FX News Today

- RBA cut key rate – as expected. Australia’s central bank reduced the key interest rate by 25 bp to 0.75% – 3rd cut this year.

- JGBs and Treasuries sold off after weak JGB auction, stocks mostly higher. Wall Street rallied. Dow is up about 2% in September and 1.4% for Q3, and just shy of all-time highs.

- The sharpest decline in 10-year JGB futures in more than a year was triggered by a very weak 10-year auction, which saw demand dipping to the lowest level since 2016.

- European futures suggest a positive start to the new month especially for the DAX, which is up 0.4%, alongside gains in US futures.

- USDJPY is trading at 108.22, as the Dollar remained supported.

- The AUD underperformed after the dovish RBA statement.

- The EUR is trading below 109 against the USD after source stories yesterday suggested that Germany’s leading economic institutes will cut their growth forecasts for the Eurozone’s largest economy, which given that the Bundesbank is expecting a technical recession should not come as a surprise, but will highlight again the downside risks for Germany as well as the Eurozone.

- The UK’s government will present detailed alternatives to the Irish backstop to Brussels this week.

- The USOIL is trading at $54.54 per barrel amid reports that production by the world’s largest oil producers fell during the third quarter.

Charts of the day

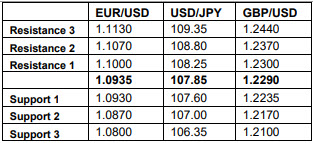

Technician’s Corner

- USDJPY:Moderately risk-on conditions supported on Monday, along with a slight uptick in Treasury yields. Relative calm on the US/China trade front has weighed some on the Yen as well, as high-level talks are expected in Washington on October 10-11. China’s Vice Premier Liu He, along with the USTR Robert Lighthizer and Treasury Secretary Steven Mnuchin are expected to run the negotiation sessions. Above Friday’s 108.18 highs, the September 19 top at 108.47 could be USDJPY’s next upside level.

- EURUSD fell another leg lower, trading under the 1.09 mark for the first time since the second week of May, 2017. There appeared to be a push to run sell-stops located just under the 1.0900 mark, following cooler German CPI, resulting in a dip to lows of 1.0885. Reports of 1.0900 option expiries on Tuesday and Wednesday may now keep the pairing glued to either side of the level until then. Eventually though, Euro is expected to remain down as European growth continues to fade, the ECB remains uber-dovish, and the Dollar continues to find support on the back of USD friendly interest rate spreads.

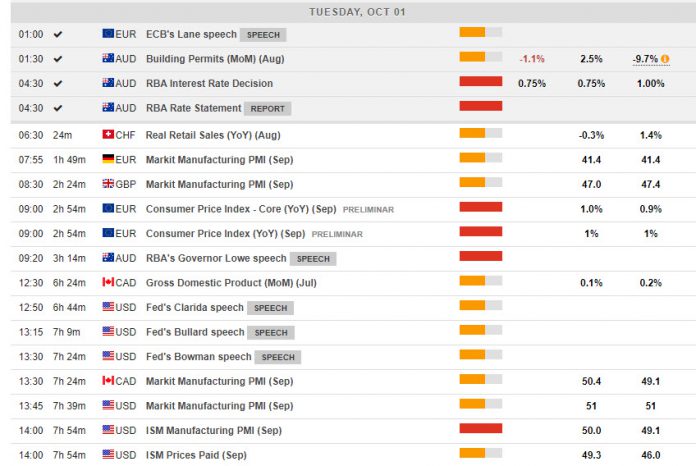

Main Macro Events Today

- Consumer Price Index (EUR, GMT 09:00) – The preliminary Euro Area CPI for September is expected to remain unchanged at 1.0% y/y, while core inflation is seen at 1.0% y/y from 0.9% y/y.

- Manufacturing PMI (EUR, GMT 07:55) – The preliminary September Eurozone PMI readings, released so far, were striking for failing to show an expected improvement and instead showing a marked contraction in manufacturing activity, with service sector activity slowing sharply. The final reading is expected to be confirmed at 41.4. The weakness in German manufacturing – triggered by geopolitical trade tensions and Brexit uncertainty is spreading to other sectors and across the Eurozone.

- ISM Manufacturing PMI (USD, GMT 14:00) – The US ISM Manufacturing PMI is expected to rise to 51.0 in September from 49.1 in August, compared to a 14-year high of 61.4 in August of last year.

Support and Resistance levels

Click here to access the Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.