Brexit: The bill to stop a no-deal Brexit on October 31 is set to become law later today (ignoring Prime Minister Johnson’s furore-creating suggestion that he might ignore it).

There will be a second vote in Parliament on the PM’s desire to hold a snap election, though opposition parties have said they won’t vote for it until they can be sure it happens after October 19, which is the date that would trigger a delay in Brexit until January 21.

It is now certain that there will be an election, the only question being when, with Prime Minister Johnson now the head of a lame duck government following 22 defections and expulsions from the Conservative Party over the last week. If the opposition get their way, an election would be held once Brexit has been delayed.

The Irish Prime Minister Varadkar said earlier that an extension to Brexit could be granted if there is a good reason, to which an election would likely qualify. Varadkar also countered Johnson’s bluster by repeating that there is “no deal” to be had without the Irish backstop. Johnson had earlier claimed that he has “an abundance” of proposals to put forward, and that a deal was still possible by October 18, even though, as has been widely reported, the EU has not received any new suggestions since Johnson became prime minister. The lack of work towards achieving a deal was cited by cabinet member Amber Rudd as the reason for her decision to quit Johnson’s government on Saturday.

Overall, a Brexit delay and a general election are looking likely. A no-deal Brexit still remains a real possibility with the Tories and Brexit Parties polling with combined support of about 41-42%, which would be enough to form a government with a strong parliamentary majority in the UK’s first past the post electoral system.

Meanwhile in the Market…..

Gilts extend slide as recession fears ease.

Data released this morning showed monthly GDP numbers coming in higher than expected, leaving the 3-month rate at 0.0%, rather than the -0.1% forecasted. The decline in manufacturing and production was also halted and with Sterling coming up from overnight lows Gilts sold off, leaving the 10-year rate at 0.544%, up 4.5 bp on the day.

The short end outperformed, although 2-year and 5-year yields are also up 3.0 bp and 3.2 bp respectively, leaving the curve steeper.

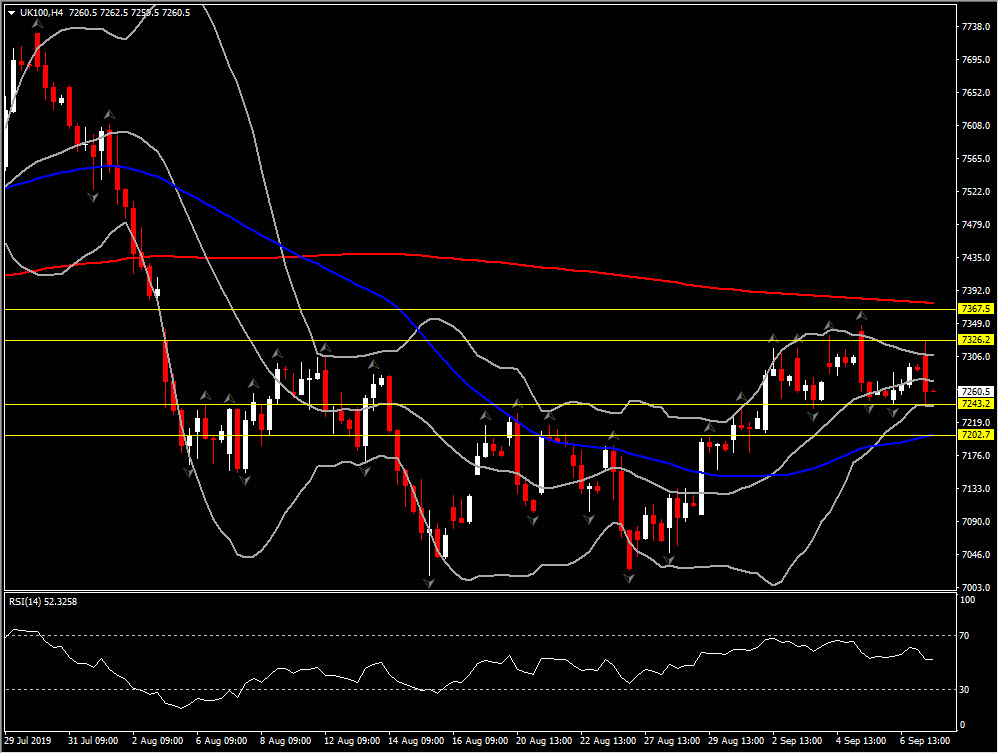

The UK100 meanwhile struggled with the stronger currency and erased early gains despite the stronger than expected data, with the UK benchmark now down -0.06%. Next Support for UK100 is the 6-day low barrier at 7243 and the 200-day SMA at 7202. A breach and break of the latter could open the doors towards August lows. Resistance meanwhile is art 7326 (August 12 upper fractal) and 50-day SMA at 7368.

Click here to access the Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.