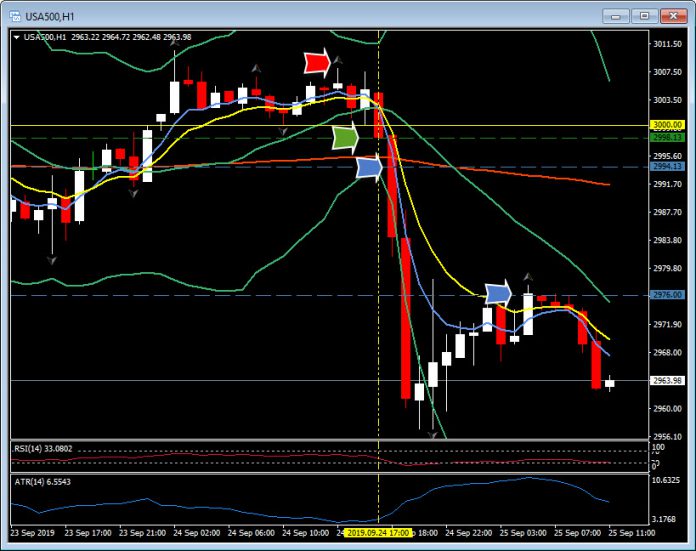

USA500, H1

The Dollar recouped losses seen yesterday in the immediate wake of news that the Democrats were commencing a formal impeachment inquiry against President Trump. The news, coupled with disappointing September consumer confidence data out of the US and the harsh criticism of Trump on China’s trade practices at the UN, saw USA500 futures close yesterday with a worst-in-a-month 0.84% decline. Asian stock markets took the bearish cue and declined, though S&P 500 futures have held steady. The narrow trade-weighted USD index (DXY) is showing a modest 0.2% gain, at 98.51, which is near the midway point of the sideways range seen over the last week. The index yesterday posted a three-session low at 98.29. EURUSD is trading near pre-impeachment news levels near 1.1000, down from the peak seen at 1.1024. USDJPY recovered to the 107.35-40 area from a low at 106.96.

The New Zealand Dollar (NZD) rallied and then settled back following the RBNZ’s unchanged policy decision earlier, which left settings unchanged, as had been widely anticipated, but produced less dovish than expected guidance — the phase that policymakers would do more “if necessary” most accurately summing up the bank’s stance. China’s version of the Beige Book (a report on anecdotal economic activity levels) concluded that the economy has been slowing at an increasing rate in Q3 so far. AUDUSD dipped on this, making a low at 0.6777, bringing the recent three-week low at 0.6760 into scope. Weekly API US oil inventory figures showed an unexpected increase, which shunted oil prices lower. USOil moved to levels below $57, have now more than reversed the sharp gains seen in the immediate wake of the attack on Saudi oil facilities.

Click here to access the Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.