FX News Today

- Asian bond markets in general under pressure as local investors caught up with developments in the US yesterday.

- Excessive easing hopes continue to be scaled back ahead of the ECB meeting tomorrow and the Fed decision yesterday but with lingering hopes that governments will step up support for the global economy helping to underpin stock markets.

- President Trump has fired National Security Adviser John Bolton.

- The departure of Bolton has lifted hopes that the US will take a softer stance on China and North Korea and it also triggered a sell-off in oil amid hopes that tensions with Iran may ease.

- China will lift limits on foreign investment, which underpinned brokerages.

- News wires are citing a report from China’s South China Morning Post that China will buy more agricultural products from the US, to “sweeten” the trade deal. This should help add to optimism of more progress.

- The WTI futures has recovered some of yesterday’s losses and is trading at $57.86 per barrel, after falling to a low of 57.20 in the wake of the Bolton announcement.

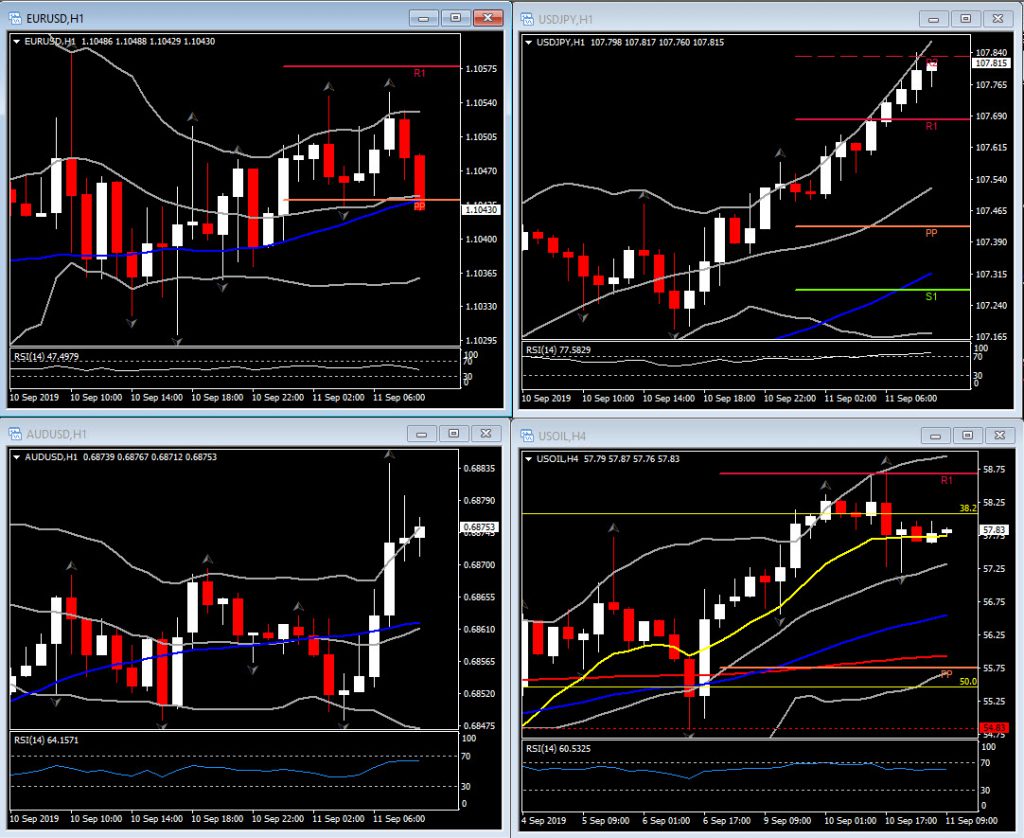

Charts of the Day

Technician’s Corner

- Oil: WTI crude slid from $58.60 to $57.30 following news that NSA Bolton was fired by Trump. The ouster of the uber-hawk Bolton is equated by the oil market as an easing in potential conflict between the US and Iran. The WTI contract remains up over $1 from Monday’s low and the 200-day SMA.

- USDJPY printed near 6-week highs of 107.84, continuing to be supported by hopes for a solution to the US/China trade dispute. US Treasury Secretary Mnuchin said recently there has been “lots of progress on talks” recently. In addition, a Reuters source report ahead of the US open indicated BoJ policymakers have discussed further easing measures, including cutting rates further into negative territory. This weighed on the Yen as well.

Main Macro Events Today

- Producer Price Index (USD, GMT 12:30) – The Headline PPI is expected at a -0.1% dip for the PPI headline in August, with a 0.2% rise in the core index. As expected readings would result in a y/y gain of 1.7% for headline PPI that matches the July gain, and a 2.2% y/y rise for the core, versus 2.1% in July. The y/y headline readings is anticipated in a 1.3%-2.0% range over coming months, while core prices should be in a 1.9%-2.3% range.

- Crude Oil Inventories (GMT 14:30)

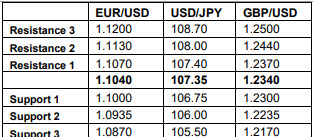

Support and Resistance levels

Click here to access the Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.