dates of September 1 and December 15. US Treasury Secretary Mnuchin had already said he is expecting Chinese negotiators to visit Washington, so confirmation from China that another round of talks are on has been tonic for investors.

Hence, optimism was the driver so far into the European session, supporting USD and Stock markets as well. The news spake a solid rally in USA500 futures, which are presently showing a 0.9% gain and pointing to a strong opening rally on Wall Street later.

The US 10-year T-note yield has also lifted, and is presently up by 2 bps on the day, at 1.501%, up over 5 bps from the 1.448% low that was seen during Asian hours. European equities have also vaulted higher, while in forex markets the YEN and CHF have seen some of their safe haven premiums unwind.

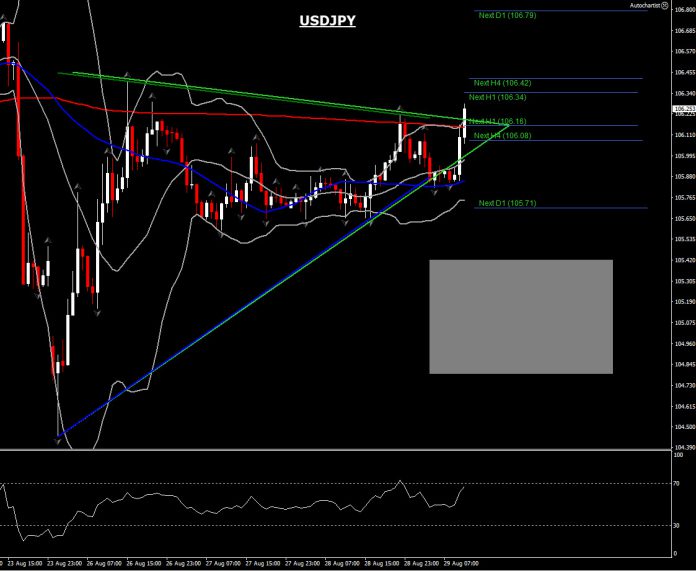

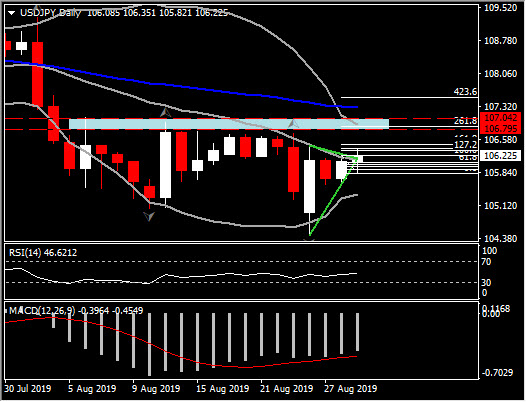

USDJPY bounced to 106.35 (127.2 Fib extension from overnight slip), breaking the upper Bollinger bands pattern and the 200-period SMA in the hourly chart. Despite this 47 pips rally, the asset looks overbought as it closed above the BB area and above the triangle formation seen this week, with intraday momentum indicators turning lower after retested the overbought barrier.

Overall, a positive outlook for USDJPY could be seen only on the break of the 17-day’s strong Resistance area, at 106.80-107.00. For now, the pair remains under a significant pressure, as momentum indicators negatively configured and hence a decline from today’s peak is expected as a correction on this snap rally. Immediate Resistance is at 106.35, and immediate Support at 105.90. Meanwhile, a slip below 105.70 Support could open the doors towards 104.50-105.40 area.

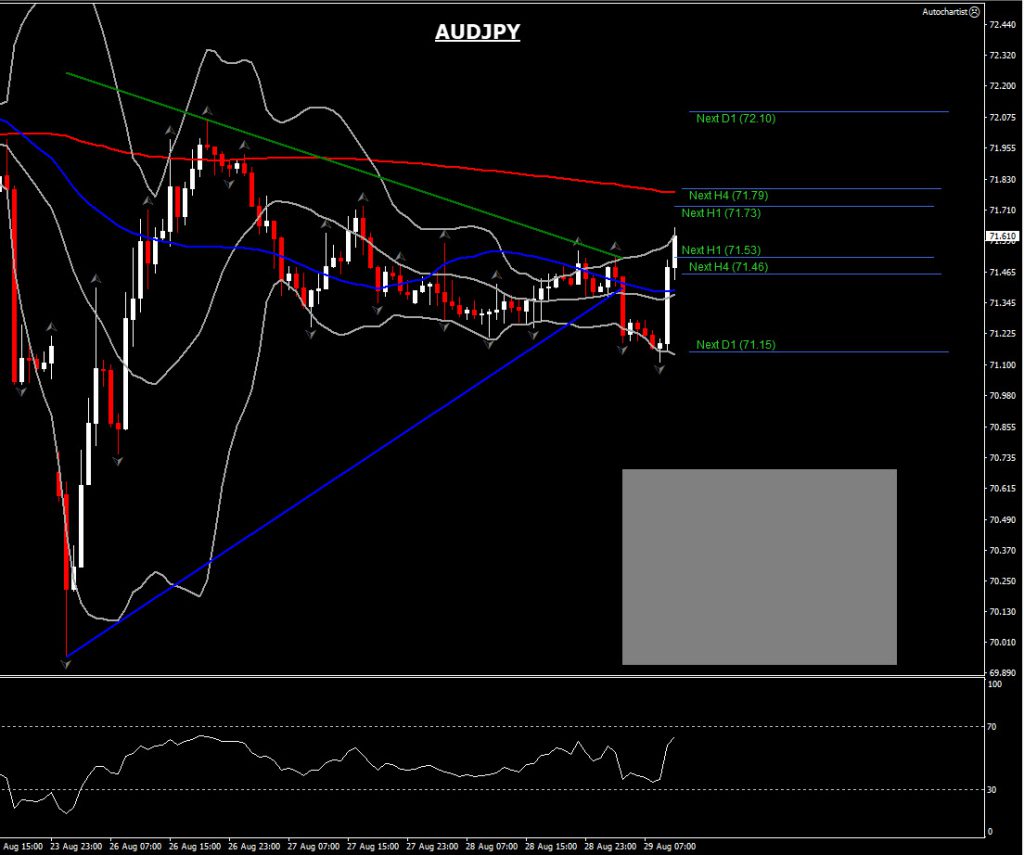

Nevertheless, the AUDJPY cross as forex markets’ barometer of risk appetite has seen the biggest magnitude of movement out of the main Dollar pairings and associated cross rates today, showing a 0.3% gain on the day at prevailing levels, having been showing a decline of nearly 0.5% at the lows.

The dynamic has been driven by a paring back in the Japanese currency’s safe haven premium. The Swiss Franc has similarly declined against the Euro, Dollar, and most other currencies.

Click here to access the Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.