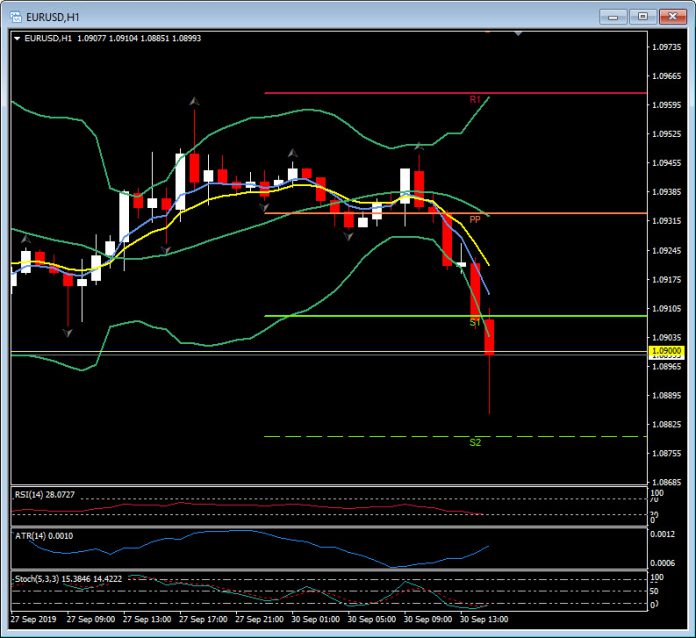

EURUSD, H1

The Dollar majors have mostly held comfortably within their respective ranges so far today.

German HICP inflation fell back to 0.9% y/y in the advance reading for September, from 1.0% y/y in the previous month. The national CPI rate dropped to 1.2% y/y from 1.4% y/y in August. The preliminary breakdown showed that lower energy prices were a key factor, with a price decline of -1.1% y/y in September, after a rise of 0.6% y/y in the August reading. Food price inflation also decelerated sharply. So some special factors impacting the headline rate, although for the ECB the data, which matched developments in other key Eurozone countries and is likely to be reflected in the overall Eurozone rate (due tomorrow), will vindicate the ECB’s latest easing measures, which remain controversial.

EURUSD dipped below 1.0900 and the 20th September 28-month low at 1.0904. S2 sits at 1.0880. USDJPY dipped to a low of 107.75 before recouping to near net unchanged levels around 107.95. AUDUSD breached its Friday low in making a nadir at S1 and 0.6745, drawing in the four-week low seen last Wednesday at 0.6739. USDCAD dipped to a low of 1.3224 before returning toward 1.3250, which is a level that the pair has been gravitating around for over a week now. The concurrent bout of Australian Dollar weakness and Canadian Dollar firmness saw the AUDCAD carve out a four-week low. The NZ Dollar came under pressure following data showing a sharp deterioration in business confidence. NZDUSD again posted a new four-year low below 0.6250, breaching the September 20 low at 0.6255.

Sterling traded firmer, reversing some of the losses seen last week. Cable printed a high at 1.2330, which is over 50 pips up on Friday’s lows, before reversing back towards 1.2300 and the daily pivot point at 1.2297. Opposition parties, led by Scotland’s SNP, are looking to stage a confidence motion as soon as this week to take down Boris Johnson’s government. Word from London is that Jeremy Corbyn is looking to muster a collective view as early as later today. Meanwhile, in Manchester, the mantra at the Tory party conference remains that “we leave on October 31, deal or no-deal”.

Click here to access the Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.