FX News Today

- News that the Bank of Japan cut purchases in its regular operations added to pressure on JGBs, but bond markets in general were pressured as risk appetite returned.

- Hopes of US-Sino trade talks continued to underpin risk appetite. Wall Street closed higher yesterday, while optimism continued to underpin markets across Asia, which are set to end a difficult month on a high note.

- President Trump said some trade discussions were taking place with more talks scheduled and China’s commerce ministry signalled it won’t retaliate on new US tariffs for now, adding that a further escalation is not helpful and that it was more important to discuss a cancellation of tariff increases.

- ECB’s Knot meanwhile questioned the necessity for a restart of asset purchases late yesterday, which suggests the risk of disappointment for markets, who have been pricing in a very comprehensive easing package for the September meeting.

- The focus is now turning to important data releases over the weekend, including China’s official manufacturing survey.

- European stock futures are also moving higher, although US futures are struggling to hold earlier gains.

- The WTI future is trading at USD 56.51 per barrel.

- AUD and NZD both saw weaker building approvals data reported, AUD especially at 9.7% drop.

Charts of the Day

Technician’s Corner

- EURUSD traded to near one-month lows, bottoming at 1.1042, down from earlier session highs of 1.1092. The pair is now within striking distance of the 27-month low of 1.1027 seen on August 1. General Dollar strength has been a driver through the session, with the positive trade news supporting. In addition, the USD’s yield advantage over largely negative yielding EGBs should continue to weigh on EURUSD going forward. A break through the key 1.1000 psych level will shift overall market sentiment, though there has been some talk of barrier options at the level, which will initially at least, likely be defended.

Main Macro Events Today

- Consumer Price Index (EUR, GMT 09:00) – The Euro Area flash CPI for August is expected to rise slightly, at 1.1% y/y from 1.0% y/y last month. Eurozone Unemployment rate is anticipated steady at 7.5%.

- Gross Domestic Product (CAD, GMT 12:30) – Canada’s economy remained sluggish in Q1, with real GDP rising just 0.4% (q/q, saar) after a 0.3% gain in Q4 (revised from 0.4%). The Q1 growth rate was shy of expectations, but it was far from a shocking result as tepid activity was projected as the economy continued to recover from the oil price shock last year. Meanwhile, the Q2 release is expected to be released higher at 0.7% q/q from 0.4% gain in Q1 , due to the strong showing from net exports. The monthly trade report revealed a 14.7% gain in export volumes (q/q, saar) following the 4.1% drop reported in the Q1 GDP report.

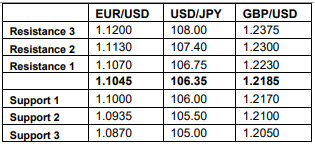

Support and Resistance levels

Click here to access the Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.