FX News Today

- Bond markets remained under pressure overnight and Bund futures are selling off ahead of the opening in cash markets.

- Draghi’s policy bazooka and especially the promise of open-ended asset purchases helped to bring down BTP yields in particular but in core markets, it put pressure on the long end as risk appetite improved.

- US President Trump said he would consider an interim trade deal on China and while there is nothing substantial yet, hopes that both sides are inching closer to a deal have been strengthened this week.

- The GER30 closed above the 12400 mark yesterday with a gain of 0.4% and GER30 as well as UK100 futures are moving higher in tandem with, but underperforming US futures, after a positive session in Asia. Today’s data calendar is quiet, with only Eurozone trade data of note, which will leave investors to look to US releases while digesting the impact of yesterday’s ECB move.

- China and South Korea were closed for a holiday, but elsewhere across Asia stock markets moved higher with investors hoping that central bank support and progress on the trade front will help to revive global growth.

- US futures are posting gains of 0.2-0.3%.

- The WTI future is trading at USD 55.12 per barrel and heading for a weekly drop after the IEA warned this week that OPEC and its allies are facing a looming supply surplus. OPEC+ urged its members to implement promised production cuts this week but didn’t discuss deepening cuts, while the IEA highlighted that production from competitors is set to surge.

Charts of the Day

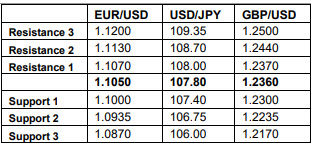

Technician’s Corner

- YEN: The Yen posted fresh trend lows against the Dollar, though remained just off the lows it saw against the Euro, Australian Dollar and other currencies yesterday. USDJPY printed a 6-week high at 108.26 in what is now the fourth consecutive day of higher-high making. The Japanese currency has been deflating amid a persisting phase of risk-on conditions in global markets.

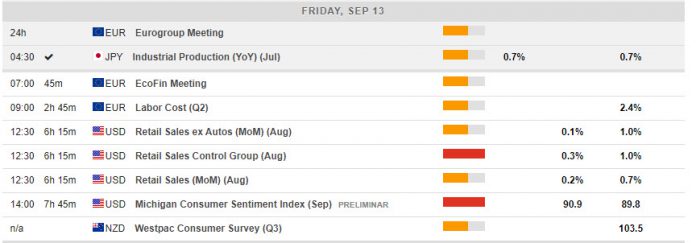

Main Macro Events Today

- Retail Sales (USD, GMT 12:30) – A 0.1% August retail sales headline rise with a flat ex-autos figure is projected, following a 0.7% July headline rise with a hefty 1.0% ex-auto gain. Gasoline prices should prove a drag on retail activity given an estimated -3% drop for the CPI gasoline index, and unit vehicle sales should hold steady in August from a 16.8 mln clip in July. Real consumer spending is expected to grow at a 3.6% rate in Q3, following the 4.7% Q2 clip.

- Michigan Sentiment (USD, GMT 14:00) – The US consumer sentiment fell 8.6 points to 89.8 in the final August print (92.1 preliminary), weaker than expected, after inching up 0.2 ticks to 98.4 in July. The preliminary September Michigan sentiment reading is forecast at 90.5.

Support and Resistance levels

Click here to access the Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.