FX News Today

• European Outlook: Stock market sentiment remains very cautious with Brexit risks and signs of fresh US-Sino tensions ahead of this week’s trade talks weighing on confidence.

• Talks between the UK and the EU on trade are expected to officially break down this week, with “leaked” memos out of Westminster putting the blame firmly in the EU’s court and threatening those EU countries that support another delay of the Brexit date. UK PM Johnson is due to meet Irish Pm Varadkar later.

• Overnight – US-China relations stressed further as new visa restrictions by the US were introduced. Trade talks on going and high level contact still scheduled Thursday & Friday.

Equities markets fell 1.5% in the US and Nikkei has closed down 0.6%.

• USD keeps the bid due to safe haven status, even after a Dovish Powell hints at rate cut (s) and starting to repurchase assets again.

Charts of the day

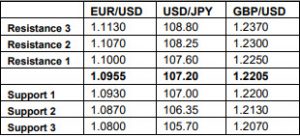

Technician’s Corner

- EURUSD pulled back to 1.0945 lows into the London close, after failing to decisively take out the key 1.1000 level over the past four sessions. US based accounts were sellers from near the open, stepping in over 1.0990. Safe-haven flows into Dollars and Treasuries were noted. Last Thursday’s 1.0940 low is the near term downside target, followed by Wednesday’s 1.0904 bottom. Trades on London open at 1.0960 pivot point.

- Cable Cable was crushed to one-month low of 1.2195 in N.Y. morning trade, down from London highs over 1.2300. The BBC cited a UK government source saying that Germany’s Merkel conveyed to PM Johnson that a deal based on his government’s proposals was “overwhelmingly unlikely.”. The development makes it a near certainty that Johnson won’t have a deal by the October-19 deadline set out in the newly created parliamentary bill that would require the prime minister to ask the EU for an extension in Brexit to January 31.

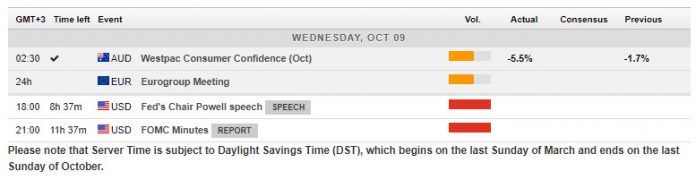

Main Macro Events Today

- JOLTS Job Openings (USD, GMT 14:00) – JOLTS define Job Openings as all positions that have not be filled on the last business day of the month. July’s JOLTS job openings came out at 7.217M.

- FOMC Minutes (USD, GMT 18:00) – The FOMC Minutes report provides the FOMC Members’ opinions regarding the US economic outlook and any views regarding future rate hikes. FOMC trimmed rates 25 bps, as expected, but with 3 dissents. In the last FOMC statement, on July 31 decision showed mixed views, two dissents for steady policy, two participants who wanted 50 bps in cuts and several wanted steady stance.

Support and Resistance levels

Click here to access the Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.