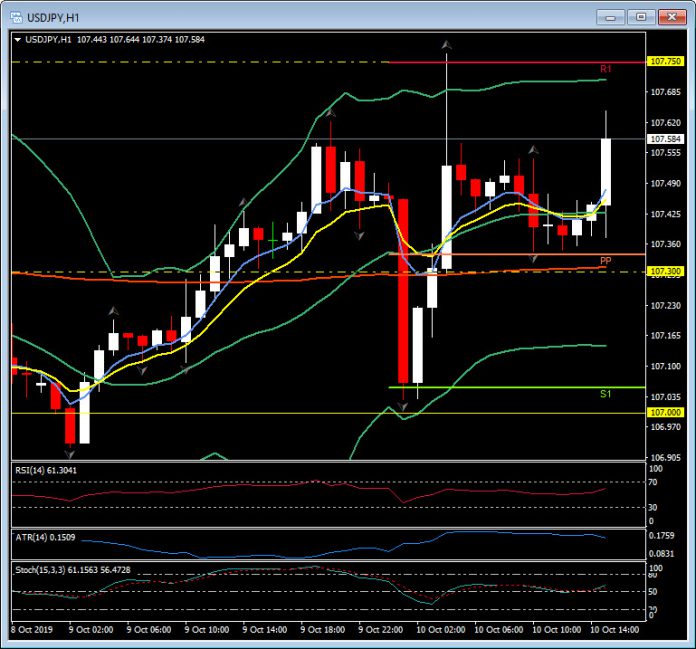

USDJPY, H1

US September CPI was flat, and the core was up 0.1%, both a little shy of estimates, following unrevised gains of 0.1% and 0.3%, respectively. The 12-month headline and core rates were steady at 1.7% y/y and 2.4% y/y, with the latter holding above the Fed’s 2% target (though the PCE is the favoured indicator). Energy costs were down -1.4% following the 1.9% prior slide, with gasoline off -2.4%. Used car prices dropped 1.6%. Food prices dipped 0.1% and apparel fell -0.4%. Pressure on prices remains elusive.

Meanwhile, US initial jobless claims dropped 10k to 210k in the week ended October 5, surprising forecasts for a rise, after increasing 5k to 220k previously (revised from 219k). That’s stronger than expected despite the UAW strike in its 4th week. The 4-week moving average edged up to 213.75k from 212.75k (revised from 212.5k). Continuing claims climbed 29k to 1,684k in the September 28 week after slipping 1k to 1,655k (revised from 1,651k).

Initial reaction from the Dollar was a dip after the cooler CPI outcome, seeing USDJPY slip briefly to 107.37 from near 107.50, and EURUSD trade over 1.1030 from under 1.1025. USDJPY has since recovered to test 107.60 but is capped at R1 and 107.75 with support at S1 and 107.00 ahead of Day One of the latest round of high level US-China trade talks, which has all eyes on Washington DC.

Click here to access the Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.